Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Identify which of the conditions requiring a deviation from a standard unmodified opinion audit report is applicable. State the level of materiality as immaterial, material,

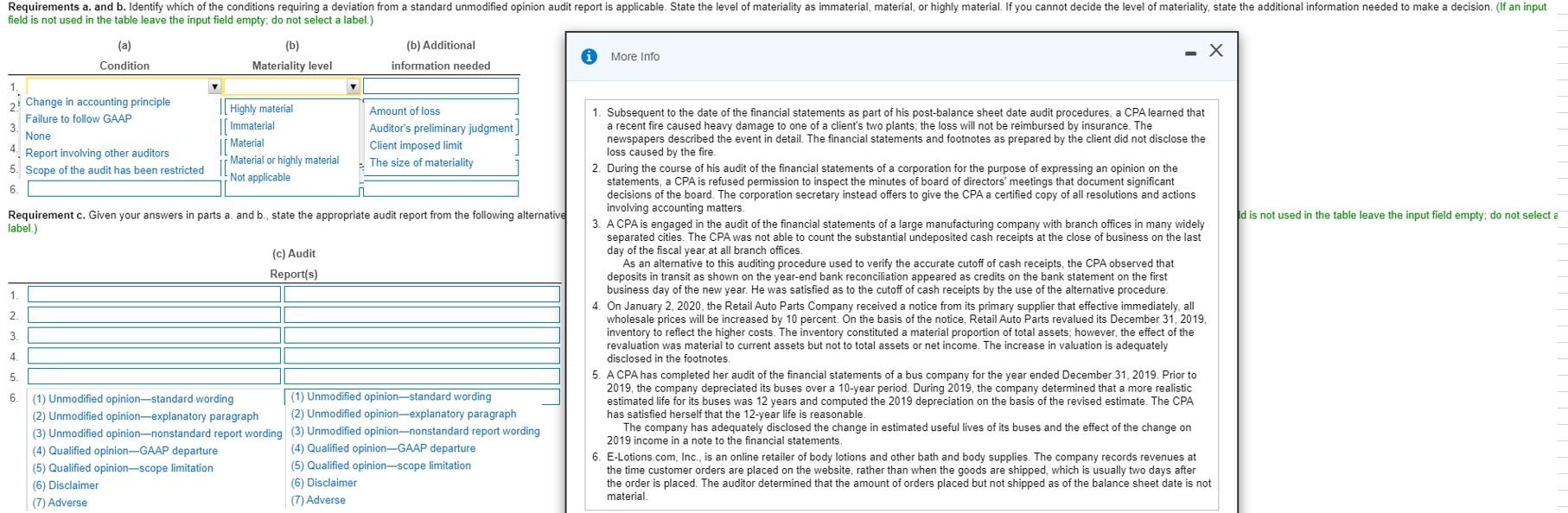

Identify which of the conditions requiring a deviation from a standard unmodified opinion audit report is applicable. State the level of materiality as immaterial, material, or highly material. If you cannot decide the level of materiality, state the additional information needed to make a decision. (If an input field is not used in the table leave the input field empty; do not select a label.)

Requirements a. and b. Identify which of the conditions requiring a deviation from a standard unmodified opinion audit report is applicable. State the level of materiality as immaterial, material, or highly material. If you cannot decide the level of materiality, state the additional information needed to make a decision. (If an input field is not used in the table leave the input field empty; do not select a label.) (a) (b) (b) Additional More Info - X Condition Materiality level information needed 2! Change in accounting principle Failure to follow GAAP 3. None Highly material |[ Immaterial 1. Subsequent to the date of the financial statements as part of his post-balance sheet date audit procedures, a CPA learned that a recent fire caused heavy damage to one of a client's two plants; the loss will not be reimbursed by insurance. The newspapers described the event in detail. The financial statements and footnotes as prepared by the client did not disclose the loss caused by the fire. Amount of loss Auditor's preliminary judgment Material Client imposed limit The size of materiality 4. Report involving other auditors Material or highly material 2. During the course of his audit of the financial statements of a corporation for the purpose of expressing an opinion on the statements, a decisions of the board. The corporation secretary instead offers to give the CPA a certified copy of all resolutions and actions involving accounting matters. 3. A CPA is engaged in the audit of the financial statements of a large manufacturing company with branch offices in many widely separated cities. The CPA was not able to count the substantial undeposited cash receipts at the close of business on the last day of the fiscal year As an alternative to this auditing procedure used to verify the accurate cutoff of cash receipts, the CPA observed that deposits in transit as shown on the year-end bank reconciliation appeared as credits on the bank statement on the first business day of the new year. He was satisfied as to the cutoff of cash receipts by the use of the alternative procedure. 4. On January 2, 2020, the Retail Auto Parts Company received a notice from its primary supplier that effective immediately, all wholesale prices will be increased by 10 percent. On the basis of the notice, Retail Auto Parts revalued its December 31, 2019, inventory to reflect the higher costs. The inventory constituted a material proportion of total assets; however, the effect of the 5. Scope of the audit has been restricted Not applicable CPA is refused permission to inspect the minutes of board of directors' meetings that document significant 6. d is not used in the table leave the input field empty; do not select a Requirement c. Given your answers in parts a. and b., state the appropriate audit report from the following alternative label.) at all branch offices. (c) Audit Report(s) 1. 2. 3. revaluation was material to current assets but not to total assets or net income. The increase in valuation is adequately disclosed in the footnotes. 4. 5. A CPA has completed her audit of the financial statements of a bus company for the year ended December 31, 2019. Prior to 2019, the company depreciated its buses over a 10-year period. During 2019, the company determined that a more realistic estimated life for its buses was 12 years and computed the 2019 depreciation on the basis of the revised estimate. The CPA has satisfied herself that the 12-year life is reasonable. The company has adequately disclosed the change in estimated useful lives of its buses and the effect of the change on 2019 income in a note to the financial statements. 5. (1) Unmodified opinion-standard wording (2) Unmodified opinion-explanatory paragraph 6. (1) Unmodified opinion- (2) Unmodified opinion-explanatory paragraph (3) Unmodified opinion-nonstandard report wording (3) Unmodified opinion-nonstandard report wording (4) Qualified opinion-GAAP departure (4) Qualified opinion-GAAP departure 6. E-Lotions.com, Inc., is an online retailer of body lotions and other bath and body supplies. The company records revenues at the time customer orders are placed on the website, rather than when the goods are shipped, which is usually two days after the order is placed. The auditor determined that the amount of orders placed but not shipped as of the balance sheet date is not material. (5) Qualified opinion-scope limitation (5) Qualified opinion-scope limitation (6) Disclaimer (6) Disclaimer (7) Adverse (7) Adverse

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started