Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Identify non-marginal investors To assess a company, we need to consider the future cash flow of the business; its sustainability and profitability. This is

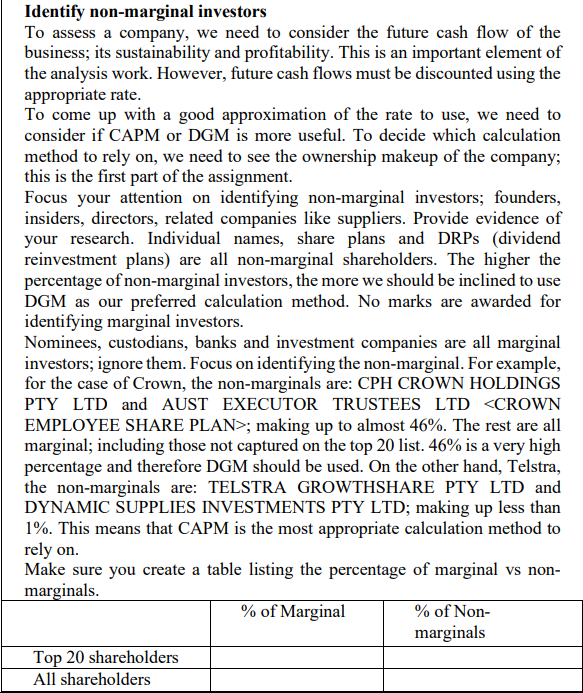

Identify non-marginal investors To assess a company, we need to consider the future cash flow of the business; its sustainability and profitability. This is an important element of the analysis work. However, future cash flows must be discounted using the appropriate rate. To come up with a good approximation of the rate to use, we need to consider if CAPM or DGM is more useful. To decide which calculation method to rely on, we need to see the ownership makeup of the company; this is the first part of the assignment. Focus your attention on identifying non-marginal investors; founders, insiders, directors, related companies like suppliers. Provide evidence of your research. Individual names, share plans and DRPs (dividend reinvestment plans) are all non-marginal shareholders. The higher the percentage of non-marginal investors, the more we should be inclined to use DGM as our preferred calculation method. No marks are awarded for identifying marginal investors. Nominees, custodians, banks and investment companies are all marginal investors; ignore them. Focus on identifying the non-marginal. For example, for the case of Crown, the non-marginals are: CPH CROWN HOLDINGS PTY LTD and AUST EXECUTOR TRUSTEES LTD ; making up to almost 46%. The rest are all marginal; including those not captured on the top 20 list. 46% is a very high percentage and therefore DGM should be used. On the other hand, Telstra, the non-marginals are: TELSTRA GROWTHSHARE PTY LTD and DYNAMIC SUPPLIES INVESTMENTS PTY LTD; making up less than 1%. This means that CAPM is the most appropriate calculation method to rely on. Make sure you create a table listing the percentage of marginal vs non- marginals. % of Marginal Top 20 shareholders All shareholders % of Non- marginals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided criteria we need to identify nonmarginal investors in a company to determine w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started