Question

If a firm can buy a machine for $60000, takes an investment tax credit of 15%, and lease out the machine for 9 years

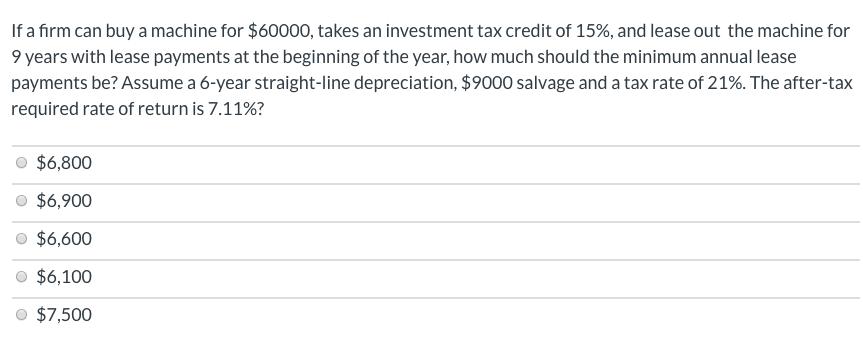

If a firm can buy a machine for $60000, takes an investment tax credit of 15%, and lease out the machine for 9 years with lease payments at the beginning of the year, how much should the minimum annual lease payments be? Assume a 6-year straight-line depreciation, $9000 salvage and a tax rate of 21%. The after-tax required rate of return is 7.11%? $6,800 $6,900 $6,600 $6,100 $7,500

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Initial cost 60000 085 51000 Depreciation each year from year 16 600006 10000 Tax benefit each yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Marketing

Authors: Charles W. Lamb, Joe F. Hair, Carl McDaniel

12th edition

111182164X, 978-1133708582, 1133708587, 978-1111821647

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App