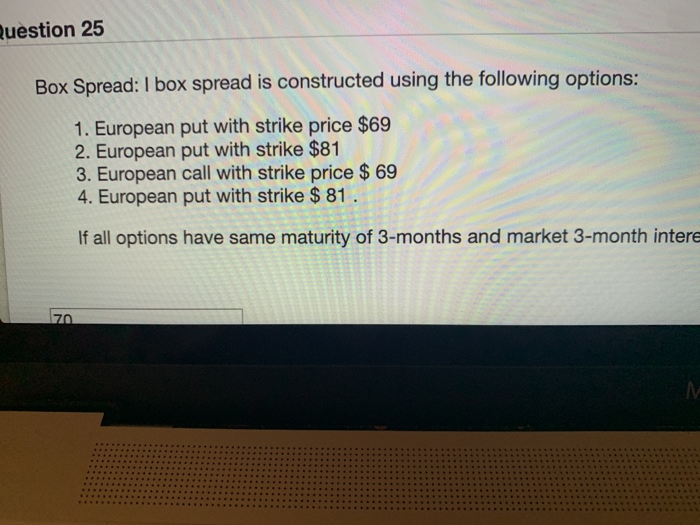

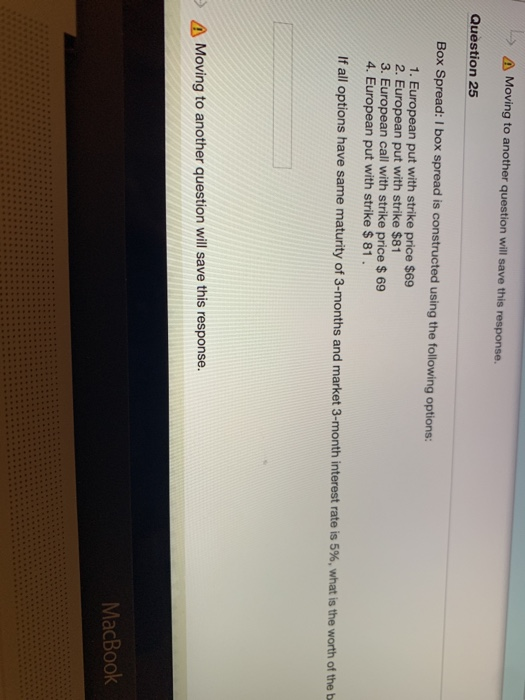

if all options have same maturity of 3 months and market 3 month interest rate is 5%, what is the worth of the box spread

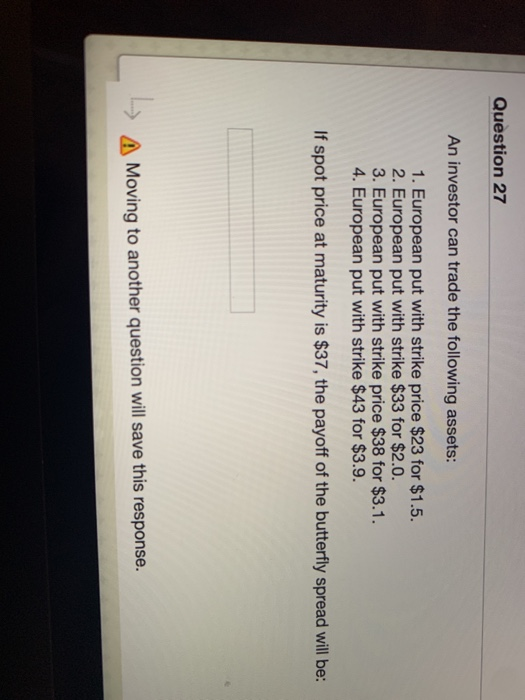

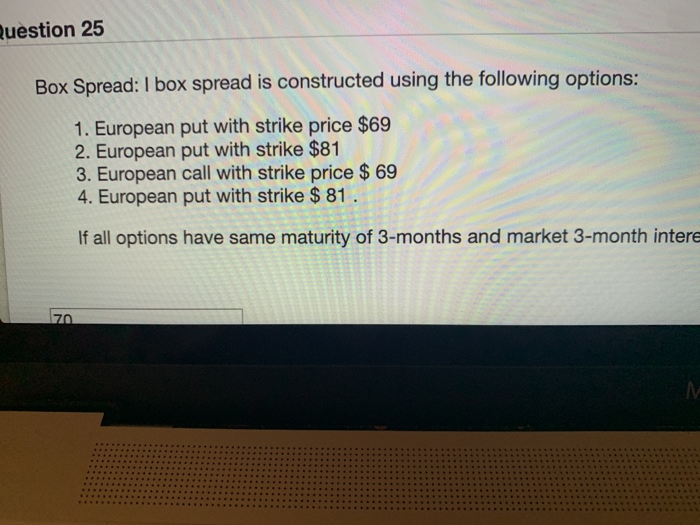

- A Moving to another question will save this response. Question 25 Box Spread: I box spread is constructed using the following options: 1. European put with strike price $69 2. European put with strike $81 3. European call with strike price $ 69 4. European put with strike $ 81. If all options have same maturity of 3-months and market 3-month interest rate is 5%, what is the worth of the b A Moving to another question will save this response. MacBook Question 27 An investor can trade the following assets: 1. European put with strike price $23 for $1.5. 2. European put with strike $33 for $2.0. 3. European put with strike price $38 for $3.1. 4. European put with strike $43 for $3.9. If spot price at maturity is $37, the payoff of the butterfly spread will be: - AMoving to another question will save this response. Ruestion 25 Box Spread: I box spread is constructed using the following options: 1. European put with strike price $69 2. European put with strike $81 3. European call with strike price $ 69 4. European put with strike $ 81. e $ 69 If all options have same maturity of 3-months and market 3-month intere - A Moving to another question will save this response. Question 25 Box Spread: I box spread is constructed using the following options: 1. European put with strike price $69 2. European put with strike $81 3. European call with strike price $ 69 4. European put with strike $ 81. If all options have same maturity of 3-months and market 3-month interest rate is 5%, what is the worth of the b A Moving to another question will save this response. MacBook Question 27 An investor can trade the following assets: 1. European put with strike price $23 for $1.5. 2. European put with strike $33 for $2.0. 3. European put with strike price $38 for $3.1. 4. European put with strike $43 for $3.9. If spot price at maturity is $37, the payoff of the butterfly spread will be: - AMoving to another question will save this response. Ruestion 25 Box Spread: I box spread is constructed using the following options: 1. European put with strike price $69 2. European put with strike $81 3. European call with strike price $ 69 4. European put with strike $ 81. e $ 69 If all options have same maturity of 3-months and market 3-month intere

if all options have same maturity of 3 months and market 3 month interest rate is 5%, what is the worth of the box spread

if all options have same maturity of 3 months and market 3 month interest rate is 5%, what is the worth of the box spread