Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Identify whether the following statements about the simple and compound interest methods are true or false. Alek is willing to invest $ 3 0 ,

Identify whether the following statements about the simple and compound interest methods are true or false.

Alek is willing to invest $ for eight years, and is an economically rational investor. He has identified three investment alternatives A B and C

that vary in their method of calculating interest and in the annual interest rate offered. Since he can only make one investment during the eightyear

investment period, complete the following table and indicate whether Alek should invest in each of the investments.

Note: When calculating each investment's future value, assume that all interest is eamed annually. The final value should be rounded to the nearest

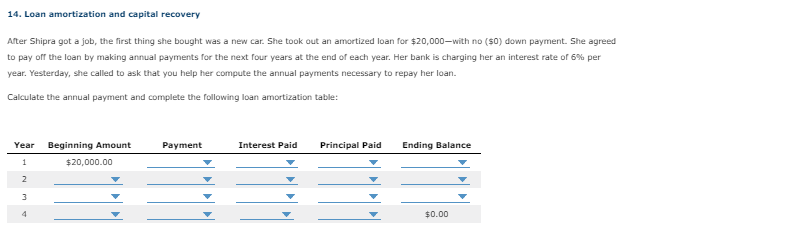

whole dollar.Loan amortization and capital recovery

After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $ with no $ down payment. She agreed to pay off the loan by making annual payments for the next four years at the end of each year. Her bank is charging her an interest rate of per year. Yesterday, she called to ask that you help her compute the annual payments necessary to repay her loan.

Calculate the annual payment and complete the following loan amortization table:

tableYearBeginning Amount,Payment,Interest Paid,Principal Paid,Ending Balance$grad,grad,grad,grad

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started