Answered step by step

Verified Expert Solution

Question

1 Approved Answer

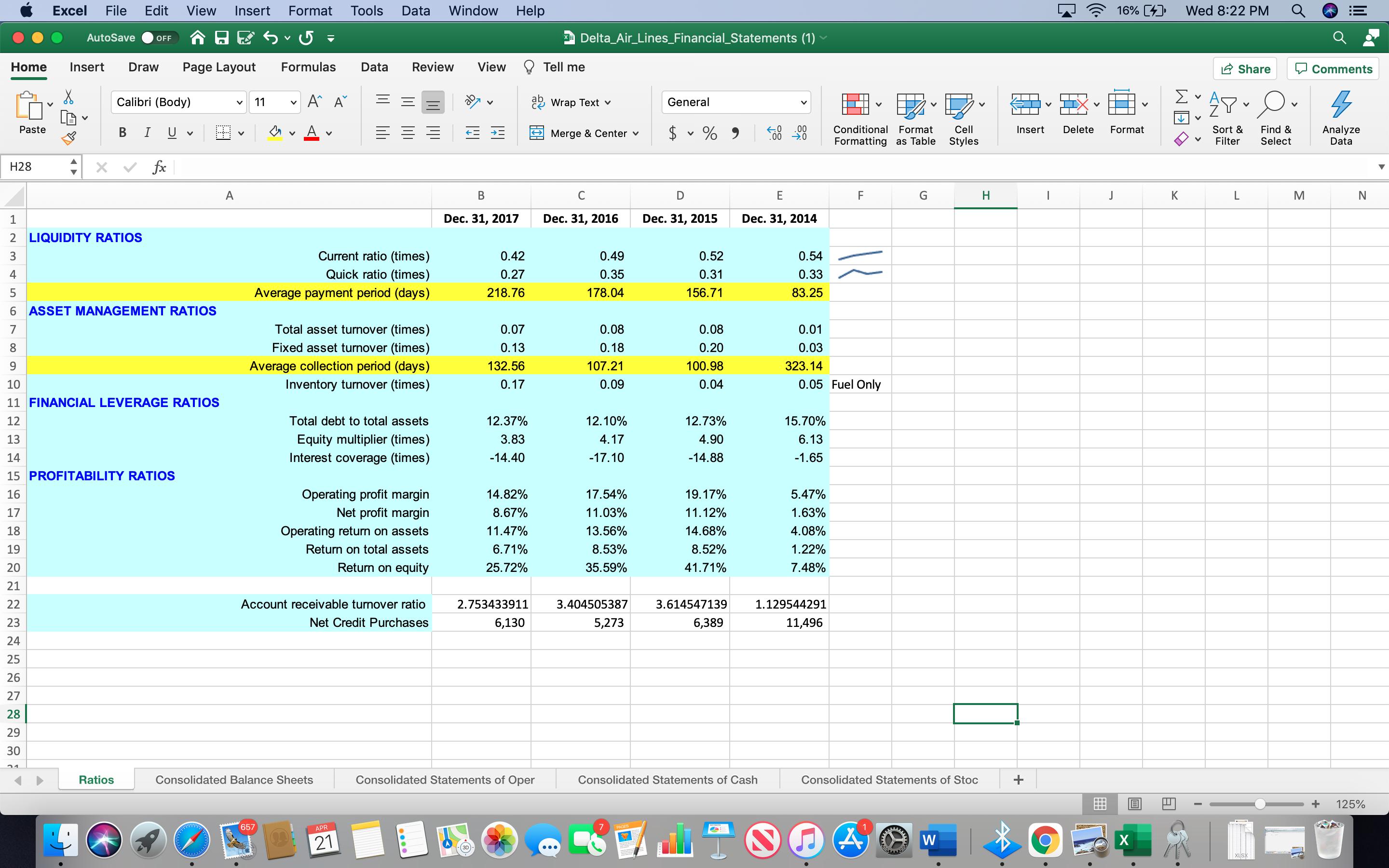

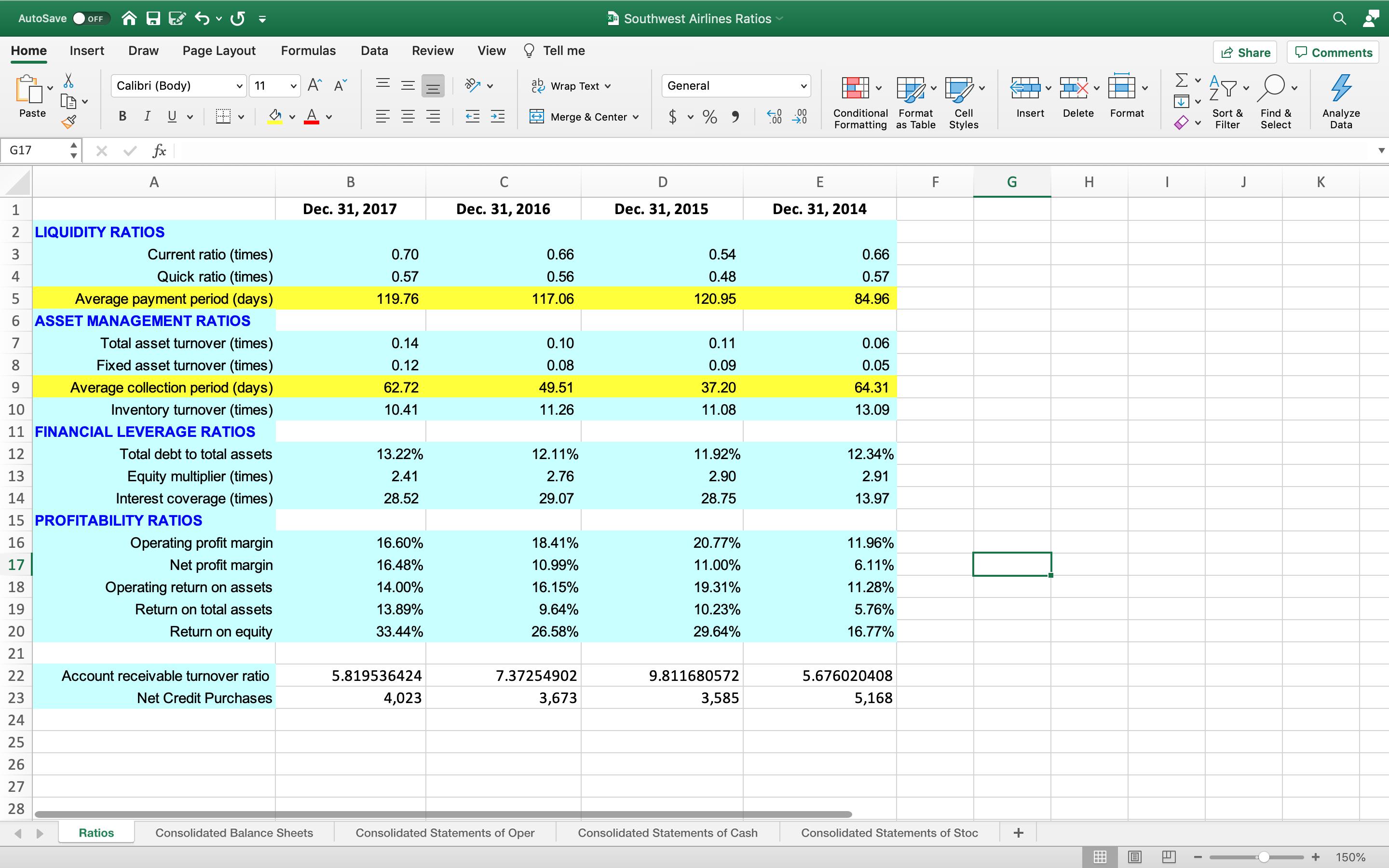

Identify each of the following ratios that are provided in the spreadsheet for Delta Airlines and Southwest Airlines for the year 2017, and provide an

Identify each of the following ratios that are provided in the spreadsheet for Delta Airlines and Southwest Airlines for the year 2017, and provide an explanation of its meaning, comparable to other years:

• Current Ratio

- Asset Turnover

- Inventory Turnover

- Debt to Asset Ratio

- Interest Coverage

- Profit Margin

- Return on Assets

- Return on Equity

2) Based on the ratios computed, identify questions you might have about the company's operations that you would like more information about if you were an analyst, company manager, or investor.

Paste Excel File Edit View Insert Format Tools Data Window Help 8 Home Insert Draw Page Layout H28 AutoSave OFF Calibri (Body) U Ratios BI fx V 1 2 LIQUIDITY RATIOS 3 4 5 6 ASSET MANAGEMENT RATIOS 7 8 9 10 11 FINANCIAL LEVERAGE RATIOS 12 13 14 15 PROFITABILITY RATIOS 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 1999997 A lalalalal v V 11 Formulas Data V V 657 A^ A A ( V Current ratio (times) Quick ratio (times) Average payment period (days) Consolidated Balance Sheets Total asset turnover (times) Fixed asset turnover (times) Average collection period (days) Inventory turnover (times) Review = = = Total debt to total assets Equity multiplier (times) Interest coverage (times) Operating profit margin Net profit margin Operating return on assets Return on total assets Return on equity Account receivable turnover ratio Net Credit Purchases APR 21 View B Dec. 31, 2017 0.42 0.27 218.76 0.07 0.13 132.56 0.17 12.37% 3.83 -14.40 14.82% 8.67% 11.47% 6.71% 25.72% 2.753433911 6,130 Delta_Air_Lines Financial Statements (1) Consolidated Statements of Oper Tell me ab Wrap Text v Merge & Center v C Dec. 31, 2016 0.49 0.35 178.04 0.08 0.18 107.21 0.09 12.10% 4.17 -17.10 17.54% 11.03% 13.56% 8.53% 35.59% General $ % PAGES V D Dec. 31, 2015 0.52 0.31 156.71 0.08 0.20 100.98 0.04 12.73% 4.90 -14.88 19.17% 11.12% 14.68% 8.52% 41.71% 3.404505387 3.614547139 5,273 6,389 5.000 Consolidated Statements of Cash .00 .0 E Dec. 31, 2014 0.54 0.33 83.25 0.01 0.03 323.14 15.70% 6.13 -1.65 0.05 Fuel Only 5.47% 1.63% 4.08% 1.22% 7.48% 1.129544291 11,496 Conditional Format Formatting as Table F FE G Consolidated Statements of Stoc w Cell Styles W H Insert + | O K Delete 16% [4] Format J X Wed 8:22 PM K Share APO Sort & Find & Filter Select L XLSX M Comments Analyze Data N 125%

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Current Ratio The current ratio measures a companys ability to pay its shortterm liabilities with its shortterm assets It is calculated by dividing cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started