Answered step by step

Verified Expert Solution

Question

1 Approved Answer

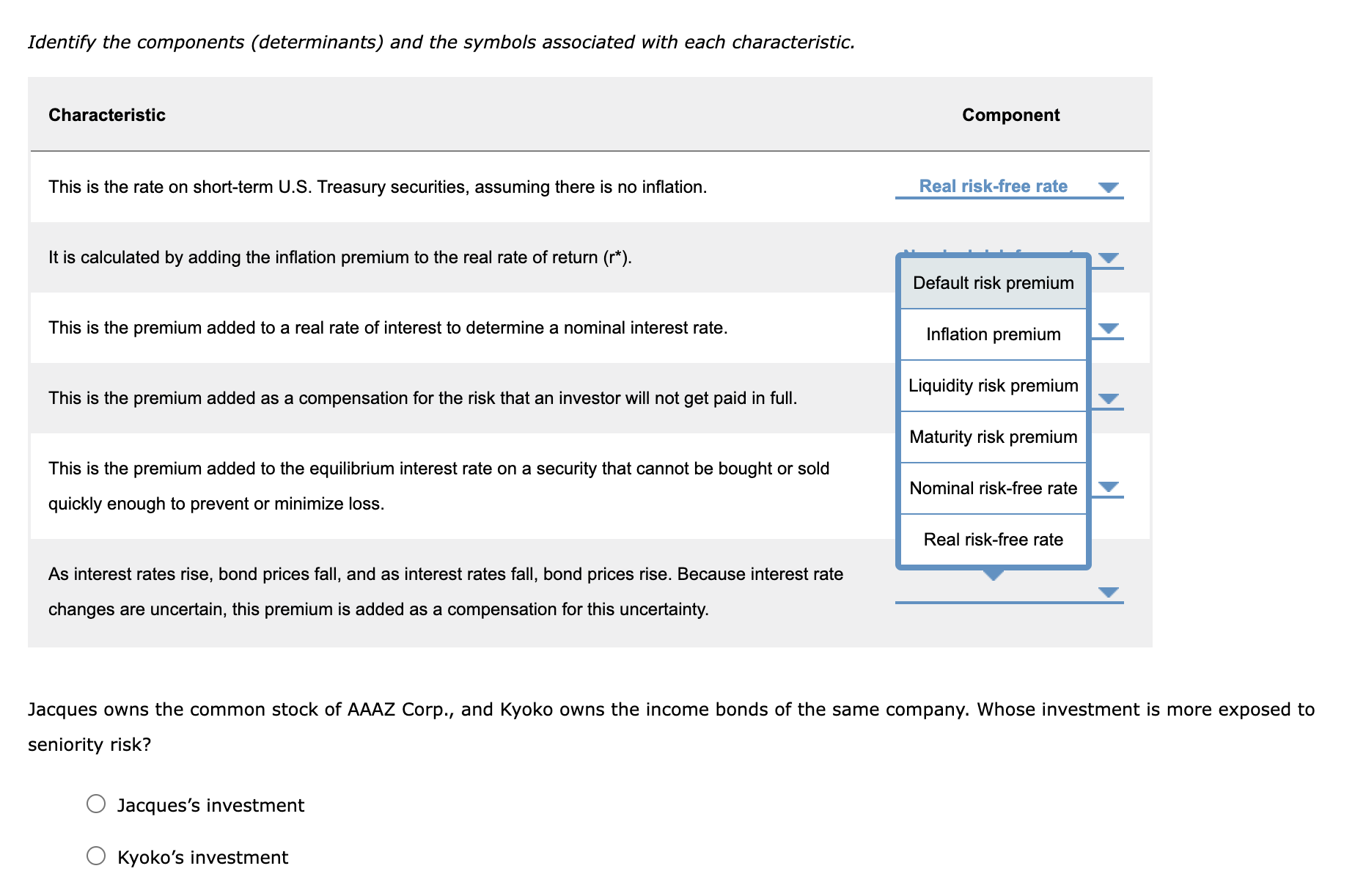

Identify the components (determinants) and the symbols associated with each characteristic. Characteristic This is the rate on short-term U.S. Treasury securities, assuming there is

Identify the components (determinants) and the symbols associated with each characteristic. Characteristic This is the rate on short-term U.S. Treasury securities, assuming there is no inflation. It is calculated by adding the inflation premium to the real rate of return (r*). This is the premium added to a real rate of interest to determine a nominal interest rate. This is the premium added as a compensation for the risk that an investor will not get paid in full. This is the premium added to the equilibrium interest rate on a security that cannot be bought or sold quickly enough to prevent or minimize loss. As interest rates rise, bond prices fall, and as interest rates fall, bond prices rise. Because interest rate changes are uncertain, this premium is added as a compensation for this uncertainty. Jacques's investment Component Kyoko's investment Real risk-free rate Default risk premium Inflation premium Liquidity risk premium Maturity risk premium Nominal risk-free rate Jacques owns the common stock of AAAZ Corp., and Kyoko owns the income bonds of the same company. Whose investment is more exposed to seniority risk? Real risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image presented appears to be an exercise in identifying different components that determine int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started