Answered step by step

Verified Expert Solution

Question

1 Approved Answer

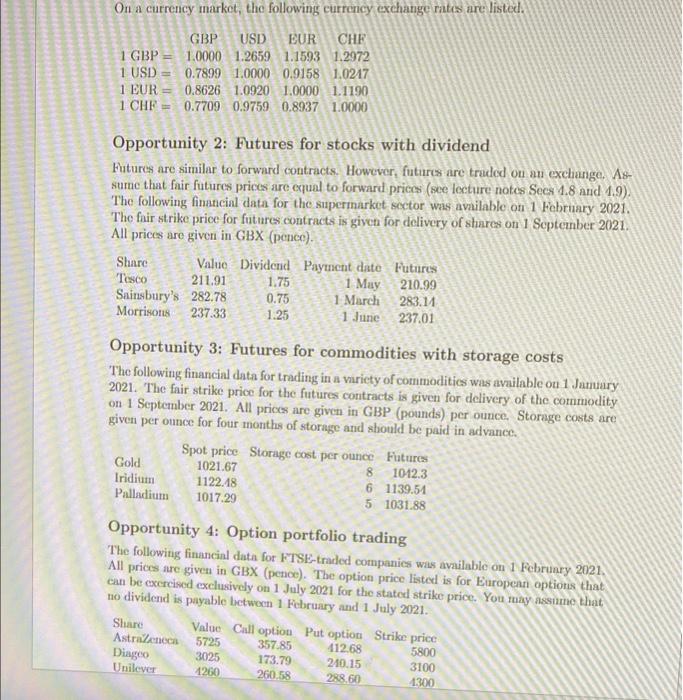

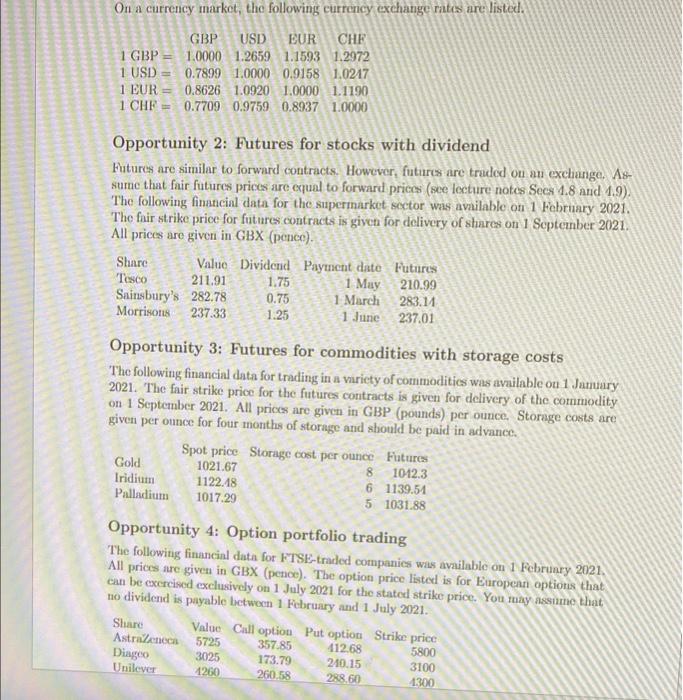

identify the significant misprice On a currency market, the following currency exchange rates are listed. GBP USD EUR CHE 1 GBP = 1.0000 1.2659 1.1593

identify the significant misprice

On a currency market, the following currency exchange rates are listed. GBP USD EUR CHE 1 GBP = 1.0000 1.2659 1.1593 1.2972 1 USD = 0.7899 1.0000 0.9158 1.0217 1 EUR = 0.8626 1.0920 1.0000 1.1190 1 CHF = 0.7709 0.9759 0.8937 1.0000 Opportunity 2: Futures for stocks with dividend Futures are similar to forward contracts. However, futures are traded ou ani exchange. As- sume that fnir futures prices are equal to forward prices (se lecture notes Secs 1.8 and 1.9). The following financial data for the supermarket sector was available on 1 February 2021. The fnir strike price for futures contracts is given for delivery of shares on 1 September 2021. All prices are given in GBX (pence). Shure Value Dividend Payment date Futures Tesco 211.91 1.75 1 May 210.99 Sainsbury's 282.78 0.75 1 March 283.14 Morrisons 237.33 1.25 1 Junie 237.01 Opportunity 3: Futures for commodities with storage costs The following financial data for trading in a variety of commodities was available on 1 Jamary 2021. The fair strike price for the futures contracts is given for delivery of the commodity on 1 September 2021. All prices are given in GBP (pounds) per ounce. Storage costs are given per ounce for four months of storage and should be paid in advance. Spot price Storage cost per ounce Futures Gold 1021.67 8 1012.3 Iridium 1122.18 6 1139.51 Palladium 1017.29 5 1031.88 Opportunity 4: Option portfolio trading The following financial data for FTSE-traded companies was available on 1 February 2021. All prices are given in GBX (pence). The option price listed is for European options that can be exercised exclusively on 1 July 2021 for the stated strike price. You may assume that no dividend is payable between 1 February and 1 July 2021. Shure Value Call option Put option Strike price Astraleneca 5725 357.85 412.68 5800 Diageo 3025 173.79 210.15 3100 Unilever 1260 260.58 288.60 1300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started