Answered step by step

Verified Expert Solution

Question

1 Approved Answer

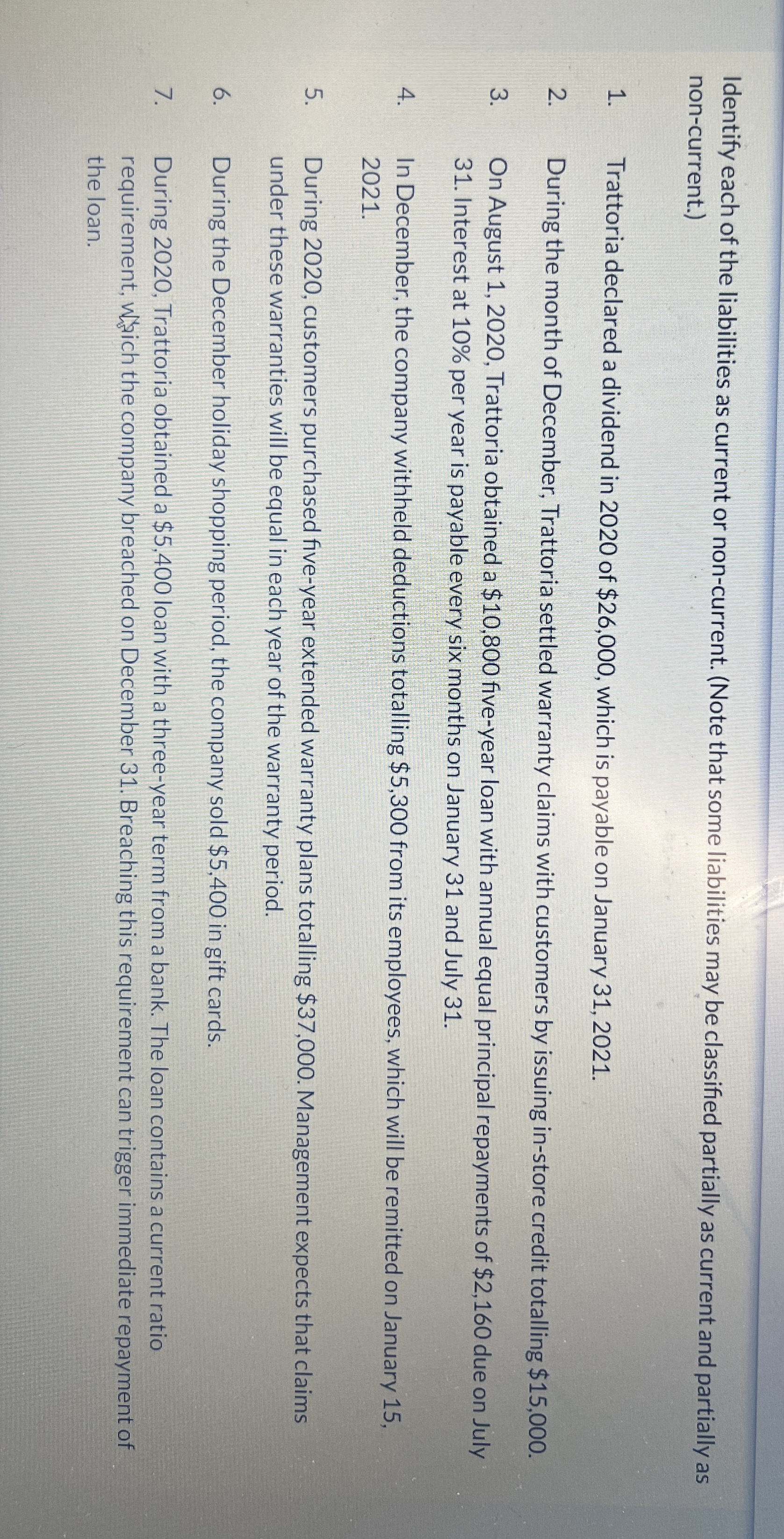

Identify each of the liabilities as current or non - current. ( Note that some liabilities may be classified partially as current and partially as

Identify each of the liabilities as current or noncurrent. Note that some liabilities may be classified partially as current and partially as noncurrent.

Trattoria declared a dividend in of $ which is payable on January

During the month of December, Trattoria settled warranty claims with customers by issuing instore credit totalling $

On August Trattoria obtained a $ fiveyear loan with annual equal principal repayments of $ due on July Interest at per year is payable every six months on January and July

In December, the company withheld deductions totalling $ from its employees, which will be remitted on January

During customers purchased fiveyear extended warranty plans totalling $ Management expects that claims under these warranties will be equal in each year of the warranty period.

During the December holiday shopping period, the company sold $ in gift cards.

During Trattoria obtained a $ loan with a threeyear term from a bank. The loan contains a current ratio requirement, wich the company breached on December Breaching this requirement can trigger immediate repayment of the loan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started