Answered step by step

Verified Expert Solution

Question

1 Approved Answer

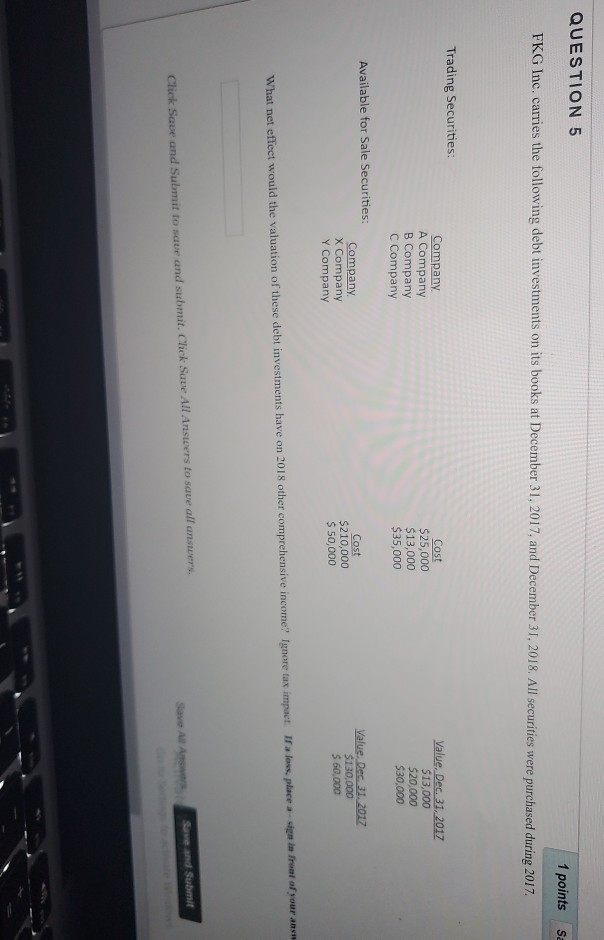

idk thats what the QUESTION 5 1 points sa FKG Inc. carries the following debt investments on its books at December 31, 2017 and December

idk thats what the

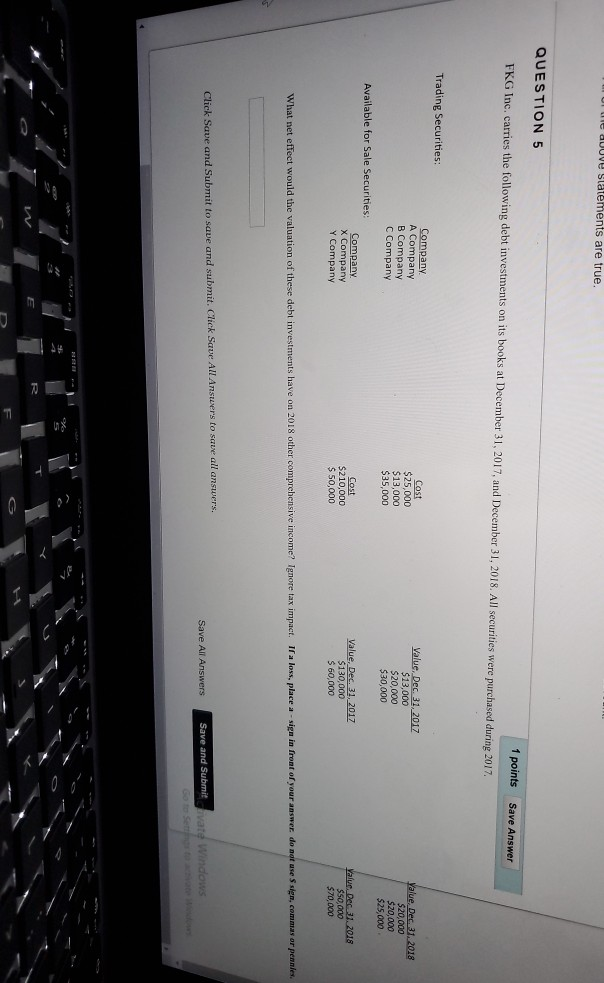

QUESTION 5 1 points sa FKG Inc. carries the following debt investments on its books at December 31, 2017 and December 31, 2018. All securities were purchased during 2017 Trading Securities: Company A Company B Company C Company Cost $25,000 $13,000 $35,000 Value, Dec 31, 2017 $13,000 $20,000 $30,000 Available for Sale Securities: Company X Company Y Company Cost $210,000 $ 50,000 Value, Dec 31, 2017 $130,000 $ 60,000 a loss, place wigs free of your ans What net effect would the valuation of these debt investments have on 2018 other comprehensive income? Ignore tax impact Save Al Save and Submit Chick Save and Submit aur and submit. Click Save All Answers to save all ans Urte dove statements are true. QUESTION 5 1 points FKG Inc. carries the following debt investments on its books at December 31, 2017, and December 31, 2018. All securities were purchased during 2017 Save Answer Trading Securities: Company A Company B Company Company Cost $25,000 $13,000 $35,000 Value, Dec 31, 2017 $13,000 $20,000 $30,000 Value, Dec. 31. 2018 $20,000 $20,000 $25,000 Available for Sale Securities: Company X Company Y Company Cost $210,000 $ 50,000 Value, Dec 31, 2017 $130,000 S 60,000 Value Dec 31, 2018 $50,000 $70,000 What net effect would the valuation of these debt investments have on 2018 other comprehensive income? Ignore tax impact. If a loss, place a sign in front of your answer do not use sim, commas or pennies. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submitivate Windows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started