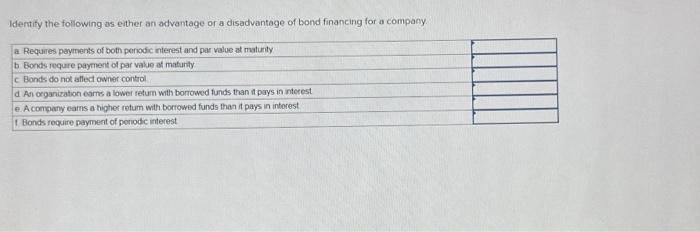

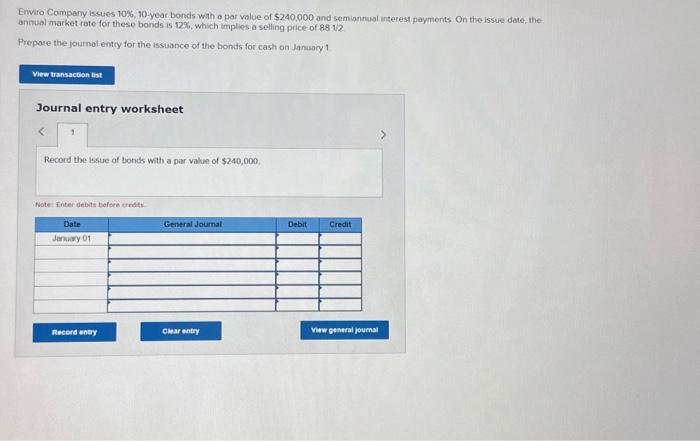

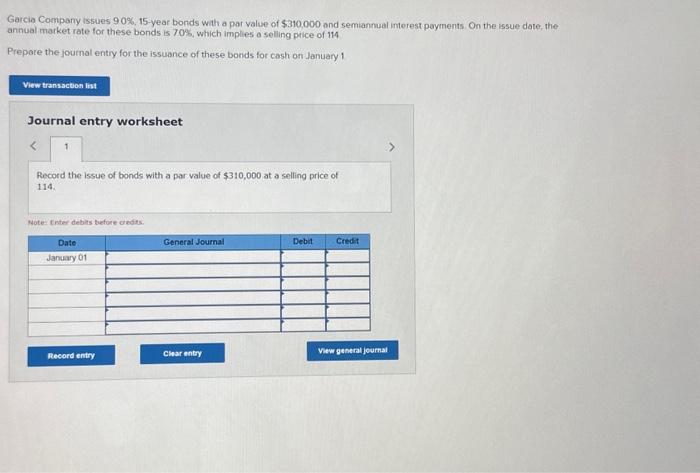

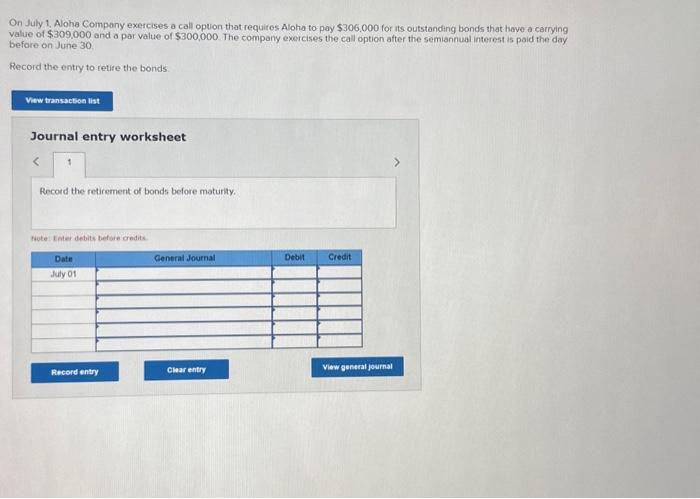

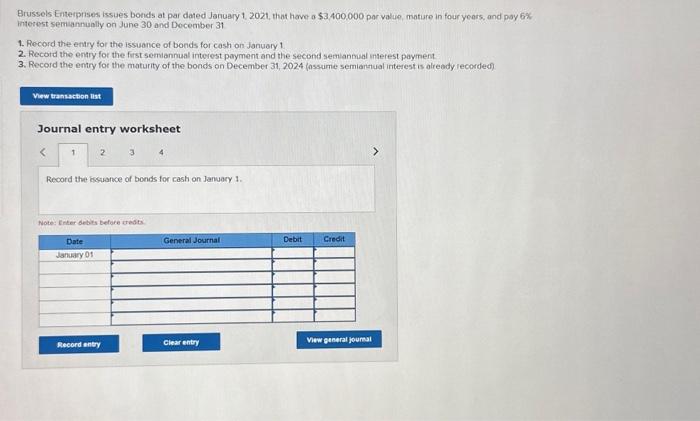

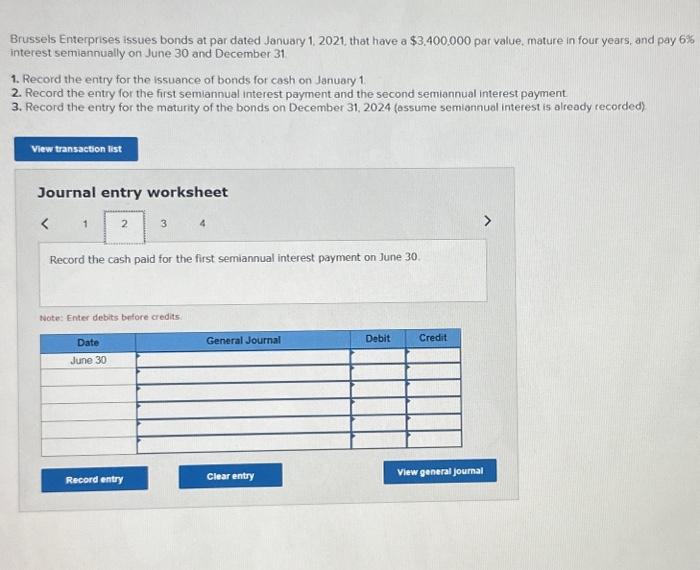

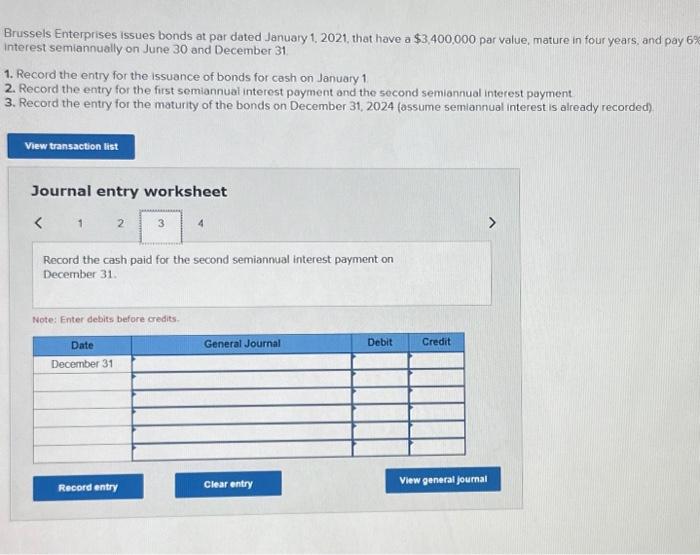

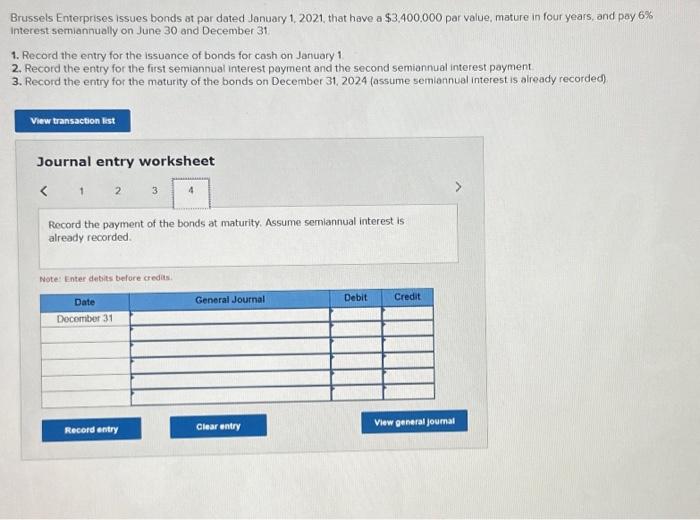

Identify the following as either an advantage or a disadvantage of bond financing for a company Envito Company issues 10%,10-year bonds wah o par value of $240,000 and semionnuol interest payments On the issue date, the annual market rate for these bonds is 12%, which implies a selling price of 8812 Prepore the journal entry for the issuance of the bonds for cash on January 1 Journal entry worksheet Record the lisue of bonds with a par vilue of $240,000 Garcia Compary issues 90%,15-year bonds with a par value of $310.000 and semiannual interest payments On the issue date, the annual market rate for these bonds is 700 , which implies a selling paice of 114 Prepare the journal entry for the issuance of these bonds for cash on January 1 Journal entry worksheet Record the issue of bonds with a par value of $310,000 at a selling price of 114. Hote- triter deblits kuefore credits. Brussels Enterpises issues bonds at par dated January 1, 2021, that have a $3,400,000 par value, mature in four years, and pay 6% Wherest semiannually on June 30 and Docember 31 1. Record the entry for the issuance of bonds for cash on Janusry 1 . 2. Recatd the entry for the fist semiannual interest payment and the second semianmal interest payment 3. Record the entry for the maturity of the bonds on December 31,2024 fassume semiarhual irterest is alieady recorded) Journal entry worksheet Record the issuance of bonds for cash on January 1. Wote: Erier debels before creats. Brussels Enterprises issues bonds at par dated January 1, 2021, that have a $3,400,000 par value. mature in four years, and pay 6% interest semiannually on June 30 and December 31 1. Record the entry for the issuance of bonds for cash on January 1 2. Record the entry for the first semiannual interest payment and the second semiannual interest payment 3. Record the entry for the maturity of the bonds on December 31,2024 (ossume semiannual interest is already recorded) Journal entry worksheet Record the cash paid for the first semiannual interest payment on June 30 . tote: Enter debits byfore credits Brussels Enterprises issues bonds at par dated January 1, 2021, that have a $3,400,000 par value, mature in four years, and pay 6% interest semiannually on June 30 and December 31 1. Record the entry for the issuance of bonds for cash on January 1 2. Record the entry for the first semiannual interest payment and the socond semiannual interest payment 3. Record the entry for the maturity of the bonds on December 31, 2024 (assume semiannual interest is already recorded) Journal entry worksheet Record the cash paid for the second semiannual interest payment on December 31. Wote: Enter debits before credits. Brussels Enterprises issues bonds at par dated January 1,2021 , that have a $3,400.000 par value, mature in four years, and pay 6% interest semiannually on June 30 and December 31 1. Record the entry for the issuance of bonds for cash on January 1 2. Record the entry for the first semiannual interest payment and the second semiannual interest payment 3. Record the entry for the maturity of the bonds on December 31,2024 (assume semiannual interest is already recorded) Journal entry worksheet Record the payment of the bonds at maturity. Assume semiannual interest is already recorded. Note: Enter detits belore credis