Answered step by step

Verified Expert Solution

Question

1 Approved Answer

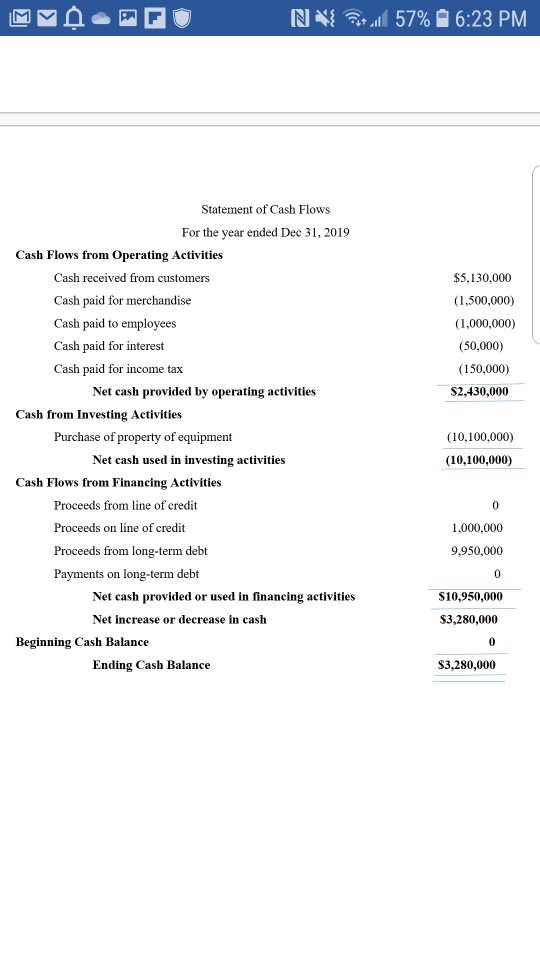

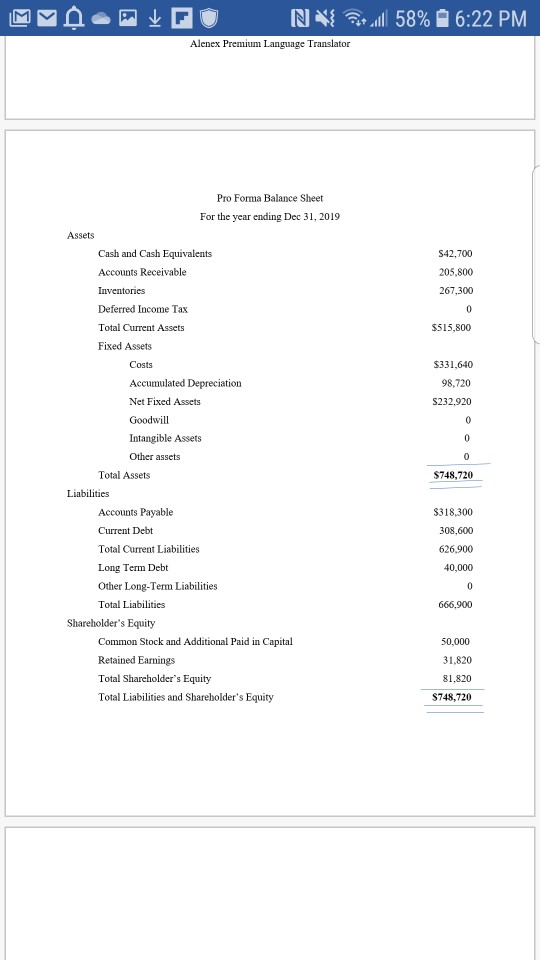

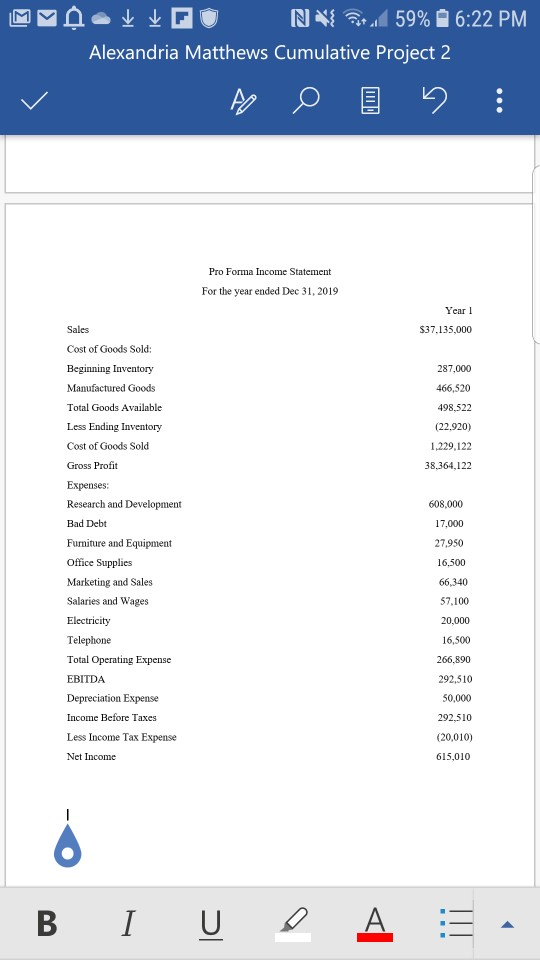

Identify at least two ratios under the following categories. Liquidity Ratios Turnover/Activity Ratios Profitability Ratios Debt/Capital Structure Ratios Capital Market Value Ratios After identifying ratios

Identify at least two ratios under the following categories.

- Liquidity Ratios

- Turnover/Activity Ratios

- Profitability Ratios

- Debt/Capital Structure Ratios

- Capital Market Value Ratios

After identifying ratios under each category, analysis the pro forma/budgeted financial statements use these ratios.

l57% 6:23 PM N Statement of Cash Flows For the year ended Dec 31, 2019 Cash Flows from Operating Activities Cash received from customers $5,130,000 Cash paid for merchandise (1,500,000) Cash paid to employees (1,000,000) Cash paid for interest (50,000) Cash paid for income tax (150,000) Net cash provided by operating activities $2,430,000 Cash from Investing Activities Purchase of property of equipment (10,100,000) Net cash used in investing activities (10,100,000) Cash Flows from Financing Activities Proceeds from line of credit Proceeds on line of credit 1,000,000 Proceeds from long-term debt 9,950,000 Payments long-term debt C on Net cash provided or used in financing activities $10,950,000 $3,280,000 Net increase or decrease in cash Beginning Cash Balance 0 Ending Cash Balance $3,280,000 N 6:22 PM ll 58% Alenex Premium Language Translator Pro Forma Balance Sheet For the year ending Dec 31, 2019 Assets Cash and Cash Equivalents S42,700 Accounts Receivable 205.800 Inventories 267,300 Deferred Income Tax 0 Total Current Assets $515,800 Fixed Assets Costs $331,640 Accumulated Depreciation 98,720 Net Fixed Assets S232.920 Goodwill 0 Intangible Assets Other assets Total Assets $748,720 Liabilities Accounts Payable S318,300 Current Debt 308,600 Total Current Liabilities 626,900 Long Term Debt 40,000 Other Long-Term Liabilities 0 Total Liabilities 666,900 Shareholder's Equity Common Stock and Additional Paid in Capital 50,000 Retained Earnings 31,820 Total Shareholder's Equity 81,820 $748,720 Total Liabilities and Shareholder's Equity N 59% 6:22 PM Alexandria Matthews Cumulative Project 2 - S : Statement of Retained Earnings For the year ended Dec 2019 Retained Eamings $288,260 Net Income For the Year Ended Dec 2019 615,010 Dividends Paid to Shareholders (550,000) Retained Earnings as at Dec 31 2019 S353,270 A B IU N 59% 6:22 PM Alexandria Matthews Cumulative Project 2 Pro Forma Income Statement For the year ended Dec 31, 2019 Year 1 Sales $37,135,000 Cost of Goods Sold: Beginning Inventory 287,000 Manufactured Goods 466,520 Total Goods Available 498,522 Less Ending Inventory (22,920) Cost of Goods Sold 1,229,122 Gross Profit 38,364,122 Expenses Research and Development 608,000 Bad Debt 17,000 Furniture and Equipment 27,950 Office Supplies 16,500 Marketing and Sales 66,340 Salaries and Wages 57,100 Electricity 20,000 Telephone 16,500 Total Operating Expense 266,890 EBITDA 292,510 50,000 Depreciation Expense Income Before Taxes 292,510 Less Income Tax Expense (20,010) Net Income 615,010 I U A B l57% 6:23 PM N Statement of Cash Flows For the year ended Dec 31, 2019 Cash Flows from Operating Activities Cash received from customers $5,130,000 Cash paid for merchandise (1,500,000) Cash paid to employees (1,000,000) Cash paid for interest (50,000) Cash paid for income tax (150,000) Net cash provided by operating activities $2,430,000 Cash from Investing Activities Purchase of property of equipment (10,100,000) Net cash used in investing activities (10,100,000) Cash Flows from Financing Activities Proceeds from line of credit Proceeds on line of credit 1,000,000 Proceeds from long-term debt 9,950,000 Payments long-term debt C on Net cash provided or used in financing activities $10,950,000 $3,280,000 Net increase or decrease in cash Beginning Cash Balance 0 Ending Cash Balance $3,280,000 N 6:22 PM ll 58% Alenex Premium Language Translator Pro Forma Balance Sheet For the year ending Dec 31, 2019 Assets Cash and Cash Equivalents S42,700 Accounts Receivable 205.800 Inventories 267,300 Deferred Income Tax 0 Total Current Assets $515,800 Fixed Assets Costs $331,640 Accumulated Depreciation 98,720 Net Fixed Assets S232.920 Goodwill 0 Intangible Assets Other assets Total Assets $748,720 Liabilities Accounts Payable S318,300 Current Debt 308,600 Total Current Liabilities 626,900 Long Term Debt 40,000 Other Long-Term Liabilities 0 Total Liabilities 666,900 Shareholder's Equity Common Stock and Additional Paid in Capital 50,000 Retained Earnings 31,820 Total Shareholder's Equity 81,820 $748,720 Total Liabilities and Shareholder's Equity N 59% 6:22 PM Alexandria Matthews Cumulative Project 2 - S : Statement of Retained Earnings For the year ended Dec 2019 Retained Eamings $288,260 Net Income For the Year Ended Dec 2019 615,010 Dividends Paid to Shareholders (550,000) Retained Earnings as at Dec 31 2019 S353,270 A B IU N 59% 6:22 PM Alexandria Matthews Cumulative Project 2 Pro Forma Income Statement For the year ended Dec 31, 2019 Year 1 Sales $37,135,000 Cost of Goods Sold: Beginning Inventory 287,000 Manufactured Goods 466,520 Total Goods Available 498,522 Less Ending Inventory (22,920) Cost of Goods Sold 1,229,122 Gross Profit 38,364,122 Expenses Research and Development 608,000 Bad Debt 17,000 Furniture and Equipment 27,950 Office Supplies 16,500 Marketing and Sales 66,340 Salaries and Wages 57,100 Electricity 20,000 Telephone 16,500 Total Operating Expense 266,890 EBITDA 292,510 50,000 Depreciation Expense Income Before Taxes 292,510 Less Income Tax Expense (20,010) Net Income 615,010 I U A B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started