Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If all 3 answers can be provided, thank you. Will like and comment feedback 1. Which one of the following statements is correct? A. If

If all 3 answers can be provided, thank you. Will like and comment feedback

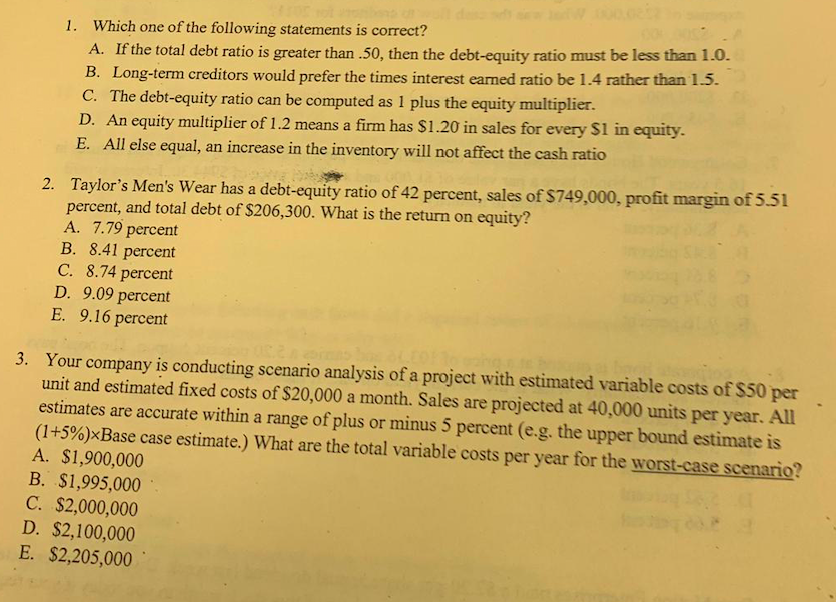

1. Which one of the following statements is correct? A. If the total debt ratio is greater than .50, then the debt-equity ratio must be less than 1.0. B. Long-term creditors would prefer the times interest earned ratio be 1.4 rather than 1.5. C. The debt-equity ratio can be computed as 1 plus the equity multiplier. D. An equity multiplier of 1.2 means a firm has $1.20 in sales for every S1 in equity. E. All else equal, an increase in the inventory will not affect the cash rati 2. Taylor's Men's Wear has a debt-equity ratio of 42 percent, sales of $749,000, profit margin of 5.51 percent, and total debt of $206,300. What is the return on equity? A. 7.79 percent B. 8.41 percernt C. 8.74 percent D. 9.09 percent E. 9.16 percent 3. Your company is conducting scenario analysis of a project with estimated variable costs of S50 per unit and estimated fixed costs of $20,000 a month. Sales are projected at 40,000 units per year. All estimates are accurate within a range of plus or minus 5 percent (e.g. the upper bound estimate is (1+5%) x Base case estimate) What are the total variable costs per year for the worst-ca A. $1,900,000 B. $1,995,000 C. $2,000,000 D. $2,100,000 E. $2,205,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started