Question

Identifying and Analyzing Financial Statement Effects of Dividends The stockholders' equity of DiFrancesco Company at March 31, 2019 is shown below. 4% preferred stock, $1,000

Identifying and Analyzing Financial Statement Effects of Dividends The stockholders' equity of DiFrancesco Company at March 31, 2019 is shown below.

| 4% preferred stock, $1,000 par value, 25,000 shares authorized; 10,000 shares issued and outstanding | $10,000,000 |

| Common stock, $1 par value, 3,000,000 shares authorized; 700,000 shares issued and outstanding | 700,000 |

| Additional paid-in capitalpreferred stock | 60,000 |

| Additional paid-in capitalcommon stock | 17,150,000 |

| Retained earnings | 58,806,827 |

| Total stockholders' equity | $86,716,827 |

The following transactions, among others, occurred during the fiscal year ended March 31, 2020. April 15, 2019 Declare and pay preferred dividends of $480,000. April 15, 2019 Declare and pay common dividends of $1.80 per share. October 1, 2019 Execute a 3-for-1 stock split of the common stock when the stock price was $168 per share. March 1, 2020 Declare and pay common dividends of $1.00 per share.

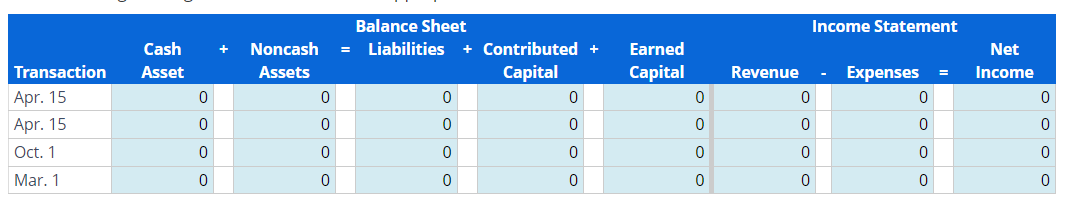

(a) Use the financial statement effects template to indicate the effects of these separate transactions. Note: Use negative signs with answers, when appropriate.

(b) At March 31, 2020, the company reported net income for the year of $8,900,610. Compute retained earnings as of March 31, 2020. $Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started