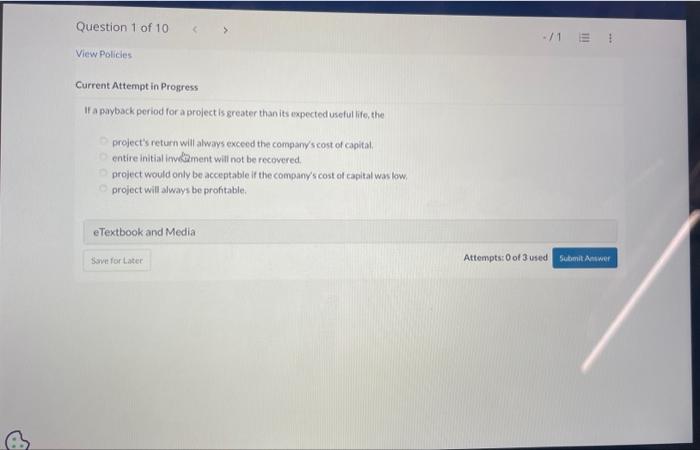

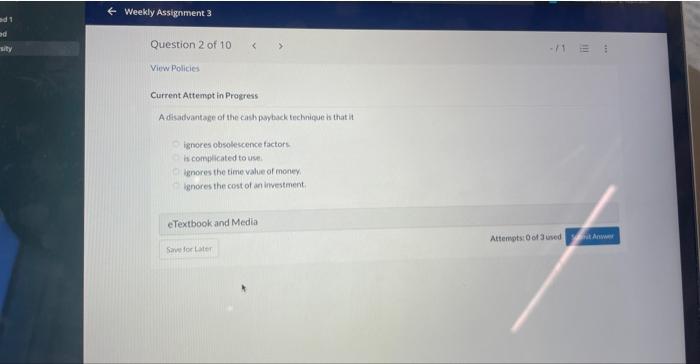

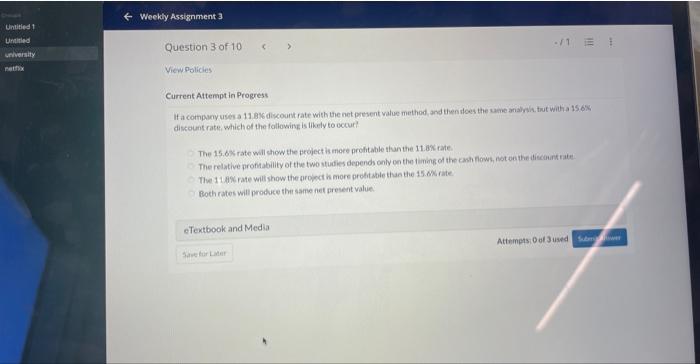

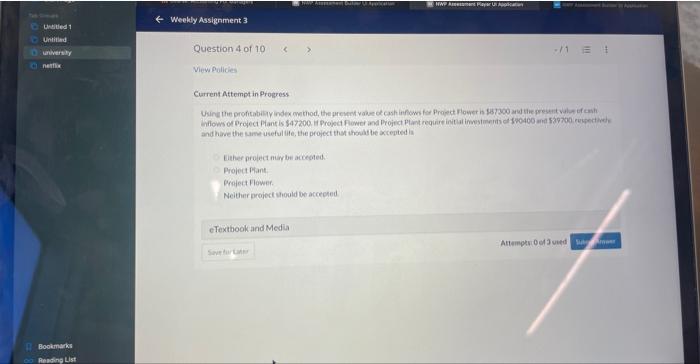

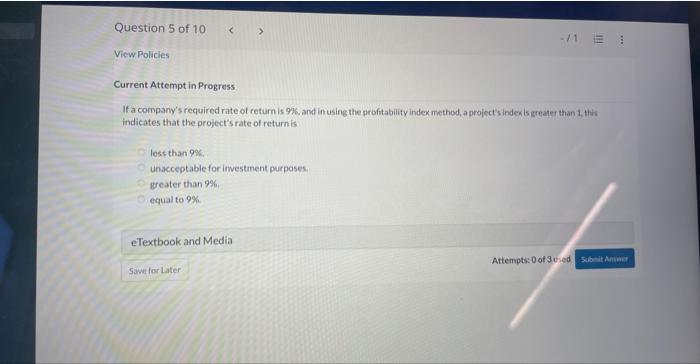

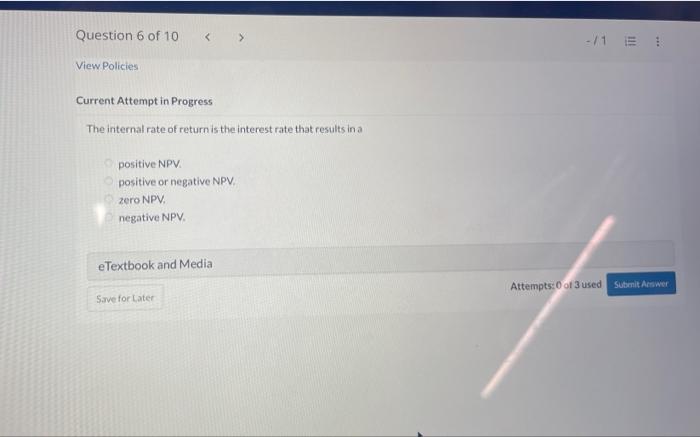

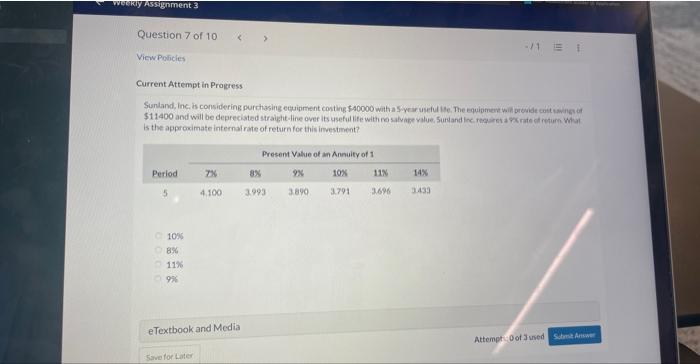

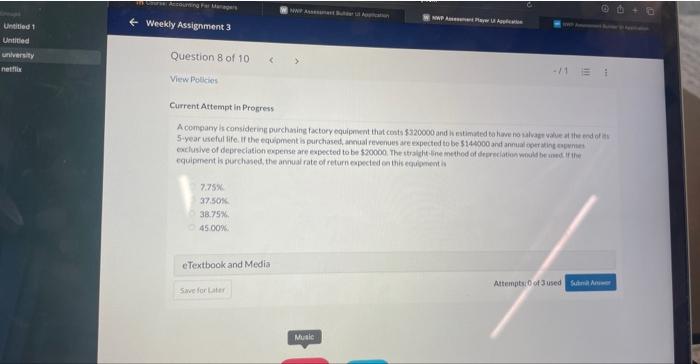

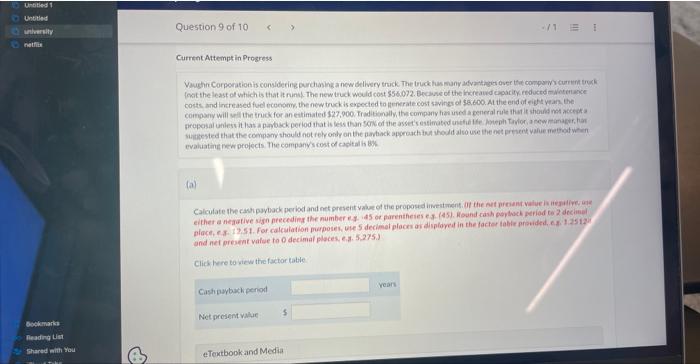

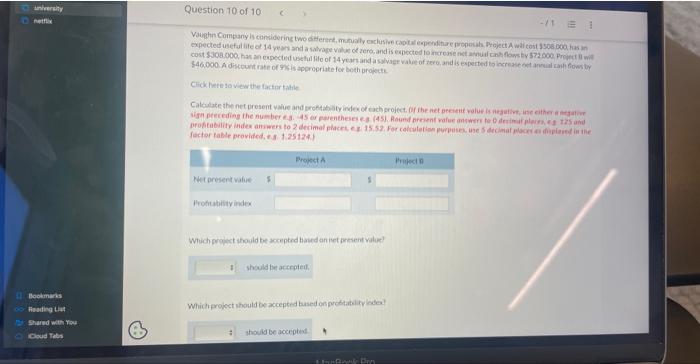

If a payback period for a project is greater than its expected useful life, the project's return will always exceed the company scost of capital. entire initial imvoliment will not be recovered. Current Attempt in Progress A disadvantage of the cash pyback technicue is that it ignores obsolescence factors it complicated to use. Ignores the time value of money. ignores the cost of an investment If a compeny uses a 118 sdiscount rate with the net gresent value method, and then does the same analysit. tut with a 15 . 6 \$s. discount rate, which of the followire is likely to occut? The 15,6 rate will stion the project is more prohtable than the 11.8% rate. The relative profsability of the two studies depends only on the timag of the cash fiows, not on the diecount ate: The 11.80 rate wili show the qrojoct h more prodi Mble than the 15. AN rate. Both rates will produce thi same fet present value. and have the carne useful tife, the project thisf thoubs be accepted in Either proiect ning bi accected. Prolect Phant: Prodect Hower. Neither project thould tob accected If a company's required rate of return is 9%, and in using the profitability index method, a project's indexis greater than 1 , this indicates that the project's rate of return is loss than 9% unacceptable for imvestment purposes. greater than 9% equal to 9%. The internal rate of return is the interest rate that results in a positive NPV. positive or negative NPV. zero NPV. negative NPV. $11400 and will be depreciated straight-fine over its yseful life with ra satuage value, 5 unland lnc- regairet a priate of return hisi is the approsimate internalrate of return for this inwestenent? 8% 115 A company is considering purchasing fectory equipment that conts $320000 and h natimuted to haye no alvage wave at the end of at 5 -year useful fife. If the equipmont is purchased, annual revemies are expected to bo 5142000 and annual oper ating cacwnen cuclusive of depreciation mpense are expested to be 580000 . The straldh tine method of drersclatinn wivild he aned if the equipenent is purchased, the annuai rate of return eapecied on this equiginent is 7.75% 37.5CH. 3875% 45000O. coits and incteased fuel ecenom, the new truck is expected to ifeneratecost savings of 58.600. At the enid of eigts yeam. the evaluatine nece profects. The companys cost of cagitalis by (7) eifher a negative sign greceding the number e 1 . 45 or garentheies es. (45). Hound rash porthact period Ce 2 drecinal and net present value to of decimal places, e.a. 5.275.3 Click here to view the factor table 546000 A diccount rate of 47 sis appropriate for both projecte. Click here sovewithe tactor tatile Calculate the net uresent yaive and prottabaty indec of cach crofect, of the net pecient volue is neadint, inceither a fration foctor Pable provided, ef 1.25124.1 Which prowet thould ter acceptrd haved an iset bresent vilue? Which project thould be accepted bused onprotatelifrindea