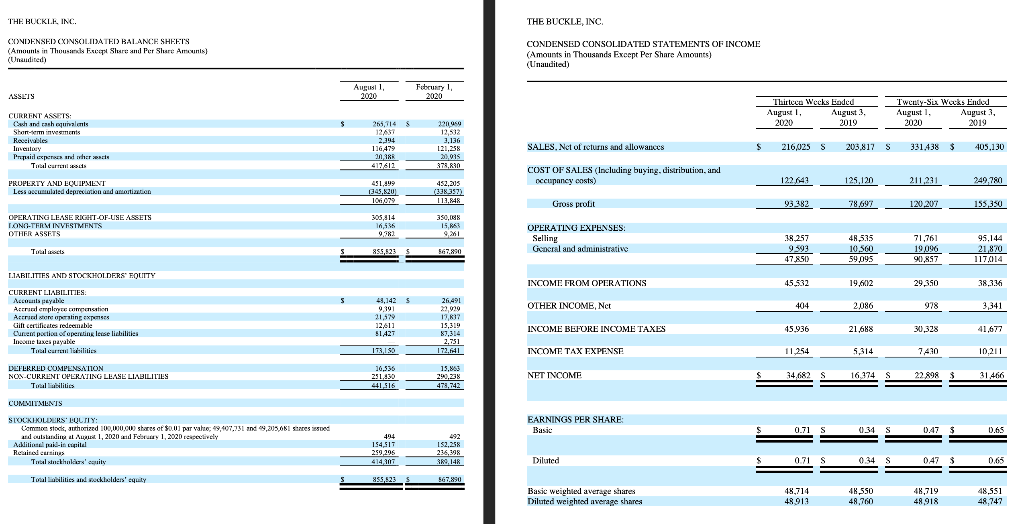

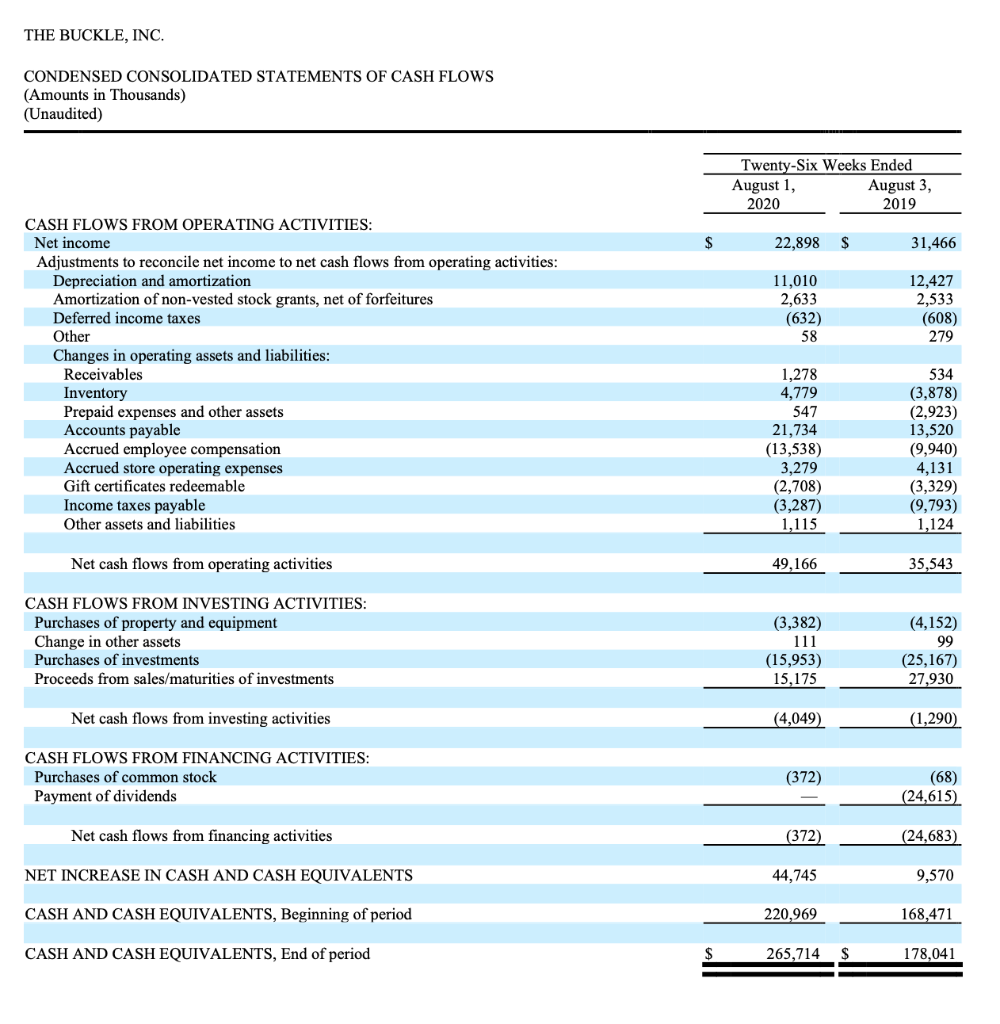

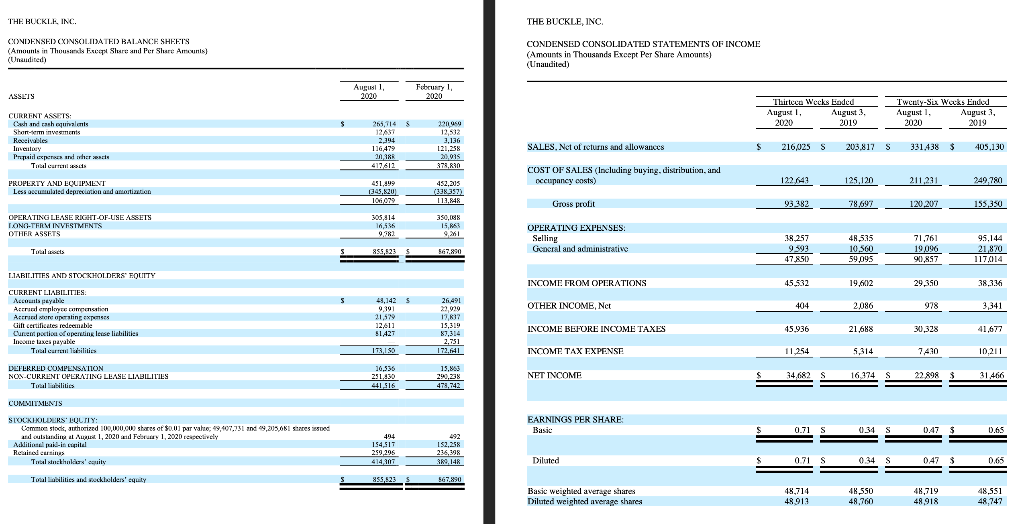

If all sales for The Buckle, Inc. are credit sales, determine the operating cycle in days and the cash conversion cycle in days. Use the financial statements for your calculations. [Hint: use the 26-week data and remember that the Income Statement will only have 26 weeks of results, whereas the Balance Sheet will be at a point-in-time.] Use a 365-day year assumption.

Compare 2020 to 2019 and comment on the demonstrated impact of the pandemic on the cycle using 2/1/2020 Balance Sheet with 26 weeks of 2019 Income Statement for your 2019 assessment (remembering to annualize the Income Statement data).

As a third analytics point, do you reach a different conclusion from the 13-week data than from the 26-week data (i.e., the first six months of the current year versus the last quarter) and what might that suggest about the health of the business?

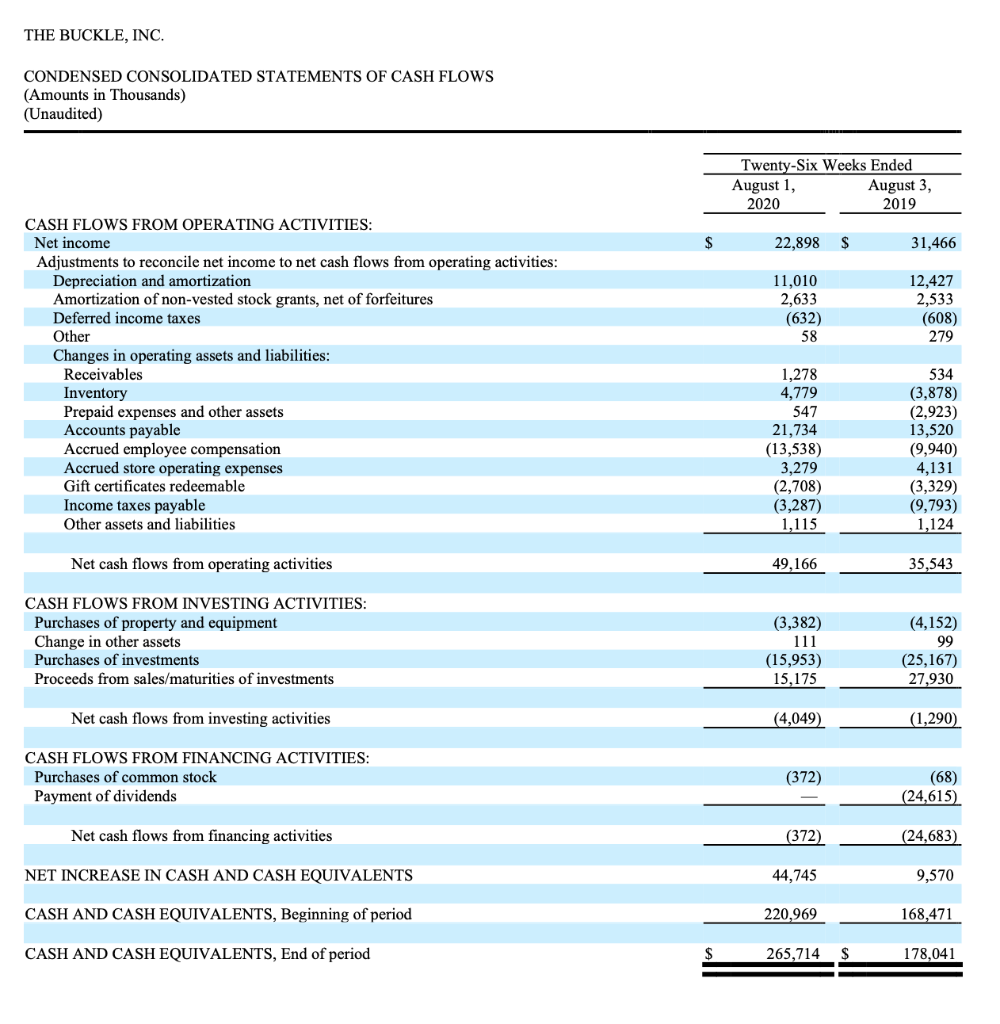

THE BUCKLE, INC. THE BUCKLE, INC. CXONDENSER CXINSCHLIDATEI BALANCH SHEETS (Amounts in Thousands Excepl Slure and Per Slure Ameunis) (Unandited) CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) (Unaudited) August February 1, 2020 ASSETS Thiricco Wecks Baded August 1 August 3. 2020 2019 Twenty-Six Wecks Ended August 1. August 3, 2020 2019 S 5 S CURRENT ASSETS Cash and cash equivalents Sharminvements Receivables Inventory Propies and where set Tobler 265,714 12AXY 2,394 116,479 20388 413612 220969 12.512 3.136 121,258 21.015 37 RNO SALES, Nct of cturns and allowances $ 216,025 S 203.817 S 331.438 $ 405,130 COST OF SALES (Including buying, distribution, and occupancy costs) 122649 125,120 211,231 249,280 PROPERTY AND EQUIPMENT Less occutulated depreciation and an 431,999 1345,20 10,079 452,25 (338.357) 112.848 Gross profil 93382 78.697 120.207 155,350 OPERATING LEASE RIGHT-OF-USE ASSETS LONG-TERM INVESTMENTS OTHER ASSETS 305,914 16,585 UR 350.00 15,6 I OPERATING EXPENSES: Selling Gencral and administrative 48,535 Tools 855,123 567.890 38.257 9.599 47.851) 10.560 71,761 19.096 901,857 95.144 21,870 117.014 59,095 LIABILITIES AND STOCKHOLDERS' EQUITY INCOME FROM OPERATIONS 45,532 19,6012 29,350 38.3.16 26.491 OTHER INCOME, Nct 404 2,086 978 3,341 CURRENT LIABILITIES Accounts payable Arrial emple comensation Arriere apating expe Gift certificates redeemable Current portion of operating lesse lichilities Inoxne laxes payable Terreni Mobilities 43,142 S 0 19 21,579 12,611 5142 17,837 15,319 INCOME BEFORE INCOME TAXES 45.936 21.688 30,328 41,677 173,50 2.731 172.541 INCOME TAX EXPENSE 11264 5,314 7,430 10.211 DEFERRED COMPENSATION NON-CURRENT OPERATING LEASE LIABILITIES Tonalities 26.536 251.430 441,316 15,863 290,238 479,742 NET INCOME 34,682 S 16,174 S 22.898 $ 31466 CUMMITMENTS EARNINGS PER SHARE: Basic 0.71 S 0.34 S 0.47 $ 0.65 STOCKIKILLERS' BOLLY: Comme stock, authorized 100,000.00 shares at $0.01 prva: 9,407.731 and 9,205,61 stares sed olsandi alam 1, 2020 and Feisty 1, 202D respectively Athiliui mit-in utilal Recitaluri Total stuckholders'city 494 154,517 259.295 414 307 492 152.258 236 M 389,148 567.890 Diluted 0.71 S 0.34 S 047 0.65 855,523 Tallibilities and suckholders' equily Basic weighted average scares Diluted weighted average shares 48,714 48.911 48,550 48,760 48,719 48,918 48,551 48,747 THE BUCKLE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) (Unaudited) Twenty-Six Weeks Ended August 1, August 3, 2020 2019 22,898 $ 31,466 11,010 2,633 (632) 58 12,427 2,533 (608) 279 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash flows from operating activities: Depreciation and amortization Amortization of non-vested stock grants, net of forfeitures Deferred income taxes Other Changes in operating assets and liabilities: Receivables Inventory Prepaid expenses and other assets Accounts payable Accrued employee compensation Accrued store operating expenses Gift certificates redeemable Income taxes payable Other assets and liabilities 1,278 4,779 547 21,734 (13,538) 3,279 (2,708) (3,287) 1,115 534 (3,878) (2,923) 13,520 (9,940) 4,131 (3,329) (9,793) 1,124 Net cash flows from operating activities 49,166 35,543 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property and equipment Change in other assets Purchases of investments Proceeds from sales/maturities of investments (3,382) 111 (15,953) 15,175 (4,152) 99 (25,167) 27,930 Net cash flows from investing activities (4,049) (1,290) CASH FLOWS FROM FINANCING ACTIVITIES: Purchases of common stock Payment of dividends (372) (68) (24,615) Net cash flows from financing activities (372) (24,683) NET INCREASE IN CASH AND CASH EQUIVALENTS 44,745 9,570 CASH AND CASH EQUIVALENTS, Beginning of period 220,969 168,471 CASH AND CASH EQUIVALENTS, End of period 265,714 $ 178,041 THE BUCKLE, INC. THE BUCKLE, INC. CXONDENSER CXINSCHLIDATEI BALANCH SHEETS (Amounts in Thousands Excepl Slure and Per Slure Ameunis) (Unandited) CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) (Unaudited) August February 1, 2020 ASSETS Thiricco Wecks Baded August 1 August 3. 2020 2019 Twenty-Six Wecks Ended August 1. August 3, 2020 2019 S 5 S CURRENT ASSETS Cash and cash equivalents Sharminvements Receivables Inventory Propies and where set Tobler 265,714 12AXY 2,394 116,479 20388 413612 220969 12.512 3.136 121,258 21.015 37 RNO SALES, Nct of cturns and allowances $ 216,025 S 203.817 S 331.438 $ 405,130 COST OF SALES (Including buying, distribution, and occupancy costs) 122649 125,120 211,231 249,280 PROPERTY AND EQUIPMENT Less occutulated depreciation and an 431,999 1345,20 10,079 452,25 (338.357) 112.848 Gross profil 93382 78.697 120.207 155,350 OPERATING LEASE RIGHT-OF-USE ASSETS LONG-TERM INVESTMENTS OTHER ASSETS 305,914 16,585 UR 350.00 15,6 I OPERATING EXPENSES: Selling Gencral and administrative 48,535 Tools 855,123 567.890 38.257 9.599 47.851) 10.560 71,761 19.096 901,857 95.144 21,870 117.014 59,095 LIABILITIES AND STOCKHOLDERS' EQUITY INCOME FROM OPERATIONS 45,532 19,6012 29,350 38.3.16 26.491 OTHER INCOME, Nct 404 2,086 978 3,341 CURRENT LIABILITIES Accounts payable Arrial emple comensation Arriere apating expe Gift certificates redeemable Current portion of operating lesse lichilities Inoxne laxes payable Terreni Mobilities 43,142 S 0 19 21,579 12,611 5142 17,837 15,319 INCOME BEFORE INCOME TAXES 45.936 21.688 30,328 41,677 173,50 2.731 172.541 INCOME TAX EXPENSE 11264 5,314 7,430 10.211 DEFERRED COMPENSATION NON-CURRENT OPERATING LEASE LIABILITIES Tonalities 26.536 251.430 441,316 15,863 290,238 479,742 NET INCOME 34,682 S 16,174 S 22.898 $ 31466 CUMMITMENTS EARNINGS PER SHARE: Basic 0.71 S 0.34 S 0.47 $ 0.65 STOCKIKILLERS' BOLLY: Comme stock, authorized 100,000.00 shares at $0.01 prva: 9,407.731 and 9,205,61 stares sed olsandi alam 1, 2020 and Feisty 1, 202D respectively Athiliui mit-in utilal Recitaluri Total stuckholders'city 494 154,517 259.295 414 307 492 152.258 236 M 389,148 567.890 Diluted 0.71 S 0.34 S 047 0.65 855,523 Tallibilities and suckholders' equily Basic weighted average scares Diluted weighted average shares 48,714 48.911 48,550 48,760 48,719 48,918 48,551 48,747 THE BUCKLE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) (Unaudited) Twenty-Six Weeks Ended August 1, August 3, 2020 2019 22,898 $ 31,466 11,010 2,633 (632) 58 12,427 2,533 (608) 279 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash flows from operating activities: Depreciation and amortization Amortization of non-vested stock grants, net of forfeitures Deferred income taxes Other Changes in operating assets and liabilities: Receivables Inventory Prepaid expenses and other assets Accounts payable Accrued employee compensation Accrued store operating expenses Gift certificates redeemable Income taxes payable Other assets and liabilities 1,278 4,779 547 21,734 (13,538) 3,279 (2,708) (3,287) 1,115 534 (3,878) (2,923) 13,520 (9,940) 4,131 (3,329) (9,793) 1,124 Net cash flows from operating activities 49,166 35,543 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property and equipment Change in other assets Purchases of investments Proceeds from sales/maturities of investments (3,382) 111 (15,953) 15,175 (4,152) 99 (25,167) 27,930 Net cash flows from investing activities (4,049) (1,290) CASH FLOWS FROM FINANCING ACTIVITIES: Purchases of common stock Payment of dividends (372) (68) (24,615) Net cash flows from financing activities (372) (24,683) NET INCREASE IN CASH AND CASH EQUIVALENTS 44,745 9,570 CASH AND CASH EQUIVALENTS, Beginning of period 220,969 168,471 CASH AND CASH EQUIVALENTS, End of period 265,714 $ 178,041