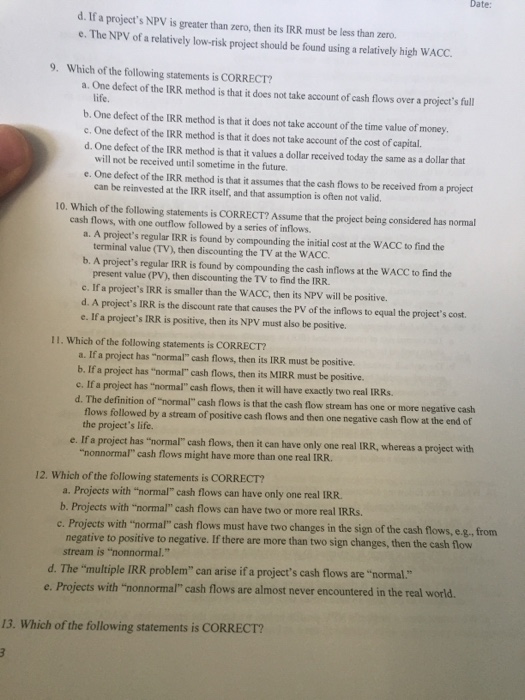

If a project's NPV is greater than zero, then its IRR must be less than zero. The NPV of a relatively low-risk project should be found using a relatively high WACC. Which of the following statements is CORRECT? One defect of the IRR method is that it does not take account of cash flows over a project's full life. One defect of the IRR method is that it does not take account of the time value of money. One defect of the IRR method is that it does not take account of the cost of capital. One defect of the IRR method is that it values a dollar received today the same as n dollar that will not be received until sometimes in the future. One defect of the IRR method is that it assumes that the cash flows to be received from a project can be reinvested at the IRR itself, and that assumption is often not valid. Which of the following statement is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. A project's regular IRR is found by compounding the initial cost at the WACC to find the terminal value (TV), then discounting the TV at the WACC. A project's regular IRR is found by compounding the cash inflows at the WACC to find the present value (PV), then discounting the TV to find the IRR. If a project's IRR is smaller than the WACC, then its NPV will be positive. A project's IRR is the discount rate that causes the PV of the inflows to equal the project's cost. If a project's IRR is positive, then its NPV must also be positive. Which of the following statement is CORRECT? If a project has "normal" cash flows, then its IRR must be positive. If a project has "normal" cash flows, then its MIRR must be positive. If a project has "normal" cash flows, then it will have exactly two real IRRs. The definition of "normal" cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flows at the end of the project's life. If a project has "normal" cash flows, then it can have only one real IRR, whereas a project with "nonnormal" cash flows might have more than one real IRR. Which of the following statement is CORRECT? Projects with "normal" cash flows can have only one real IRR. Projects with "normal" cash flows can have two or more real IRRs. Projects with "normal" cash flows must have two changes in the sign of the cash flows, e.g., from negative to positive. If there are more than two signs changes, then the cash flow stream is "nonnormal." The "multiple IRR Problem" can arise if a project's cash flows are "normal". Projects with "nonnormal" cash flows are almost never encountered in the real world. Which of the following statement is CORRECT? 3