Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If $7.50 of fixed manufacturing overhead is being eliminated why is it being added to the buy cost? Should'nt it be deducted from $20.10 and

If $7.50 of fixed manufacturing overhead is being eliminated why is it being added to the buy cost? Should'nt it be deducted from $20.10 and then the difference of that be added to the buy cost?

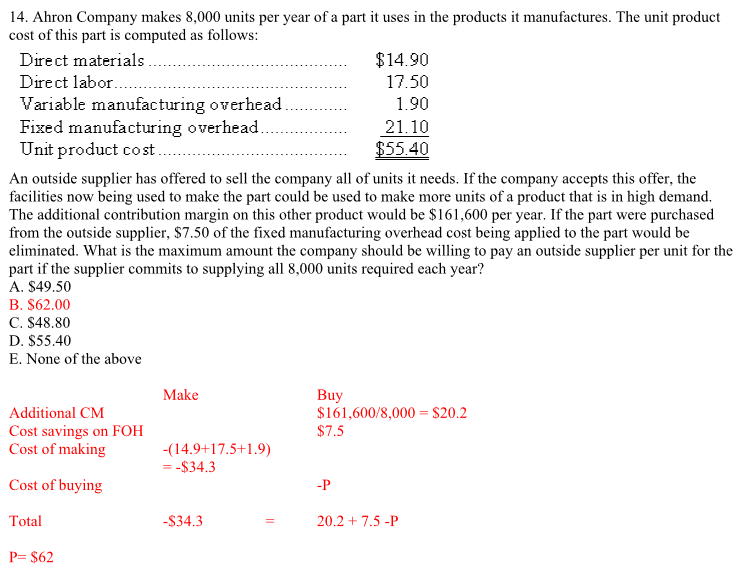

14. Ahron Company makes 8,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows $14.90 17.50 1.90 21.10 $5540 Direct labor Variable manufacturing overhead.... Fixed manufacturing overhead Unit product cost... An outside supplier has offered to sell the company all of units it needs. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $161,600 per year. If the part were purchased from the outside supplier, $7.50 of the fixed manufacturing overhead cost being applied to the part would be eliminated. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 8,000 units required each year? A. $49.50 B. S62.00 C. S48.80 D. $55.40 E. None of the above Make uly Additional CM Cost savings on FOH Cost of making 161,600/8,000 $20.2 $7.5 (14.9+17.5+1.9) -$34.3 Cost of buying Total P $62 $34.3 0.27.5-PStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started