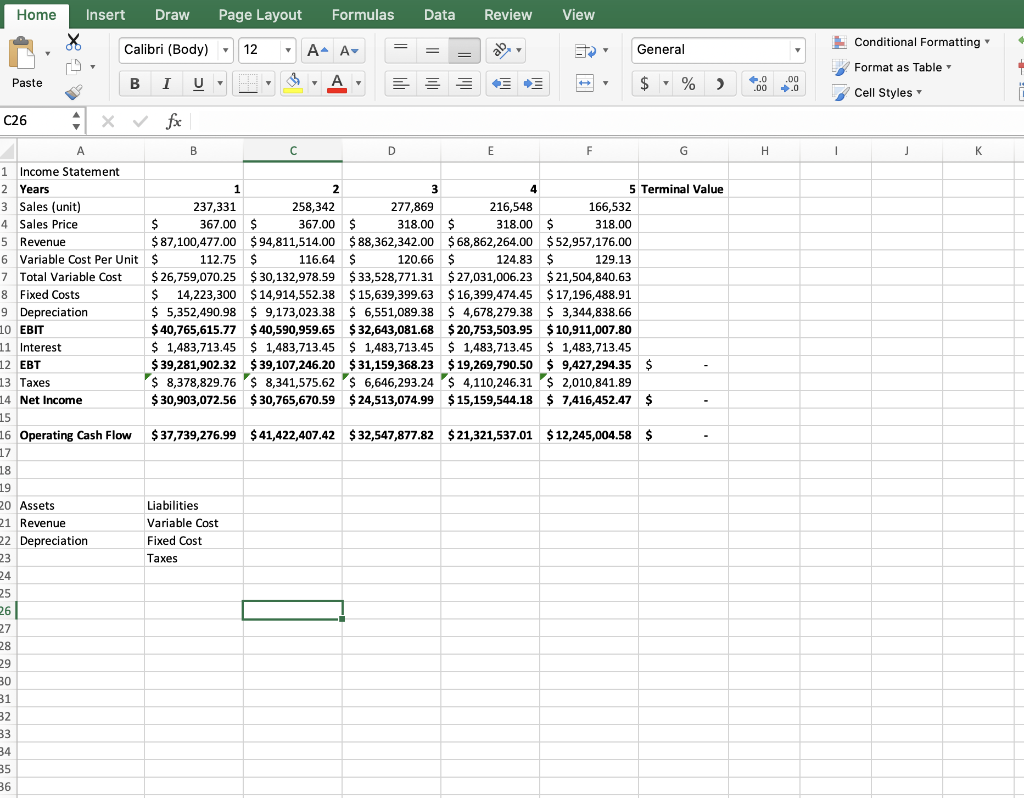

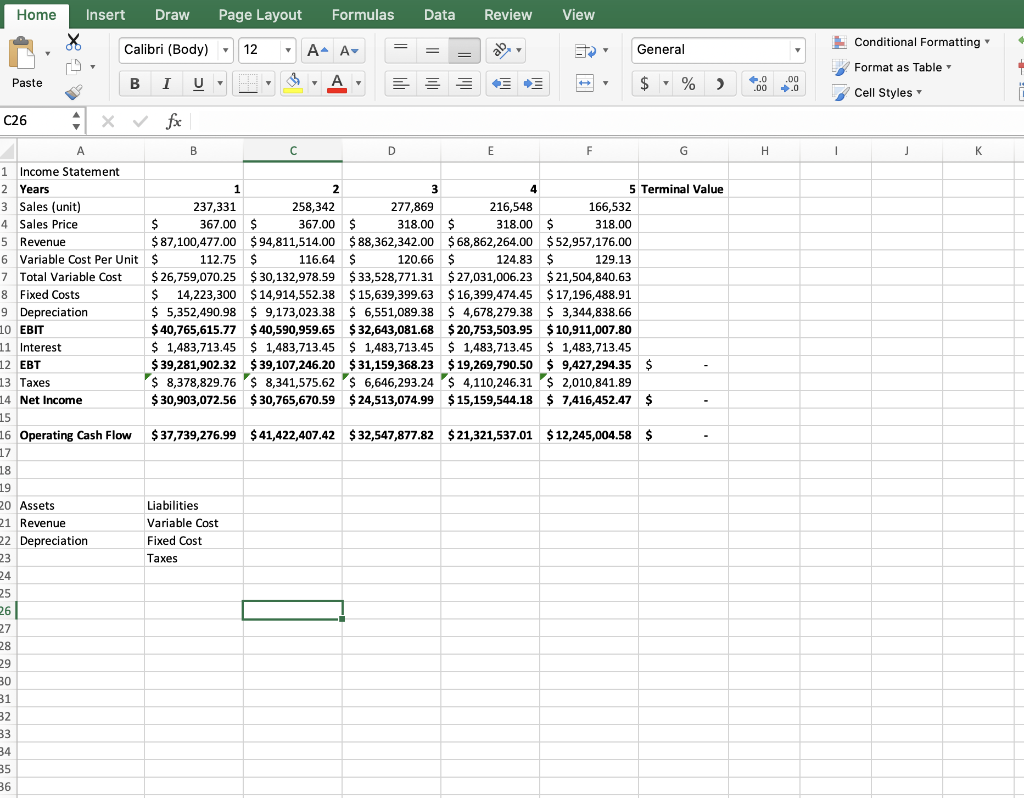

Identify the current assets and current liabilities in the given Income Statement.

Home Insert Draw Page Layout Formulas Data Review View Conditional Formatting Calibri (Body) 12 A- A = = - General Format as Table Paste BIU A $ % ) 4.0 .00 .00 0 Cell Styles C26 4 X fx G H 1 1 J K B B D E F 1 Income Statement 2 Years 1 2 3 4 5 Terminal Value 3 Sales (unit) 237,331 258,342 277,869 216,548 166,532 4 Sales Price $ $ 367.00 $ 367.00 $ 318.00 $ 318.00 $ 318.00 5 Revenue $ 87,100,477.00 $ 94,811,514.00 $88,362,342.00 $68,862,264.00 $52,957,176.00 6 Variable Cost Per Unit $ 112.75 $ 116.64 $ 120.66 $ 124.83 $ 129.13 7 Total Variable Cost $ 26,759,070.25 $ 30,132,978.59 $ 33,528,771.31 $ 27,031,006.23 $ 21,504,840.63 8 Fixed Costs $ 14,223,300 $14,914,552.38 $ 15,639,399.63 $ 16,399,474.45 $17,196,488.91 9 Depreciation $ 5,352,490.98 $ 9,173,023.38 $ 6,551,089.38 $ 4,678,279.38 $ 3,344,838.66 10 EBIT $ 40,765,615.77 $ 40,590,959.65 $32,643,081.68 $ 20,753,503.95 $10,911,007.80 11 Interest $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 12 EBT $ 39,281,902.32 $ 39,107,246.20 $ 31,159,368.23 $ 19,269,790.50 $ 9,427,294.35 $ 13 Taxes $ 8,378,829.76 $ 8,341,575.62' 6,646,293.24$ 4,110,246.31 $ 2,010,841.89 14 Net Income $ 30,903,072.56 $30,765,670.59 $ 24,513,074.99 $ 15,159,544.18 $ 7,416,452.47 $ 15 16 Operating Cash Flow $37,739,276.99 $41,422,407.42 $32,547,877.82 $21,321,537.01 $12,245,004.58 $ 17 18 19 20 Assets Liabilities 21 Revenue Variable Cost 22 Depreciation Fixed Cost 23 Taxes 24 25 26 27 - - 28 29 30 31 32 33 34 35 36 Home Insert Draw Page Layout Formulas Data Review View Conditional Formatting Calibri (Body) 12 A- A = = - General Format as Table Paste BIU A $ % ) 4.0 .00 .00 0 Cell Styles C26 4 X fx G H 1 1 J K B B D E F 1 Income Statement 2 Years 1 2 3 4 5 Terminal Value 3 Sales (unit) 237,331 258,342 277,869 216,548 166,532 4 Sales Price $ $ 367.00 $ 367.00 $ 318.00 $ 318.00 $ 318.00 5 Revenue $ 87,100,477.00 $ 94,811,514.00 $88,362,342.00 $68,862,264.00 $52,957,176.00 6 Variable Cost Per Unit $ 112.75 $ 116.64 $ 120.66 $ 124.83 $ 129.13 7 Total Variable Cost $ 26,759,070.25 $ 30,132,978.59 $ 33,528,771.31 $ 27,031,006.23 $ 21,504,840.63 8 Fixed Costs $ 14,223,300 $14,914,552.38 $ 15,639,399.63 $ 16,399,474.45 $17,196,488.91 9 Depreciation $ 5,352,490.98 $ 9,173,023.38 $ 6,551,089.38 $ 4,678,279.38 $ 3,344,838.66 10 EBIT $ 40,765,615.77 $ 40,590,959.65 $32,643,081.68 $ 20,753,503.95 $10,911,007.80 11 Interest $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 $ 1,483,713.45 12 EBT $ 39,281,902.32 $ 39,107,246.20 $ 31,159,368.23 $ 19,269,790.50 $ 9,427,294.35 $ 13 Taxes $ 8,378,829.76 $ 8,341,575.62' 6,646,293.24$ 4,110,246.31 $ 2,010,841.89 14 Net Income $ 30,903,072.56 $30,765,670.59 $ 24,513,074.99 $ 15,159,544.18 $ 7,416,452.47 $ 15 16 Operating Cash Flow $37,739,276.99 $41,422,407.42 $32,547,877.82 $21,321,537.01 $12,245,004.58 $ 17 18 19 20 Assets Liabilities 21 Revenue Variable Cost 22 Depreciation Fixed Cost 23 Taxes 24 25 26 27 - - 28 29 30 31 32 33 34 35 36