if a company were to use a dividend payout of 0%, 20%, 40%, and 50% would the forecast assumptions be realistic? in other words would it work based on the data below?

Please respond to EACH of the percentages and explain a tiny bit if you can.

Thanks in advance!

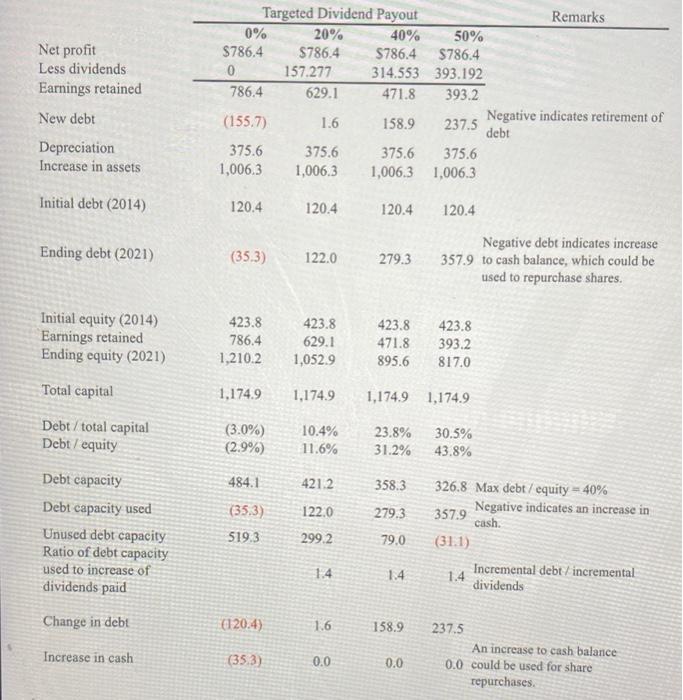

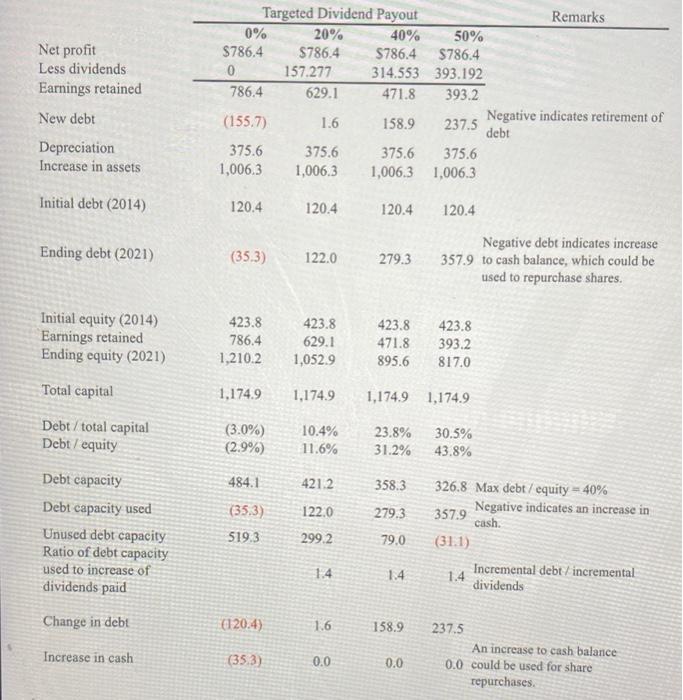

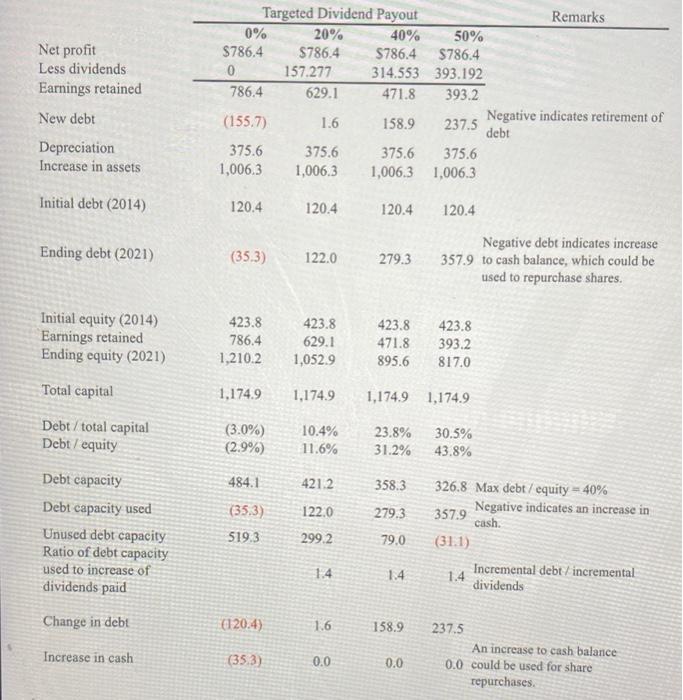

Net profit Less dividends Earnings retained Targeted Dividend Payout Remarks 0% 20% 40% 50% $786.4 $786.4 $786.4 $786.4 157.277 314.553 393.192 786.4 629.1 471.8 393.2 Negative indicates retirement of (155.7) 1.6 158.9 237.5 debt New debt Depreciation Increase in assets 375.6 1,006,3 375.6 1,006,3 375.6 375.6 1,006,3 1,006,3 Initial debt (2014) 120.4 120.4 120.4 120.4 Ending debt (2021) (35.3) 122.0 279.3 Negative debt indicates increase 357.9 to cash balance, which could be used to repurchase shares. Initial equity (2014) Earnings retained Ending equity (2021) 423.8 786.4 1,210.2 423.8 629.1 1,052.9 423.8 471.8 895.6 423.8 393.2 817.0 Total capital 1,1749 1,174.9 1,174.9 1,174.9 Debt / total capital Debt / equity 23.8% 30.5% (3.0%) (2.9%) 10.4% 11.6% 31.2% 43.8% Debt capacity 484.1 421.2 358.3 Debt capacity used (35.3) 122.0 279.3 326.8 Max debt/equity = 40% Negative indicates an increase in 357.9 cash. (31.1) 519.3 299.2 79.0 Unused debt capacity Ratio of debt capacity used to increase of dividends paid 1.4 1.4 1.4 Incremental debt / incremental dividends Change in debt (120.4) 1.6 158.9 Increase in cash (35.3) 0.0 237.5 An increase to cash balance 0.0 could be used for share repurchases. 0.0 Net profit Less dividends Earnings retained Targeted Dividend Payout Remarks 0% 20% 40% 50% $786.4 $786.4 $786.4 $786.4 157.277 314.553 393.192 786.4 629.1 471.8 393.2 Negative indicates retirement of (155.7) 1.6 158.9 237.5 debt New debt Depreciation Increase in assets 375.6 1,006,3 375.6 1,006,3 375.6 375.6 1,006,3 1,006,3 Initial debt (2014) 120.4 120.4 120.4 120.4 Ending debt (2021) (35.3) 122.0 279.3 Negative debt indicates increase 357.9 to cash balance, which could be used to repurchase shares. Initial equity (2014) Earnings retained Ending equity (2021) 423.8 786.4 1,210.2 423.8 629.1 1,052.9 423.8 471.8 895.6 423.8 393.2 817.0 Total capital 1,1749 1,174.9 1,174.9 1,174.9 Debt / total capital Debt / equity 23.8% 30.5% (3.0%) (2.9%) 10.4% 11.6% 31.2% 43.8% Debt capacity 484.1 421.2 358.3 Debt capacity used (35.3) 122.0 279.3 326.8 Max debt/equity = 40% Negative indicates an increase in 357.9 cash. (31.1) 519.3 299.2 79.0 Unused debt capacity Ratio of debt capacity used to increase of dividends paid 1.4 1.4 1.4 Incremental debt / incremental dividends Change in debt (120.4) 1.6 158.9 Increase in cash (35.3) 0.0 237.5 An increase to cash balance 0.0 could be used for share repurchases. 0.0