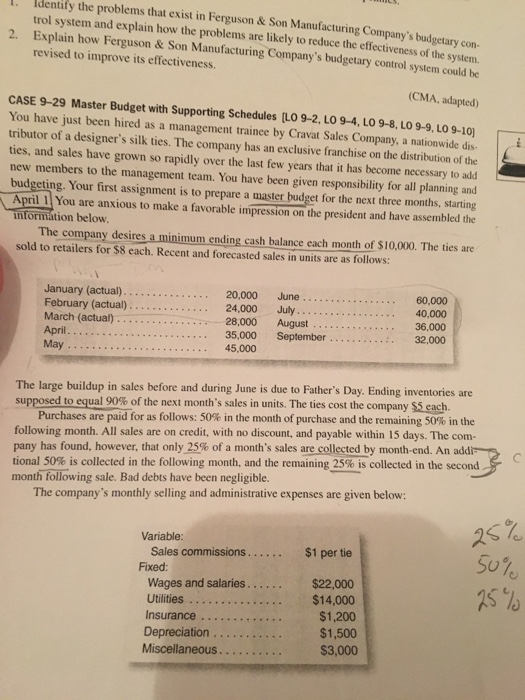

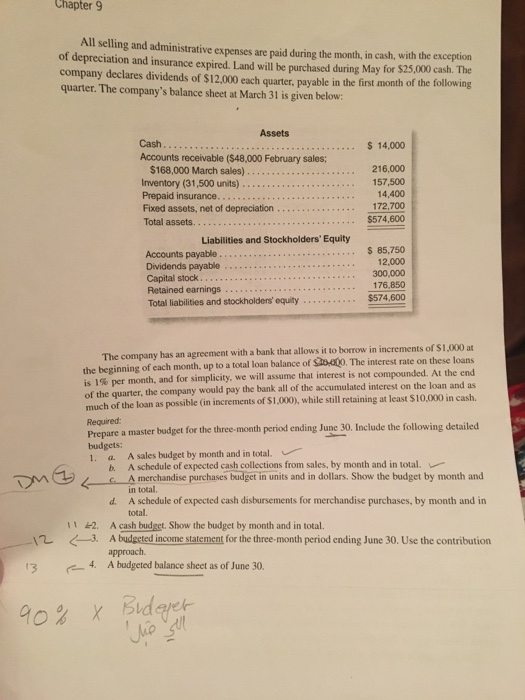

. Identity the problems that exist in Ferguson& Son Manufacturing Company's budgetary con- trol system and explain how the problems are likely to reduce the effectiveness of the system. Explain how Ferguson& Son Manufacturing Company's budgetary control system could be 2. revised to improve its effectiveness. (CMA, adapted CASE 9-29 Master Budget with Supporting Schedules LO 9-2, LO 9-4, LO 9-8, LO 9-9, LO 9-10 You have just been hired as a management trainee by Cravat Sales Company, a nationwide dis tributor of a designer's silk ties. The company has an exclusive franchise on the distribution of the ties, and sales have grown so rapidly over the last few years that it has become necessary to add new members to the management team. You have been given responsibility for all planning and budgeting. Your first assignment is to prepare a master budget for the next three months, starting April 1! You are anxious to make a favorable impression on the president and have assembled the nformation below The company desires a minimum ending cash balance each month of $10,000. The ties are sold to retailers for $8 each. Recent and forecasted sales in units are as follows: February (actual). March (actual).... April May 60,000 40,000 36,000 35,000 September . . . 32,000 . 28,000 August 45,000 The large buildup in sales before and during June is due to Father's Day. Ending inventories are supposed toe ua 90%of the next month's sales in units. The ties cost the company s each Purchases are paid for as follows: 50% in the month of purchase and the remaining 50% in the following month. All sales are on credit, with no discount, and payable within 15 days. The com- pany has found, however, that only25% of a month's sales arecollectedby month-end. An add tional 50% is collected in the following month, and the remaining 25% is collected in the second month following sale. Bad debts have been negligible. The company's monthly selling and administrative expenses are given below: 25 52 Variable: Sales commissions.... $1 per tie Fixed: Wages and salaries.... Utilities Insurance Depreciation $22,000 $1,200 $1,500 $3,000