Answered step by step

Verified Expert Solution

Question

1 Approved Answer

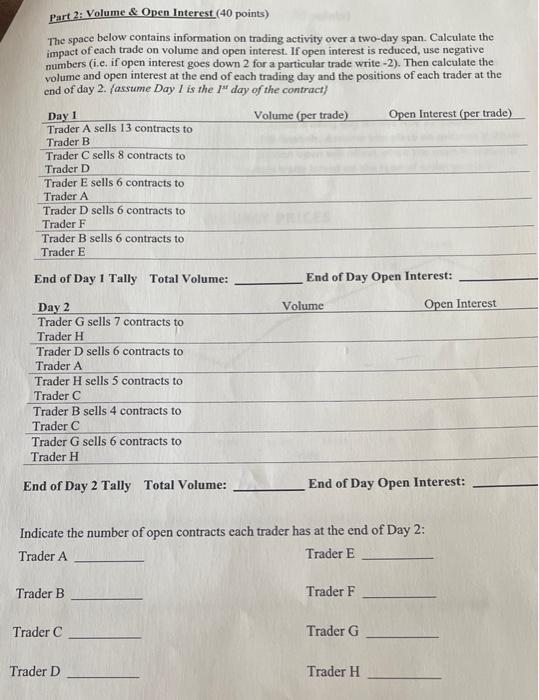

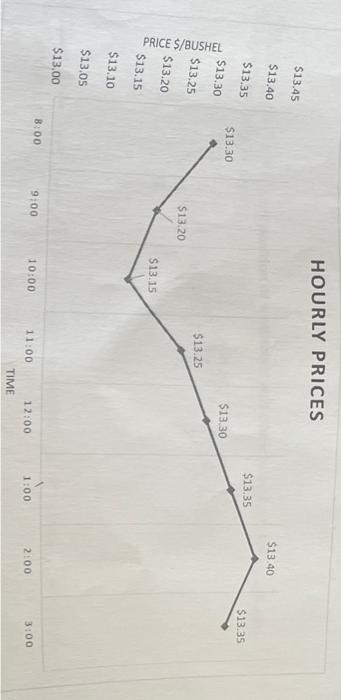

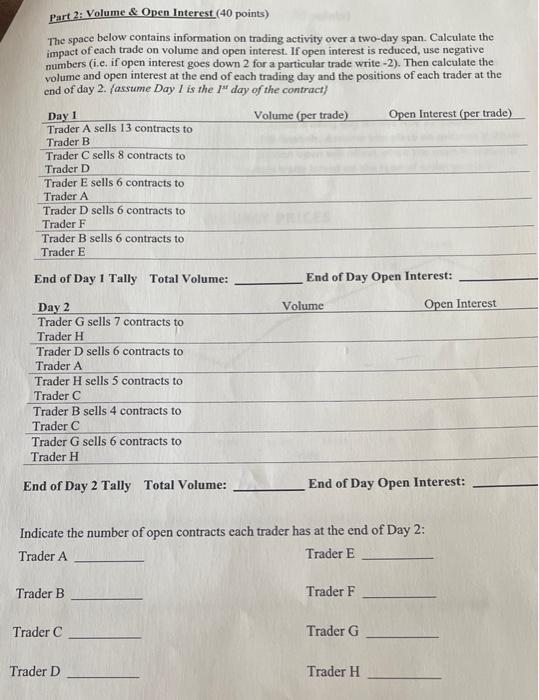

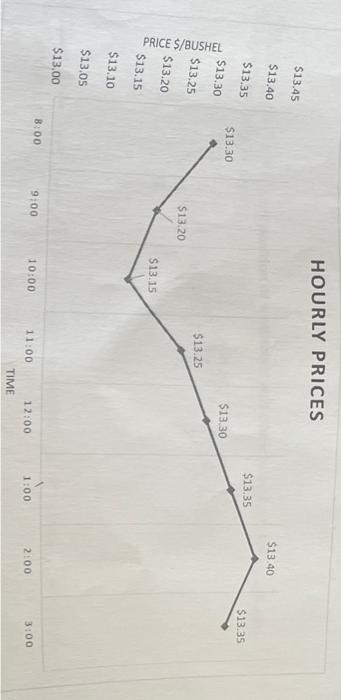

idk if you need the graph, but i put it on here as well Part 2: Volume & Open Interest (40 points) The space below

idk if you need the graph, but i put it on here as well

Part 2: Volume \& Open Interest (40 points) The space below contains information on trading activity over a two-day span. Calculate the impact of each trade on volume and open interest. If open interest is reduced, use negative numbers (i.e. if open interest goes down 2 for a particular trade write 2 ). Then calculate the volume and open interest at the end of each trading day and the positions of each trader at the end of day 2. fassume Day I is the Isf day of the contract? End of Day 1 Tally Total Volume: End of Day Open Interest: End of Day 2 Tally Total Volume: End of Day Open Interest: Indicate the number of open contracts each trader has at the end of Day 2 : Trader A Trader E Trader B Trader F Trader C Trader G Trader D Trader H HOURLY PRICES Part 2: Volume \& Open Interest (40 points) The space below contains information on trading activity over a two-day span. Calculate the impact of each trade on volume and open interest. If open interest is reduced, use negative numbers (i.e. if open interest goes down 2 for a particular trade write 2 ). Then calculate the volume and open interest at the end of each trading day and the positions of each trader at the end of day 2. fassume Day I is the Isf day of the contract? End of Day 1 Tally Total Volume: End of Day Open Interest: End of Day 2 Tally Total Volume: End of Day Open Interest: Indicate the number of open contracts each trader has at the end of Day 2 : Trader A Trader E Trader B Trader F Trader C Trader G Trader D Trader H HOURLY PRICES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started