Question

Identify which question you are answering. Round all decimals. On January 1, Year 4 A purchased 80% of the outstanding common shares of B. The

Identify which question you are answering. Round all decimals.

On January 1, Year 4 A purchased 80% of the outstanding common shares of B.

The acquisition differential of $20,000 was allocated as follows:

Equipment with a remaining useful life of 5 years $10,000

Goodwill to the parent company only $10,000

On this date B had a balance of common shares of $100,000 and retained earnings of $180, 000. Accumulated depreciation on B’s equipment on this date was $20,000.

On July 1, Year 5 B purchased 60% of the outstanding common shares of C. The acquisition differential of $5,000 was allocated to equipment with a remaining useful life of 5 years. On this date C had a balance of common shares of $100,000 and retained earnings of $90, 000. Accumulated depreciation on C’s equipment on this date was $8,000.

A and B use the cost method to account for their investments. All companies have a 40% tax rate and a December 31 fiscal year-end.

During Year 6 intercompany sales were as follows:

A selling to B $40,000

C selling to B $20,000

Beginning Inventory Profits:

A selling to B $5,000

C selling to B $3,000

Ending Inventory Profits:

A selling to B $8,000

C selling to B $4,000

On June 30, Year 4 A sold land to C and recorded a gain on sale of $10,000. This land was sold by C in Year 6.

On June 30, Year 5 A sold equipment to B and recorded a gain on sale of $5,000. The equipment had a remaining useful life at the time of the sale of 5 years.

B charged C $2,000 for management fees in Year 6. B records this as Sales and C records it as General expenses.

The recoverable amount of goodwill as of December 31, Year 6 was determined to be $7,000. The impairment was charged in Year 6. C declared dividends but has not paid them yet. All other dividends have been paid.

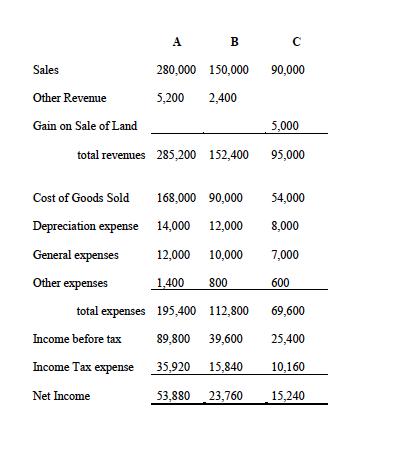

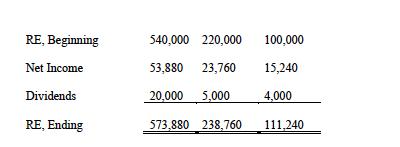

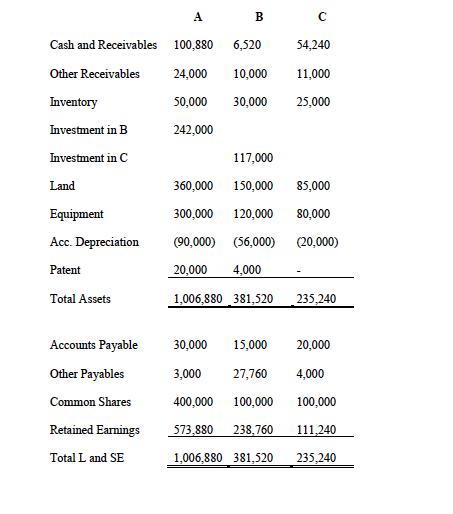

The separate income statements, statements of retained earnings and balance sheets for each company for Year 6 are:

1) Calculate consolidated net income attributable to A and NCI (13 marks)

2) Calculate consolidated retained earnings for January 1, Year 6 (10 marks)

3) Calculate consolidated retained earnings for December 31, Year 6 (do NOT simply use a statement of retained earnings, you must calculate it). (10 marks)

4) Calculate NCI for December 31, Year 6 (9 marks)

5) Prepare a consolidated income statement for year ended December 31, Year 6 (18 marks)

6) Prepare a consolidated balance sheet for December 31, Year 6 (23 marks)

Sales Other Revenue Gain on Sale of Land total revenues 285,200 152,400 Cost of Goods Sold Depreciation expense General expenses Other expenses total expenses A B 280,000 150,000 5,200 2,400 Income before tax Income Tax expense Net Income C 90,000 10,000 5,000 95,000 168,000 90,000 54,000 14,000 12,000 8,000 12,000 7,000 1,400 800 195,400 112,800 69,600 89,800 39,600 25,400 35,920 15,840 10,160 53,880 23,760 15,240 600

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Consolidated net income attributable to A and NCI is 32400 A Net Income for A 53880 Net Income for B 23760 Net Income for C 15240 Intercompany trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started