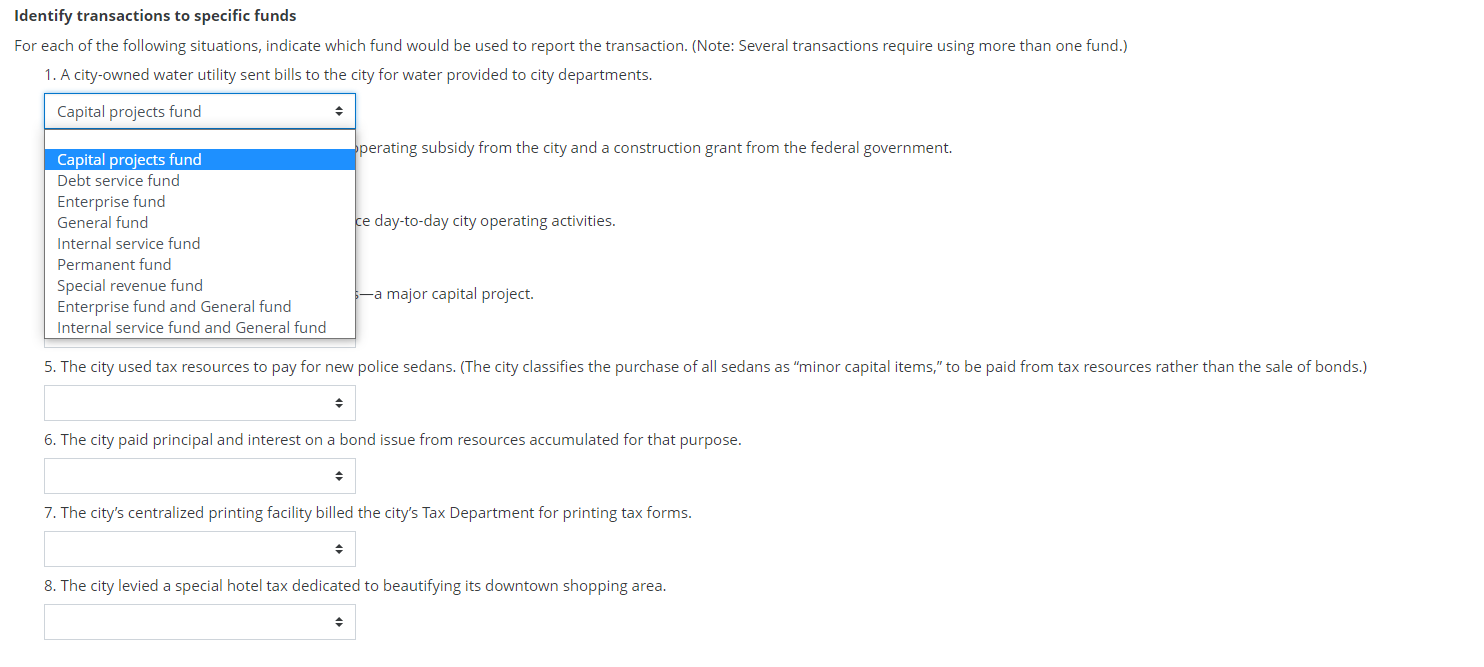

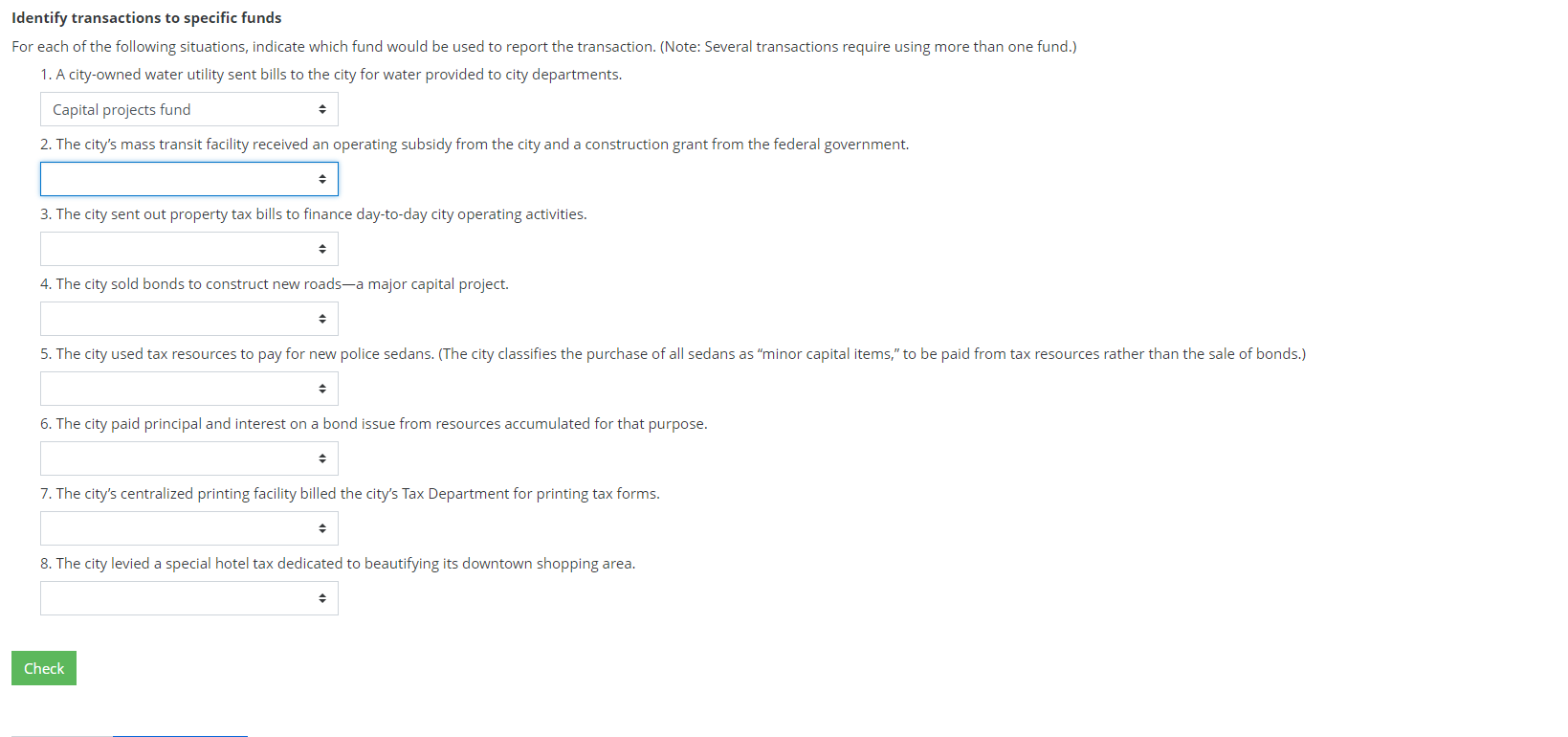

Identify transactions to specific funds For each of the following situations, indicate which fund would used to report the transaction. (Note: Several transactions require using more than one fund.) 1. A city-owned water utility sent bills to the city for water provided to city departments. Capital projects fund perating subsidy from the city and a construction grant from the federal government. ce day-to-day city operating activities. Capital projects fund Debt service fund Enterprise fund General fund Internal service fund Permanent fund Special revenue fund Enterprise fund and General fund Internal service fund and General fund -a major capital project. 5. The city used tax resources to pay for new police sedans. (The city classifies the purchase of all sedans as minor capital items," to be paid from tax resources rather than the sale of bonds.) 6. The city paid principal and interest on a bond issue from resources accumulated for that purpose. 7. The city's centralized printing facility billed the city's Tax Department for printing tax forms. 8. The city levied a special hotel tax dedicated to beautifying its downtown shopping area. Identify transactions to specific funds For each of the following situations, indicate which fund would be used to report the transaction. (Note: Several transactions require using more than one fund.) 1. A city-owned water utility sent bills to the city for water provided to city departments. Capital projects fund 2. The city's mass transit facility received an operating subsidy from the city and a construction grant from the federal government. 3. The city sent out property tax bills to finance day-to-day city operating activities. 4. The city sold bonds to construct new roads-a major capital project. 5. The city used tax resources to pay for new police sedans. (The city classifies the purchase of all sedans as "minor capital items," to be paid from tax resources rather than the sale of bonds.) 6. The city paid principal and interest on a bond issue from resources accumulated for that purpose. 7. The city's centralized printing facility billed the city's Tax Department for printing tax forms. . 8. The city levied a special hotel tax dedicated to beautifying its downtown shopping area. Check