Answered step by step

Verified Expert Solution

Question

1 Approved Answer

idk how to find the monthly returns please help me please!!! Task 1: Use the monthly returns of IBM and Verizon Communication between November 2015

idk how to find the monthly returns please help me please!!!

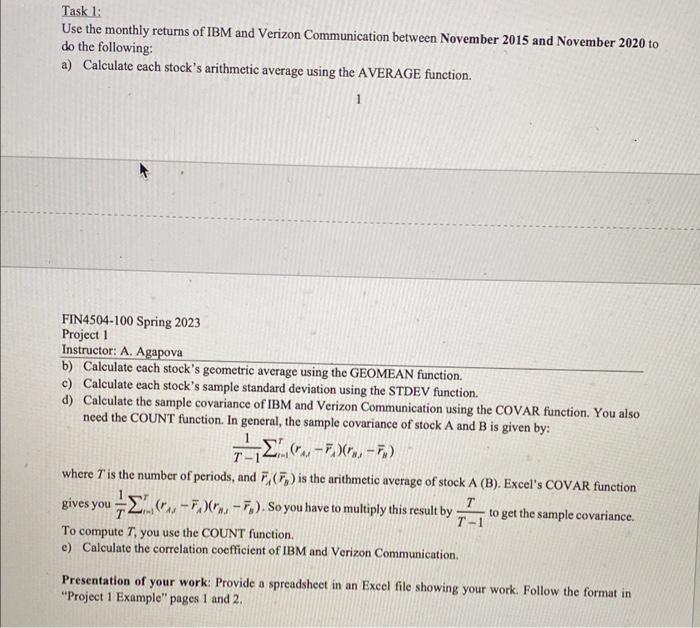

Task 1: Use the monthly returns of IBM and Verizon Communication between November 2015 and November 2020 to do the following: a) Calculate each stock's arithmetic average using the AVERAGE function. 1 FIN4504-100 Spring 2023 Project 1 Instructor: A. Agapova b) Calculate each stock's geometric average using the GEOMEAN function. c) Calculate each stock's sample standard deviation using the STDEV function. d) Calculate the sample covariance of IBM and Verizon Communication using the COVAR function. You also need the COUNT function. In general, the sample covariance of stock A and B is given by: T11i=1T(rA,rA)(rB,rH) where T is the number of periods, and rA(rB) is the arithmetic average of stock A (B). Excel's COVAR function gives you T1A=1T(rA,rA)(rH,rB). So you have to multiply this result by T1T to get the sample covariance. To compute T, you use the COUNT function. e) Calculate the correlation coefficient of IBM and Verizon Communication. Presentation of your work: Provide a spreadsheet in an Excel file showing your work. Follow the format in "Project 1 Example" pages 1 and 2. Task 1: Use the monthly returns of IBM and Verizon Communication between November 2015 and November 2020 to do the following: a) Calculate each stock's arithmetic average using the AVERAGE function. 1 FIN4504-100 Spring 2023 Project 1 Instructor: A. Agapova b) Calculate each stock's geometric average using the GEOMEAN function. c) Calculate each stock's sample standard deviation using the STDEV function. d) Calculate the sample covariance of IBM and Verizon Communication using the COVAR function. You also need the COUNT function. In general, the sample covariance of stock A and B is given by: T11i=1T(rA,rA)(rB,rH) where T is the number of periods, and rA(rB) is the arithmetic average of stock A (B). Excel's COVAR function gives you T1A=1T(rA,rA)(rH,rB). So you have to multiply this result by T1T to get the sample covariance. To compute T, you use the COUNT function. e) Calculate the correlation coefficient of IBM and Verizon Communication. Presentation of your work: Provide a spreadsheet in an Excel file showing your work. Follow the format in "Project 1 Example" pages 1 and 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started