Identify key risk exposures and sector allocations of the portfolio

Identify key risk exposures and sector allocations of the portfolio

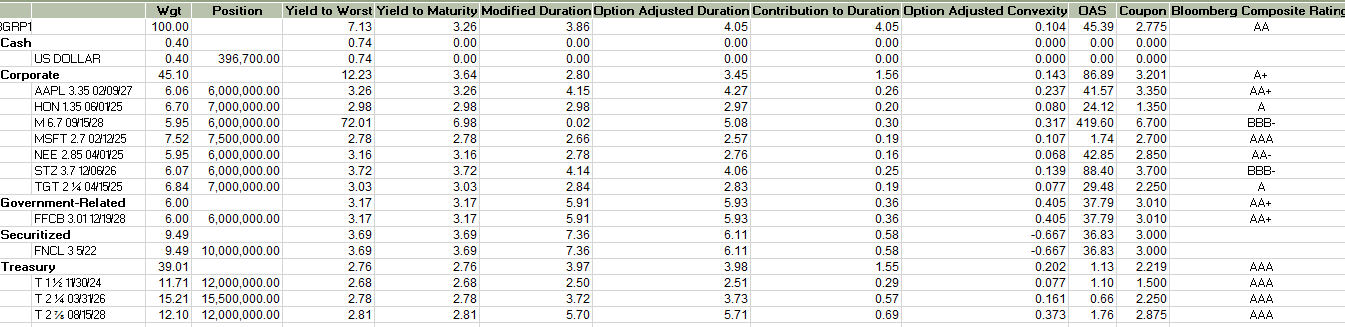

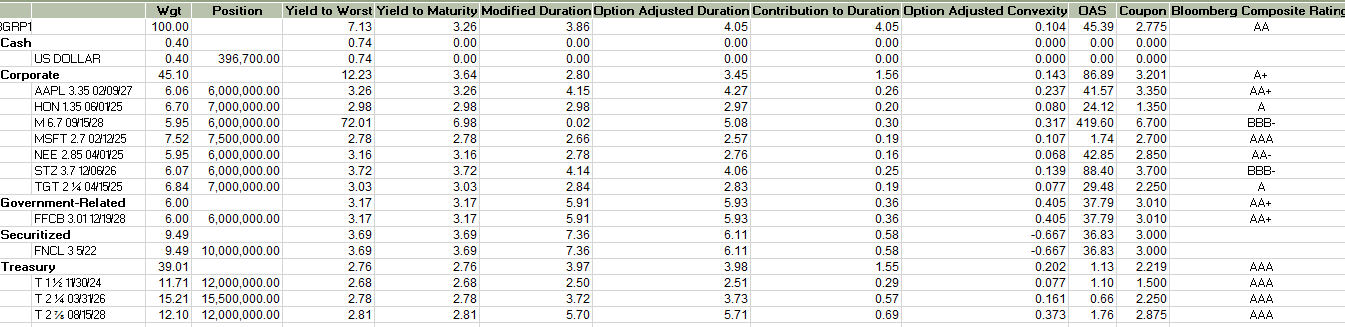

BGRP1 Cash US DOLLAR Corporate AAPL 3.35 02/09/27 HON 1.35 06/0125 M6.7 0915/28 MSFT 2.7 02112125 NEE 2.85 040125 STZ 3.7 1206/26 TGT 2 14 04/15/25 Government-Related FFCB 3.01 12/19/28 Securitized FNCL 3522 Treasury 114 113024 T214 03/3126 T 27. 08/15/28 Wgt Position 100.00 0.40 0.40 396,700.00 140 45.10 6.06 6,000,000.00 7 6.70 7,000,000.00 os 5.95 6,000,000.00 7.52 7,500,000.00 05 5.95 6,000,000.00 6.07 6,000,000.00 6.84 200 7,000,000.00 6.00 od 6.00 6,000,000.00 940 9.49 9.49 10,000,000.00 40 39.01 2004 11.71 12,000,000.00 15.21 15,500,000.00 12.10 12,000,000.00 Yield to Worst Yield to Maturity Modified Duration Option Adjusted Duration Contribution to Duration Option Adjusted Convexity OAS Coupon Bloomberg Composite Rating 7.13 3.26 3.86 4.05 4.05 0.104 45.39 2.775 AA 0.74 0.00 0.00 0.00 0.00 0.000 0.00 0.000 0.74 0.00 0.00 0.00 0.00 0.000 0.00 0.000 100 12.23 3.64 2.80 non 245 3.45 1.56 0.143 86.89 2001 4+ 28 3.201 mar 3.26 3.26 4.15 00 0.26 1902 wa 4.27 0.237 200 200 41.57 3.350 AA+ 2.98 2.98 2.98 000 20 wa word 2.97 0.20 0.080 24.12 A 2004 00 1.350 w o 72.01 6.98 0.02 30 40 0.30 od 5.08 0.317 419.60 OD 28 70 02 6.700 BBB- 24 2.78 2.78 0440 2.66 w 2.57 0.19 0.107 28 1.74 48 2.700 AAA 22 3.16 3.16 2.78 2002 2.76 0.16 0.068 42.85 2.850 AA- 3.72 3.72 03 400 00440 4.14 4.06 0.25 320d 0.139 88.40 03 3.700 205 BBB- 02 3.03 3.03 wa 42 2010 2.84 2.83 0.19 0.077 29.48 A 200 2.250 o 3.17 220 3.17 5.91 5600 5.93 0.36 24 22 0.405 37.79 AA+ 20 3.010 mo 3.17 2 100 3.17 5.91 2770 0.36 wo 5.93 200 0.405 37.79 AA+ 3.010 3.69 za 3.69 wa 7.36 ees 0.58 6.11 -0.667 36.83 3.000 200 20 wed 3.69 3.69 7.36 28 6.11 0.58 -0.667 2800 36.83 za 3.000 2.76 2.76 3.97 3.98 1.55 4940 0.202 1.13 2.219 AAA 2.68 2.68 2.50 2.51 0.29 1.10 1.500 AAA 2.78 2.78 3.72 3.73 0.57 0.161 0.66 2.250 AAA 2.81 2.81 5.70 5.71 0.69 0.373 1.76 2.875 AAA 0.077 BGRP1 Cash US DOLLAR Corporate AAPL 3.35 02/09/27 HON 1.35 06/0125 M6.7 0915/28 MSFT 2.7 02112125 NEE 2.85 040125 STZ 3.7 1206/26 TGT 2 14 04/15/25 Government-Related FFCB 3.01 12/19/28 Securitized FNCL 3522 Treasury 114 113024 T214 03/3126 T 27. 08/15/28 Wgt Position 100.00 0.40 0.40 396,700.00 140 45.10 6.06 6,000,000.00 7 6.70 7,000,000.00 os 5.95 6,000,000.00 7.52 7,500,000.00 05 5.95 6,000,000.00 6.07 6,000,000.00 6.84 200 7,000,000.00 6.00 od 6.00 6,000,000.00 940 9.49 9.49 10,000,000.00 40 39.01 2004 11.71 12,000,000.00 15.21 15,500,000.00 12.10 12,000,000.00 Yield to Worst Yield to Maturity Modified Duration Option Adjusted Duration Contribution to Duration Option Adjusted Convexity OAS Coupon Bloomberg Composite Rating 7.13 3.26 3.86 4.05 4.05 0.104 45.39 2.775 AA 0.74 0.00 0.00 0.00 0.00 0.000 0.00 0.000 0.74 0.00 0.00 0.00 0.00 0.000 0.00 0.000 100 12.23 3.64 2.80 non 245 3.45 1.56 0.143 86.89 2001 4+ 28 3.201 mar 3.26 3.26 4.15 00 0.26 1902 wa 4.27 0.237 200 200 41.57 3.350 AA+ 2.98 2.98 2.98 000 20 wa word 2.97 0.20 0.080 24.12 A 2004 00 1.350 w o 72.01 6.98 0.02 30 40 0.30 od 5.08 0.317 419.60 OD 28 70 02 6.700 BBB- 24 2.78 2.78 0440 2.66 w 2.57 0.19 0.107 28 1.74 48 2.700 AAA 22 3.16 3.16 2.78 2002 2.76 0.16 0.068 42.85 2.850 AA- 3.72 3.72 03 400 00440 4.14 4.06 0.25 320d 0.139 88.40 03 3.700 205 BBB- 02 3.03 3.03 wa 42 2010 2.84 2.83 0.19 0.077 29.48 A 200 2.250 o 3.17 220 3.17 5.91 5600 5.93 0.36 24 22 0.405 37.79 AA+ 20 3.010 mo 3.17 2 100 3.17 5.91 2770 0.36 wo 5.93 200 0.405 37.79 AA+ 3.010 3.69 za 3.69 wa 7.36 ees 0.58 6.11 -0.667 36.83 3.000 200 20 wed 3.69 3.69 7.36 28 6.11 0.58 -0.667 2800 36.83 za 3.000 2.76 2.76 3.97 3.98 1.55 4940 0.202 1.13 2.219 AAA 2.68 2.68 2.50 2.51 0.29 1.10 1.500 AAA 2.78 2.78 3.72 3.73 0.57 0.161 0.66 2.250 AAA 2.81 2.81 5.70 5.71 0.69 0.373 1.76 2.875 AAA 0.077

Identify key risk exposures and sector allocations of the portfolio

Identify key risk exposures and sector allocations of the portfolio