identify the factors that, if they were to change, would most affect the plans you presented in your business plan.

identify the factors that, if they were to change, would most affect the plans you presented in your business plan.

- For example, if your business plan shows the venture will be profitable after two years in business, how would this change if sales were five percent lower than projected?

- One common approach is to include three sets of financial projections: pessimistic, most likely, and optimistic.

- Critical success factor analysis is normally a description of the factors that most impact the business based on financial data. It is more than a written description describing the factors that impact the ventures operations in significant ways, because it is founded in financial analysis.

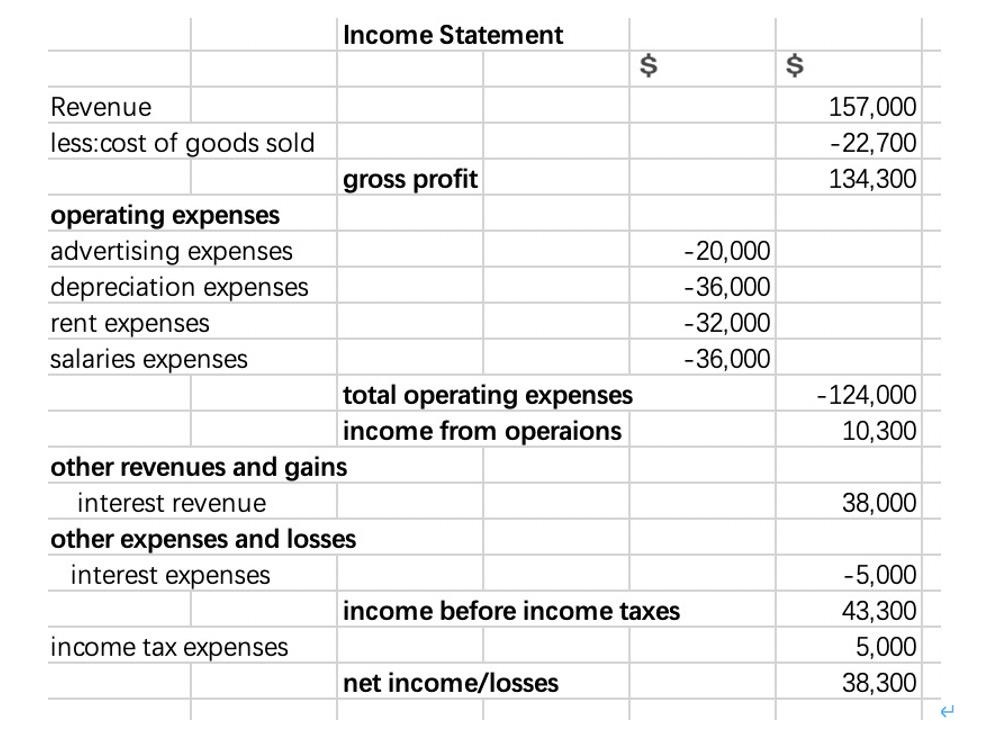

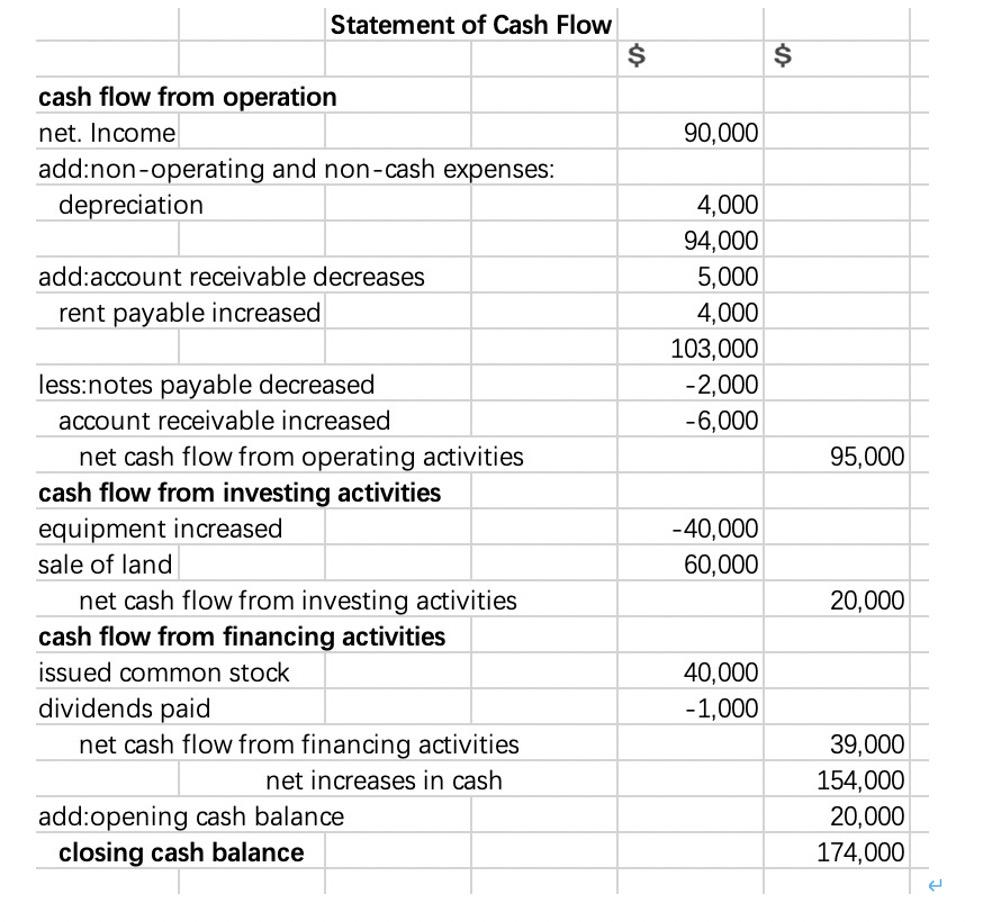

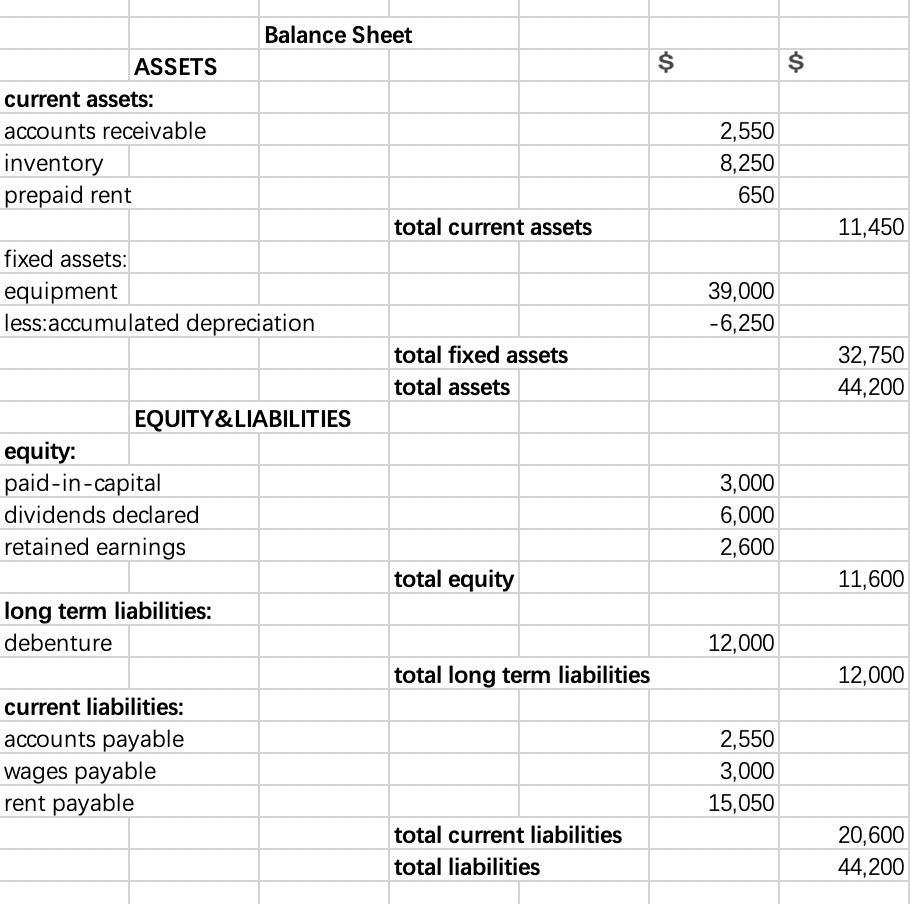

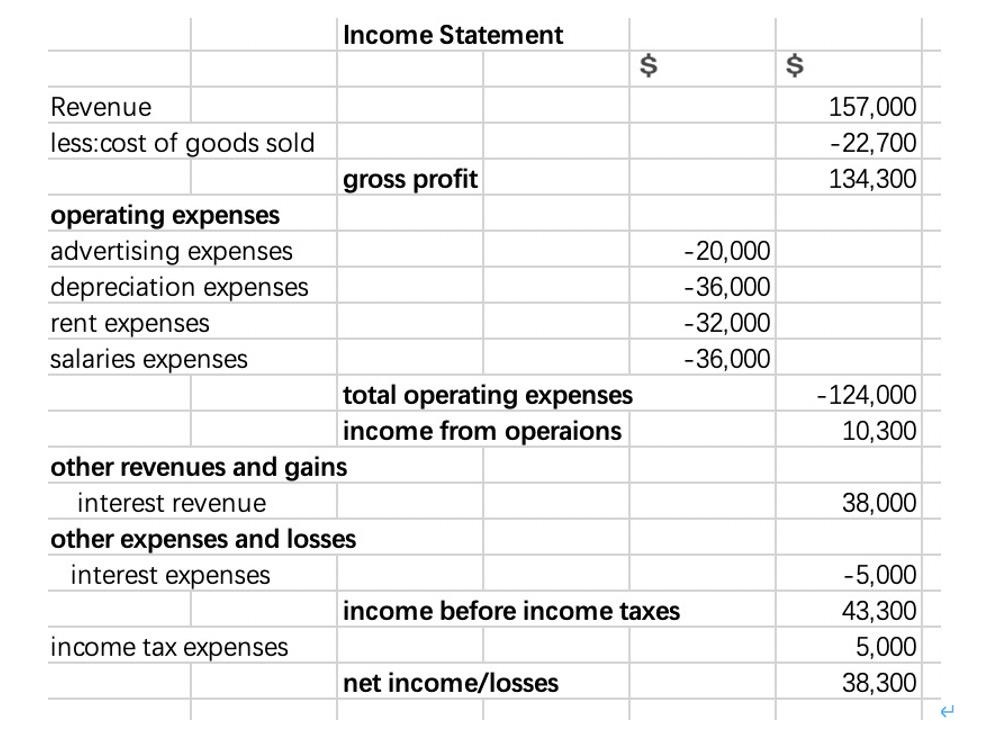

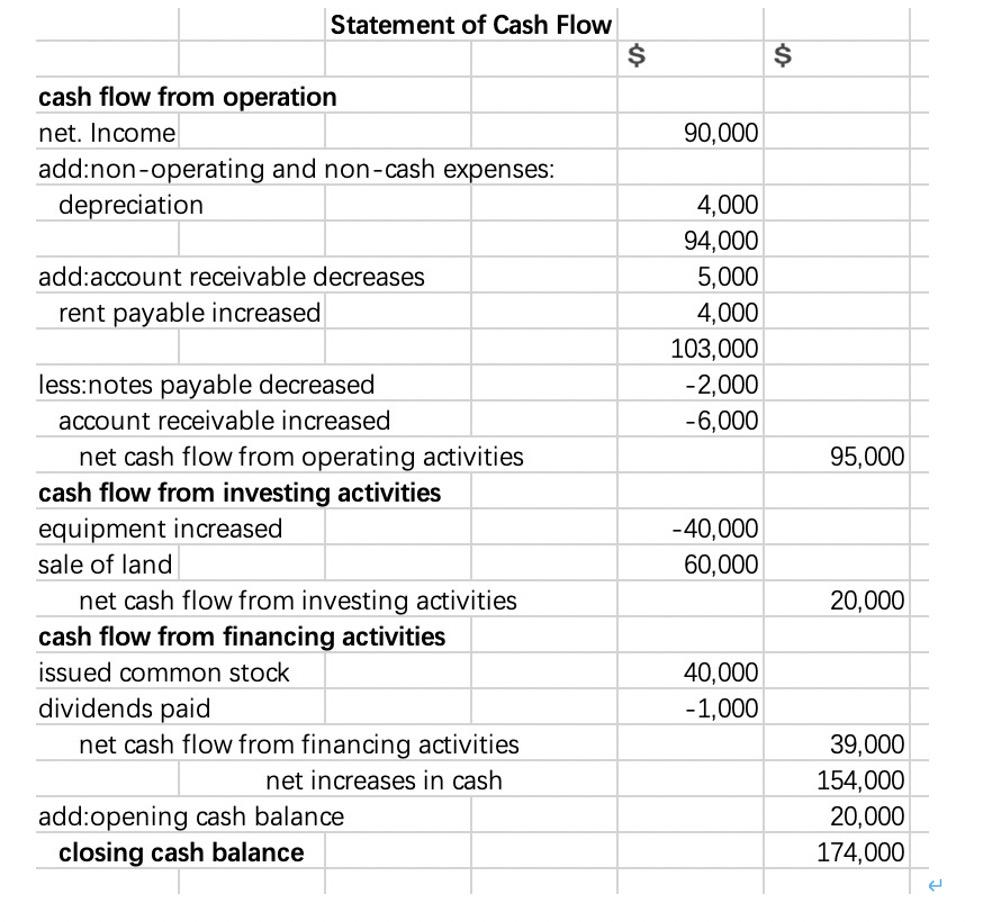

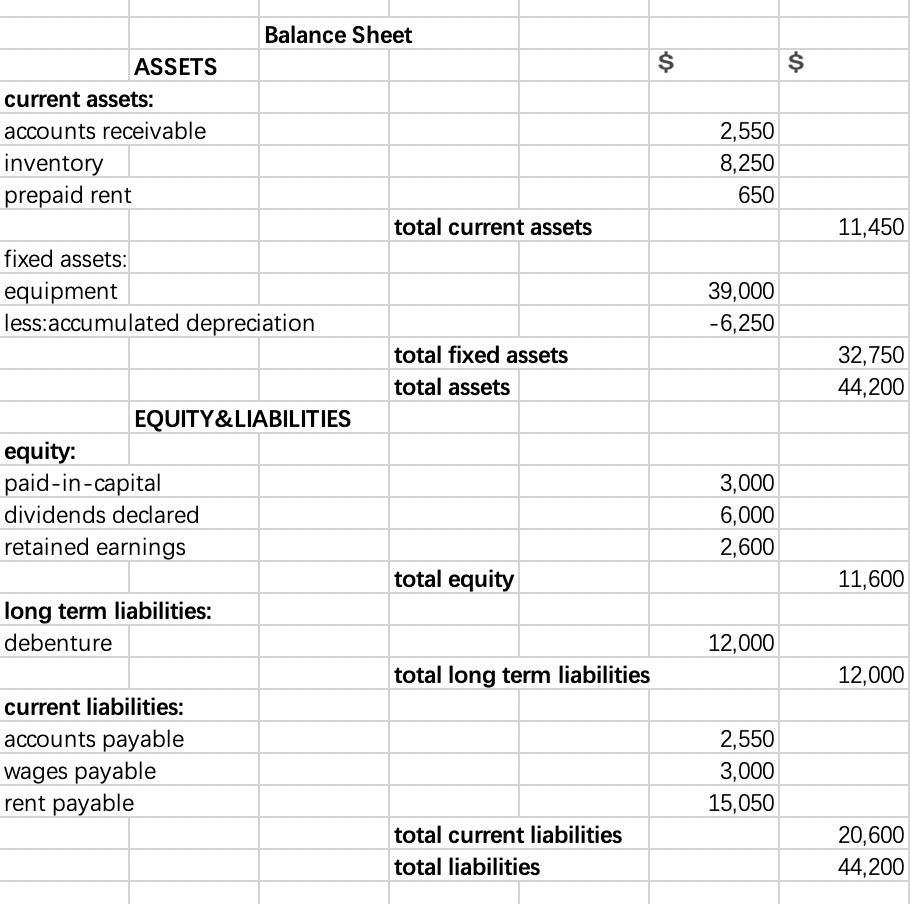

Income Statement $ $ 157,000 -22,700 134,300 Revenue less:cost of goods sold gross profit operating expenses advertising expenses -20,000 depreciation expenses -36,000 rent expenses -32,000 salaries expenses -36,000 total operating expenses income from operaions other revenues and gains interest revenue other expenses and losses interest expenses income before income taxes income tax expenses net income/losses -124,000 10,300 38,000 -5,000 43,300 5,000 38,300 $ Statement of Cash Flow $ cash flow from operation net. Income add:non-operating and non-cash expenses: depreciation 90,000 add:account receivable decreases rent payable increased 4,000 94,000 5,000 4,000 103,000 -2,000 -6,000 95,000 -40,000 60,000 20,000 less:notes payable decreased account receivable increased net cash flow from operating activities cash flow from investing activities equipment increased sale of land net cash flow from investing activities cash flow from financing activities issued common stock dividends paid net cash flow from financing activities net increases in cash add:opening cash balance closing cash balance 40,000 -1,000 39,000 154,000 20,000 174,000 Balance Sheet $ $ ASSETS current assets: accounts receivable inventory prepaid rent 2,550 8,250 650 total current assets 11,450 fixed assets: equipment less:accumulated depreciation 39,000 -6,250 total fixed assets total assets 32,750 44,200 EQUITY&LIABILITIES equity: paid-in-capital dividends declared retained earnings 3,000 6,000 2,600 total equity 11,600 long term liabilities: debenture 12,000 total long term liabilities 12,000 current liabilities: accounts payable wages payable rent payable 2,550 3,000 15,050 total current liabilities total liabilities 20,600 44,200 Income Statement $ $ 157,000 -22,700 134,300 Revenue less:cost of goods sold gross profit operating expenses advertising expenses -20,000 depreciation expenses -36,000 rent expenses -32,000 salaries expenses -36,000 total operating expenses income from operaions other revenues and gains interest revenue other expenses and losses interest expenses income before income taxes income tax expenses net income/losses -124,000 10,300 38,000 -5,000 43,300 5,000 38,300 $ Statement of Cash Flow $ cash flow from operation net. Income add:non-operating and non-cash expenses: depreciation 90,000 add:account receivable decreases rent payable increased 4,000 94,000 5,000 4,000 103,000 -2,000 -6,000 95,000 -40,000 60,000 20,000 less:notes payable decreased account receivable increased net cash flow from operating activities cash flow from investing activities equipment increased sale of land net cash flow from investing activities cash flow from financing activities issued common stock dividends paid net cash flow from financing activities net increases in cash add:opening cash balance closing cash balance 40,000 -1,000 39,000 154,000 20,000 174,000 Balance Sheet $ $ ASSETS current assets: accounts receivable inventory prepaid rent 2,550 8,250 650 total current assets 11,450 fixed assets: equipment less:accumulated depreciation 39,000 -6,250 total fixed assets total assets 32,750 44,200 EQUITY&LIABILITIES equity: paid-in-capital dividends declared retained earnings 3,000 6,000 2,600 total equity 11,600 long term liabilities: debenture 12,000 total long term liabilities 12,000 current liabilities: accounts payable wages payable rent payable 2,550 3,000 15,050 total current liabilities total liabilities 20,600 44,200

identify the factors that, if they were to change, would most affect the plans you presented in your business plan.

identify the factors that, if they were to change, would most affect the plans you presented in your business plan.