Answered step by step

Verified Expert Solution

Question

1 Approved Answer

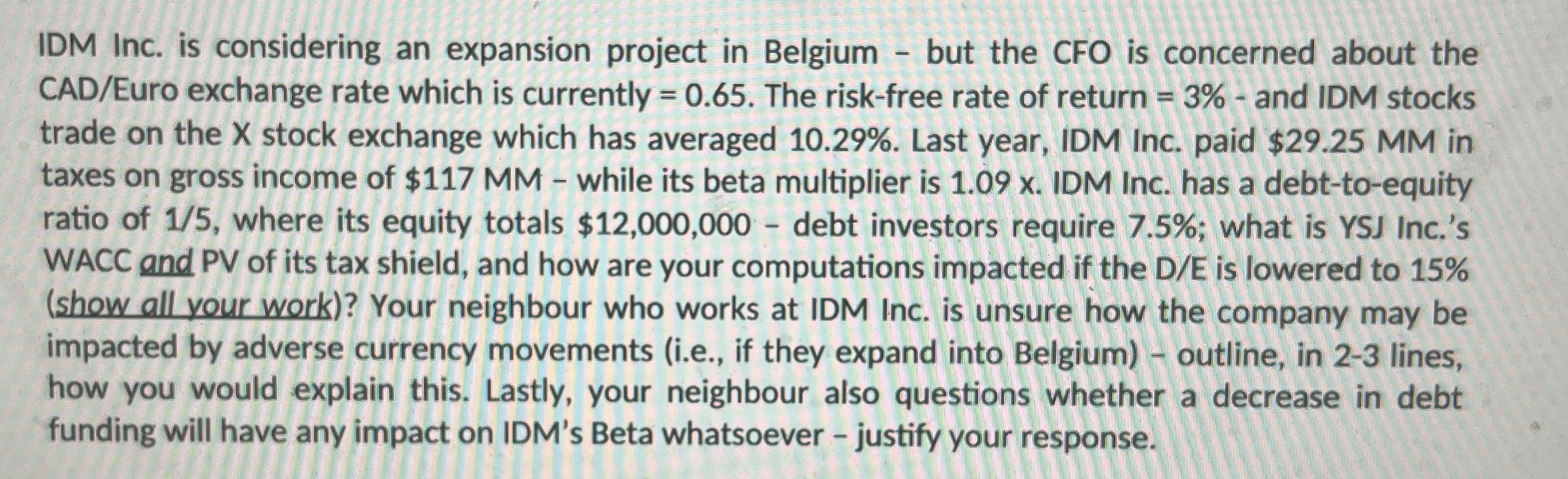

IDM Inc. is considering an expansion project in Belgium - but the CFO is concerned about the CAD / Euro exchange rate which is currently

IDM Inc. is considering an expansion project in Belgium but the CFO is concerned about the CADEuro exchange rate which is currently The riskfree rate of return and IDM stocks trade on the stock exchange which has averaged Last year, IDM Inc. paid $ in taxes on gross income of $ while its beta multiplier is x IDM Inc. has a debttoequity ratio of where its equity totals $ debt investors require ; what is YSJ Inc.s WACC and PV of its tax shield, and how are your computations impacted if the DE is lowered to show all your work Your neighbour who works at IDM Inc. is unsure how the company may be impacted by adverse currency movements ie if they expand into Belgium outline, in lines, how you would explain this. Lastly, your neighbour also questions whether a decrease in debt funding will have any impact on IDM's Beta whatsoever justify your response.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started