Answered step by step

Verified Expert Solution

Question

1 Approved Answer

identify the type of data (qualitative This Question: 15 pts You are trying to develop a strategy for investing in two different stocks. The anticipated

identify the type of data (qualitative

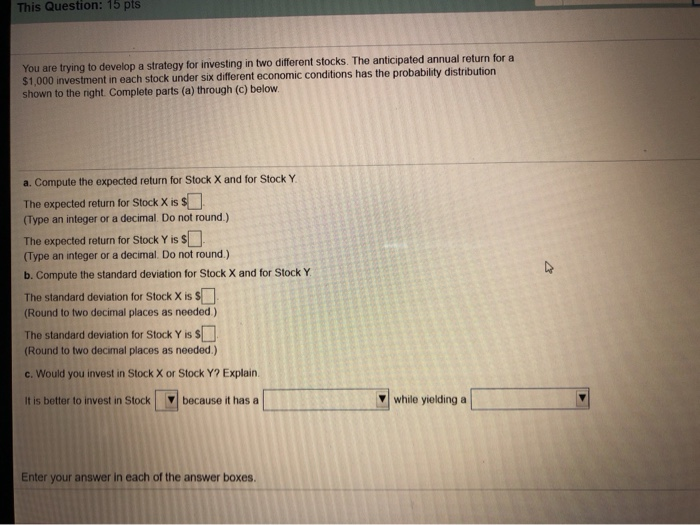

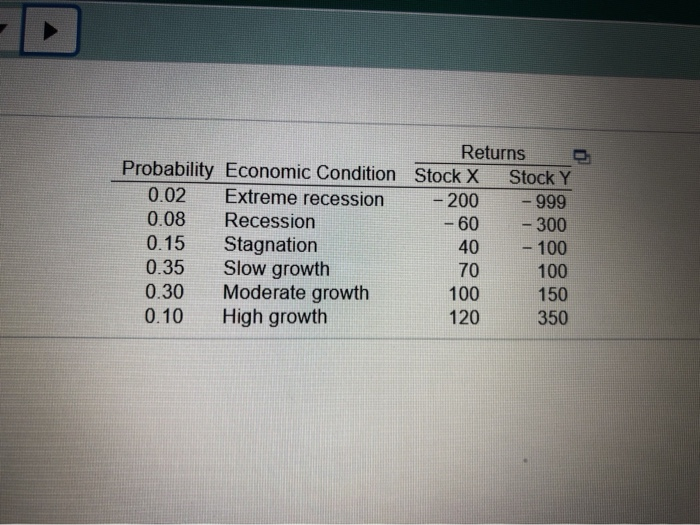

This Question: 15 pts You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in each stock under six different economic conditions has the probability distribution shown to the right. Complete parts (a) through (c) below. a. Compute the expected return for Stock X and for Stock Y The expected return for Stock X is $ (Type an integer or a decimal. Do not round.) The expected return for Stock Y is $. (Type an integer or a decimal. Do not round.) b. Compute the standard deviation for Stock X and for Stock Y The standard deviation for Stock X is $ (Round to two decimal places as needed) The standard deviation for Stock Yis $ (Round to two decimal places as needed.) c. Would you invest in Stock X or Stock Y? Explain It is better to invest in Stock because it has a while yielding a Enter your answer in each of the answer boxes. Returns Probability Economic Condition Stock X Stock Y 0.02 Extreme recession - 200 - 999 0.08 Recession - 60 - 300 0.15 Stagnation - 100 0.35 Slow growth 70 100 0.30 Moderate growth 100 150 0.10 High growth 120 350 40

This Question: 15 pts You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in each stock under six different economic conditions has the probability distribution shown to the right. Complete parts (a) through (c) below. a. Compute the expected return for Stock X and for Stock Y The expected return for Stock X is $ (Type an integer or a decimal. Do not round.) The expected return for Stock Y is $. (Type an integer or a decimal. Do not round.) b. Compute the standard deviation for Stock X and for Stock Y The standard deviation for Stock X is $ (Round to two decimal places as needed) The standard deviation for Stock Yis $ (Round to two decimal places as needed.) c. Would you invest in Stock X or Stock Y? Explain It is better to invest in Stock because it has a while yielding a Enter your answer in each of the answer boxes. Returns Probability Economic Condition Stock X Stock Y 0.02 Extreme recession - 200 - 999 0.08 Recession - 60 - 300 0.15 Stagnation - 100 0.35 Slow growth 70 100 0.30 Moderate growth 100 150 0.10 High growth 120 350 40

identify the type of data (qualitative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started