Question

If ABC123 purchased DEF456 for $400,000 in cash, prepare the consolidated balance sheet on the date of acquisition: ABC123 Inc has decided to purchase 100%

If ABC123 purchased DEF456 for $400,000 in cash, prepare the consolidated balance sheet on the date of acquisition: ABC123 Inc has decided to purchase 100% of DEF456 on July 1, 2020.

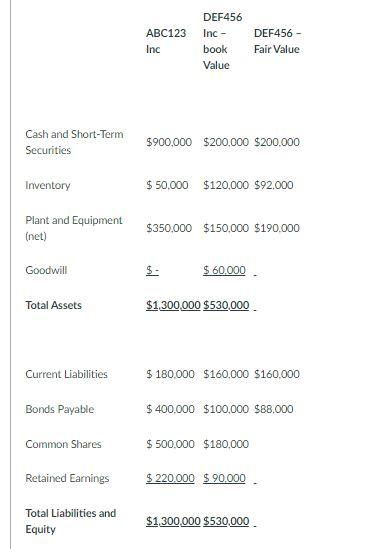

On the date, the balance sheets of each of these companies were as follows:

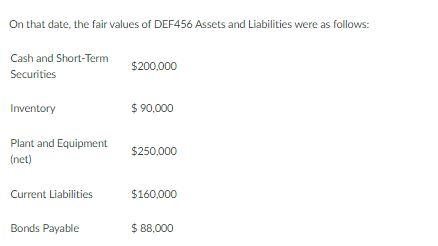

ABC123 Inc DEF456 Inc book Value DEF456 Fair Value Cash and Short-Term Securities $900,000 $200,000 $200,000 Inventory $ 50,000 $120,000 $92,000 Plant and Equipment (net) $350,000 $150,000 $190,000 Goodwill $ - $ 60,000 Total Assets $1,300,000 $530,000 Current Liabilities $ 180,000 $160,000 $160,000 Bonds Payable $ 400,000 $100,000 $88,000 Common Shares $ 500,000 $180,000 Retained Earnings $ 220,000 $ 90,000 Total Liabilities and Equity $1,300,000 $530,000 On that date, the fair values of DEF456 Assets and Liabilities were as follows: Cash and Short-Term Securities $200,000 Inventory $ 90,000 Plant and Equipment (net) $250,000 Current Liabilities $160,000 Bonds Payable $ 88,000 In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. If ABC123 purchased DEF456 for $400,000 in cash, prepare the consolidated balance sheet on the date of acquisition.

On that date, the fair values of DEF456 Assets and Liabilities were as follows: On that date, the fair values of DEF456 Assets and Liabilities were as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started