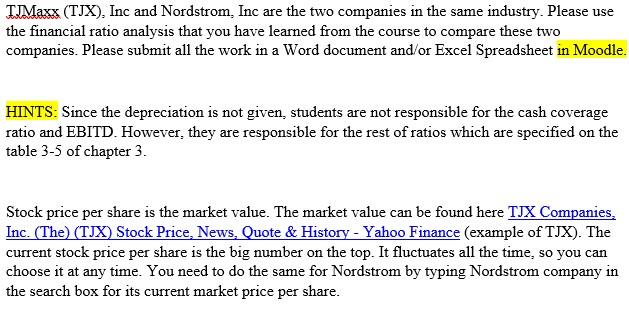

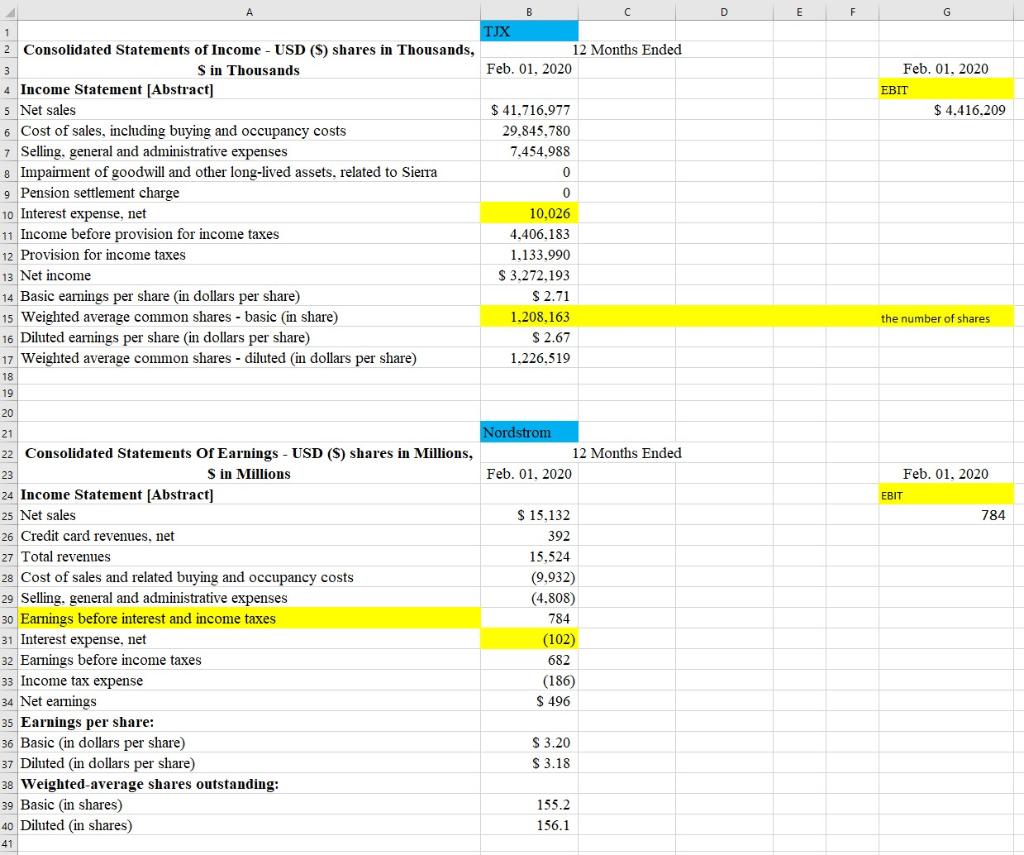

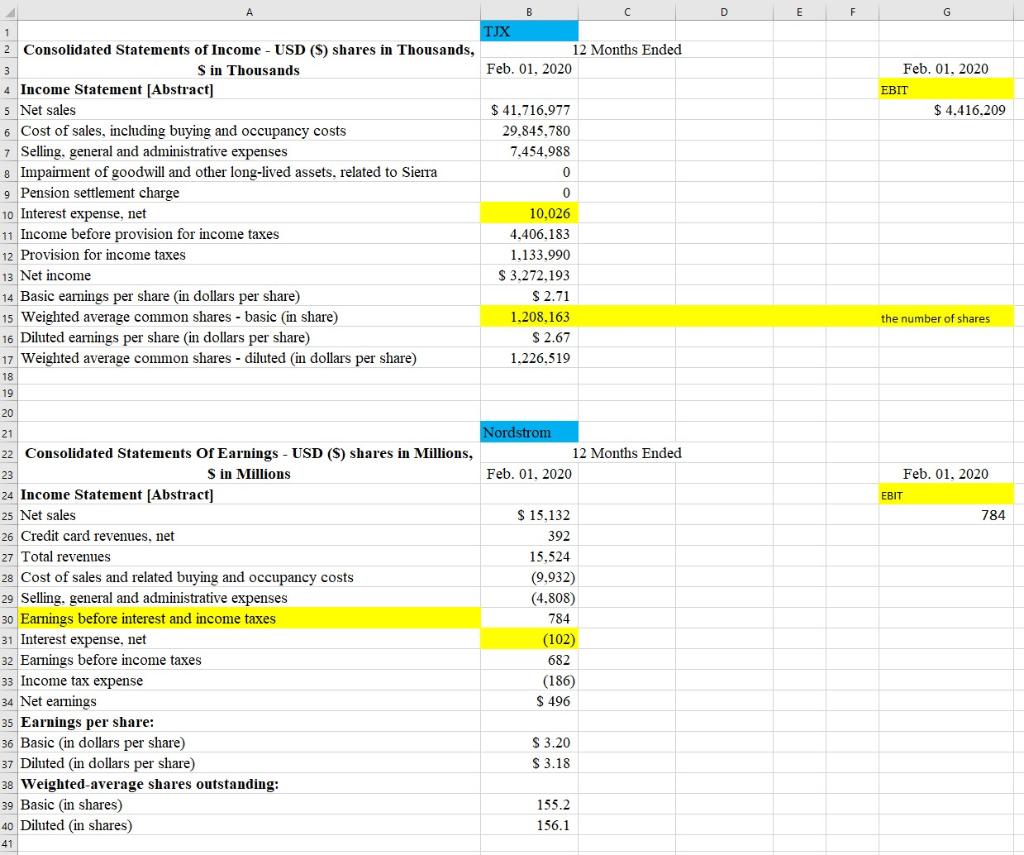

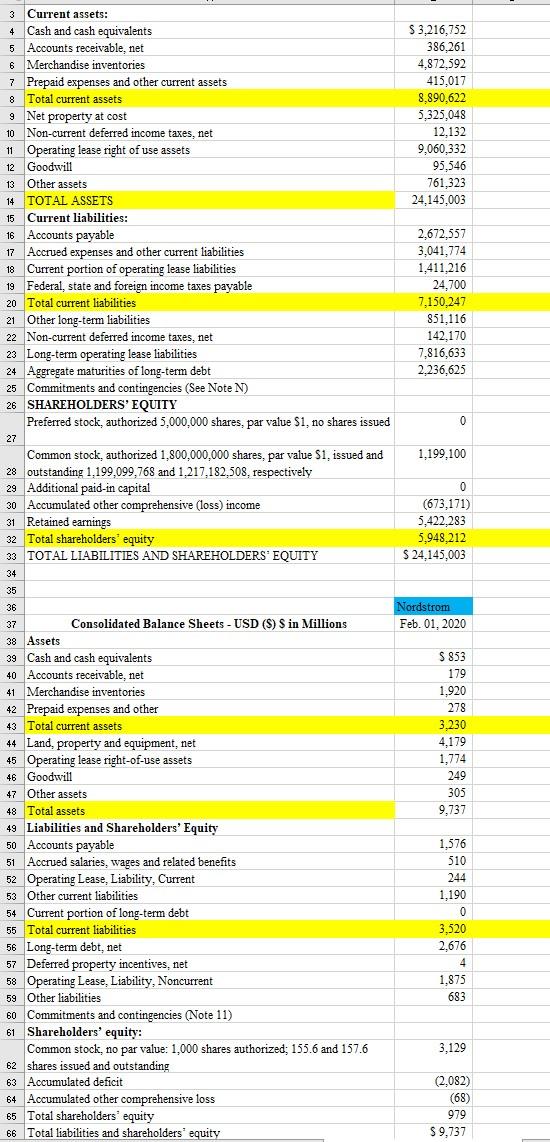

IdMaxx (TJX), Inc and Nordstrom, Inc are the two companies in the same industry. Please use the financial ratio analysis that you have learned from the course to compare these two companies. Please submit all the work in a Word document and/or Excel Spreadsheet in Moodle. HINTS: Since the depreciation is not given, students are not responsible for the cash coverage ratio and EBITD. However, they are responsible for the rest of ratios which are specified on the table 3-5 of chapter 3. Stock price per share is the market value. The market value can be found here TJX Companies, Inc. (The) (TJX) Stock Price, News, Quote & History - Yahoo Finance (example of TJX). The current stock price per share is the big number on the top. It fluctuates all the time, so you can choose it at any time. You need to do the same for Nordstrom by typing Nordstrom company in the search box for its current market price per share. D E G Feb. 01, 2020 EBIT $ 4.416.209 the number of shares S 2.67 TJX 2 Consolidated Statements of Income - USD ($) shares in Thousands, 12 Months Ended 3 S in Thousands Feb. 01, 2020 4 Income Statement [Abstract) 5 Net sales $ 41.716.977 6 Cost of sales, including buying and occupancy costs 29.845.780 7 Selling, general and administrative expenses 7.454,988 8 Impairment of goodwill and other long-lived assets, related to Sierra 0 9 Pension settlement charge 0 10 Interest expense, net 10,026 11 Income before provision for income taxes 4.406.183 12 Provision for income taxes 1.133.990 13 Net income $ 3.272.193 14 Basic earnings per share (in dollars per share) $ 2.71 15 Weighted average common shares - basic in share) 1.208.163 16 Diluted earnings per share in dollars per share) 17 Weighted average common shares - diluted (in dollars per share) 1.226,519 18 19 20 21 Nordstrom 22 Consolidated Statements Of Earnings - USD (S) shares in Millions, 12 Months Ended 23 S in Millions Feb. 01, 2020 24 Income Statement (Abstract] 25 Net sales $ 15,132 26 Credit card revenues, net 392 27 Total revenues 15,524 28 Cost of sales and related buying and occupancy costs (9.932) 29 Selling. general and administrative expenses (4.808) 30 Earnings before interest and income taxes 784 31 Interest expense, net (102) 32 Earnings before income taxes 682 33 Income tax expense (186) 34 Net earnings 35 Earnings per share: 36 Basic in dollars per share) S 3.20 37 Diluted (in dollars per share) $ 3.18 38 Weighted average shares outstanding: 39 Basic (in shares) 155.2 40 Diluted in shares) 156.1 41 Feb. 01, 2020 EBIT 784 $ 496 $3,216,752 386,261 4,872,592 415,017 8,890,622 5.325,048 12,132 9,060,332 95,546 761,323 24.145,003 18 19 2,672,557 3,041,774 1,411.216 24,700 7,150,247 851,116 142,170 7,816,633 2.236,625 0 1,199,100 30 0 (673,171) 5,422,283 5,948,212 $ 24,145,003 3 Current assets: 4 Cash and cash equivalents 5 Accounts receivable, net 6 Merchandise inventories 7 Prepaid expenses and other current assets 8 Total current assets 9 Net property at cost 10 Non-current deferred income taxes, net - 11 Operating lease right of use assets 12 Goodwill 13 Other assets 14 TOTAL ASSETS 15 Current liabilities: 16 Accounts payable 17 Accrued expenses and other current liabilities Current portion of operating lease liabilities Federal, state and foreign income taxes payable 20 Total current liabilities 21 Other long-term liabilities 22 Non-current deferred income taxes, net 23 Long-term operating lease liabilities 24 Aggregate maturities of long-term debt 25 Commitments and contingencies (See Note N) 26 SHAREHOLDERS' EQUITY Preferred stock, authorized 5,000,000 shares, par value S1, no shares issued 27 Common stock, authorized 1,800,000,000 shares, par value $1, issued and 28 outstanding 1.199,099,768 and 1.217.182,508, respectively 29 Additional paid-in capital - Accumulated other comprehensive (loss) income 31 Retained earnings 32 Total shareholders' equity 33 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 34 35 36 Consolidated Balance Sheets - USD ($) Sin Millions 38 Assets 39 Cash and cash equivalents 40 Accounts receivable, net 41 Merchandise inventories 42 Prepaid expenses and other 43 Total current assets 44 Land, property and equipment, net 45 Operating lease right-of-use assets 46 Goodwill 47 Other assets 48 Total assets 49 Liabilities and Shareholders' Equity 50 Accounts payable 51 Accrued salaries, wages and related benefits 52 Operating Lease, Liability, Current 53 Other current liabilities 54 Current portion of long-term debt 55 Total current liabilities 56 Long-term debt, net 57 Deferred property incentives, net 58 Operating Lease, Liability, Noncurrent 59 Other liabilities 60 Commitments and contingencies (Note 11) 61 Shareholders' equity: Common stock, no par value: 1,000 shares authorized; 155.6 and 157.6 shares issued and outstanding 63 Accumulated deficit 64 Accumulated other comprehensive loss 65 Total shareholders' equity 66 Total liabilities and shareholders' equity Nordstrom Feb. 01, 2020 37 S853 179 1.920 278 3,230 4,179 1,774 249 305 9,737 1,576 510 244 1,190 0 3,520 2,676 4 1.875 683 3,129 62 (2,082) (68) 979 S 9,737 IdMaxx (TJX), Inc and Nordstrom, Inc are the two companies in the same industry. Please use the financial ratio analysis that you have learned from the course to compare these two companies. Please submit all the work in a Word document and/or Excel Spreadsheet in Moodle. HINTS: Since the depreciation is not given, students are not responsible for the cash coverage ratio and EBITD. However, they are responsible for the rest of ratios which are specified on the table 3-5 of chapter 3. Stock price per share is the market value. The market value can be found here TJX Companies, Inc. (The) (TJX) Stock Price, News, Quote & History - Yahoo Finance (example of TJX). The current stock price per share is the big number on the top. It fluctuates all the time, so you can choose it at any time. You need to do the same for Nordstrom by typing Nordstrom company in the search box for its current market price per share. D E G Feb. 01, 2020 EBIT $ 4.416.209 the number of shares S 2.67 TJX 2 Consolidated Statements of Income - USD ($) shares in Thousands, 12 Months Ended 3 S in Thousands Feb. 01, 2020 4 Income Statement [Abstract) 5 Net sales $ 41.716.977 6 Cost of sales, including buying and occupancy costs 29.845.780 7 Selling, general and administrative expenses 7.454,988 8 Impairment of goodwill and other long-lived assets, related to Sierra 0 9 Pension settlement charge 0 10 Interest expense, net 10,026 11 Income before provision for income taxes 4.406.183 12 Provision for income taxes 1.133.990 13 Net income $ 3.272.193 14 Basic earnings per share (in dollars per share) $ 2.71 15 Weighted average common shares - basic in share) 1.208.163 16 Diluted earnings per share in dollars per share) 17 Weighted average common shares - diluted (in dollars per share) 1.226,519 18 19 20 21 Nordstrom 22 Consolidated Statements Of Earnings - USD (S) shares in Millions, 12 Months Ended 23 S in Millions Feb. 01, 2020 24 Income Statement (Abstract] 25 Net sales $ 15,132 26 Credit card revenues, net 392 27 Total revenues 15,524 28 Cost of sales and related buying and occupancy costs (9.932) 29 Selling. general and administrative expenses (4.808) 30 Earnings before interest and income taxes 784 31 Interest expense, net (102) 32 Earnings before income taxes 682 33 Income tax expense (186) 34 Net earnings 35 Earnings per share: 36 Basic in dollars per share) S 3.20 37 Diluted (in dollars per share) $ 3.18 38 Weighted average shares outstanding: 39 Basic (in shares) 155.2 40 Diluted in shares) 156.1 41 Feb. 01, 2020 EBIT 784 $ 496 $3,216,752 386,261 4,872,592 415,017 8,890,622 5.325,048 12,132 9,060,332 95,546 761,323 24.145,003 18 19 2,672,557 3,041,774 1,411.216 24,700 7,150,247 851,116 142,170 7,816,633 2.236,625 0 1,199,100 30 0 (673,171) 5,422,283 5,948,212 $ 24,145,003 3 Current assets: 4 Cash and cash equivalents 5 Accounts receivable, net 6 Merchandise inventories 7 Prepaid expenses and other current assets 8 Total current assets 9 Net property at cost 10 Non-current deferred income taxes, net - 11 Operating lease right of use assets 12 Goodwill 13 Other assets 14 TOTAL ASSETS 15 Current liabilities: 16 Accounts payable 17 Accrued expenses and other current liabilities Current portion of operating lease liabilities Federal, state and foreign income taxes payable 20 Total current liabilities 21 Other long-term liabilities 22 Non-current deferred income taxes, net 23 Long-term operating lease liabilities 24 Aggregate maturities of long-term debt 25 Commitments and contingencies (See Note N) 26 SHAREHOLDERS' EQUITY Preferred stock, authorized 5,000,000 shares, par value S1, no shares issued 27 Common stock, authorized 1,800,000,000 shares, par value $1, issued and 28 outstanding 1.199,099,768 and 1.217.182,508, respectively 29 Additional paid-in capital - Accumulated other comprehensive (loss) income 31 Retained earnings 32 Total shareholders' equity 33 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 34 35 36 Consolidated Balance Sheets - USD ($) Sin Millions 38 Assets 39 Cash and cash equivalents 40 Accounts receivable, net 41 Merchandise inventories 42 Prepaid expenses and other 43 Total current assets 44 Land, property and equipment, net 45 Operating lease right-of-use assets 46 Goodwill 47 Other assets 48 Total assets 49 Liabilities and Shareholders' Equity 50 Accounts payable 51 Accrued salaries, wages and related benefits 52 Operating Lease, Liability, Current 53 Other current liabilities 54 Current portion of long-term debt 55 Total current liabilities 56 Long-term debt, net 57 Deferred property incentives, net 58 Operating Lease, Liability, Noncurrent 59 Other liabilities 60 Commitments and contingencies (Note 11) 61 Shareholders' equity: Common stock, no par value: 1,000 shares authorized; 155.6 and 157.6 shares issued and outstanding 63 Accumulated deficit 64 Accumulated other comprehensive loss 65 Total shareholders' equity 66 Total liabilities and shareholders' equity Nordstrom Feb. 01, 2020 37 S853 179 1.920 278 3,230 4,179 1,774 249 305 9,737 1,576 510 244 1,190 0 3,520 2,676 4 1.875 683 3,129 62 (2,082) (68) 979 S 9,737