Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Identify the criteria necessary for owners of rental real estate to qualify for the qualified business income ( QBI ) deduction. The taxpayer's primary residence

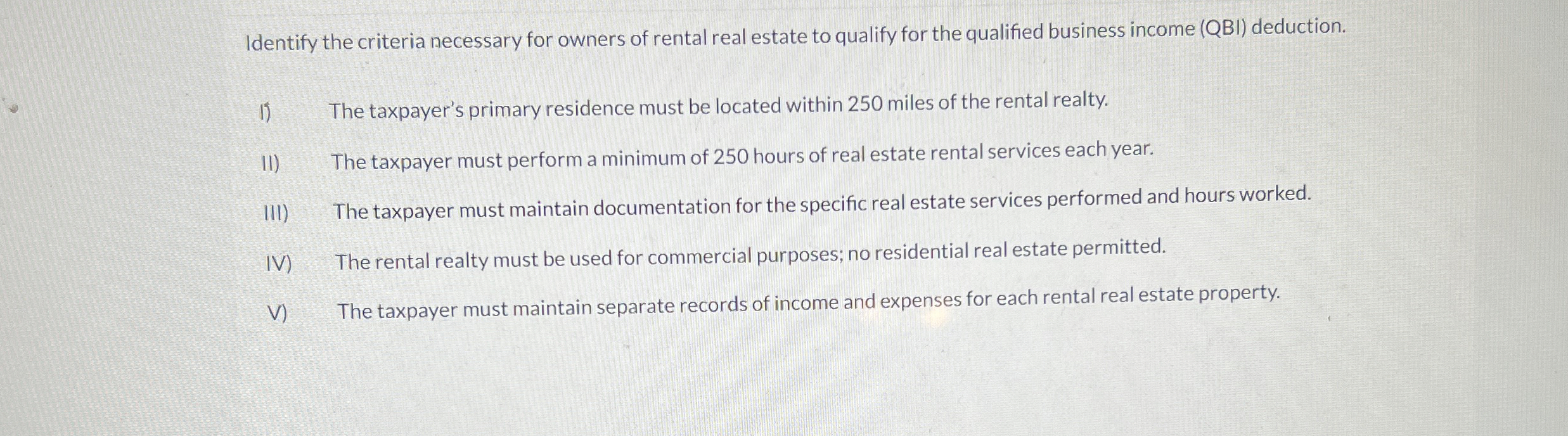

Identify the criteria necessary for owners of rental real estate to qualify for the qualified business income QBI deduction.

The taxpayer's primary residence must be located within miles of the rental realty.

II The taxpayer must perform a minimum of hours of real estate rental services each year.

III The taxpayer must maintain documentation for the specific real estate services performed and hours worked.

IV The rental realty must be used for commercial purposes; no residential real estate permitted.

V The taxpayer must maintain separate records of income and expenses for each rental real estate property.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started