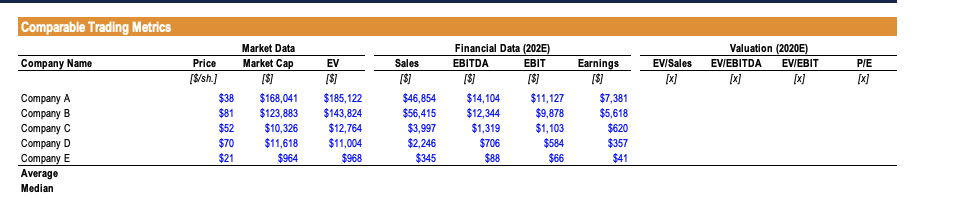

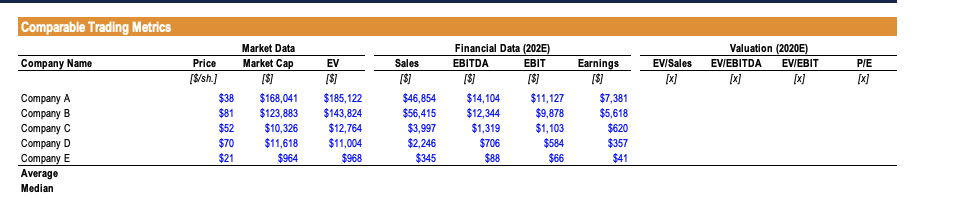

If an investment using the value implied by the median EV/EBITDA multiple from the comps is made at the transaction date, what is the implied IRR? Assume the terminal value is the average of the values determined using the perpetual growth rate and an EBITDA exit multiple.

9.12%

8.88%

9.55%

9.51%

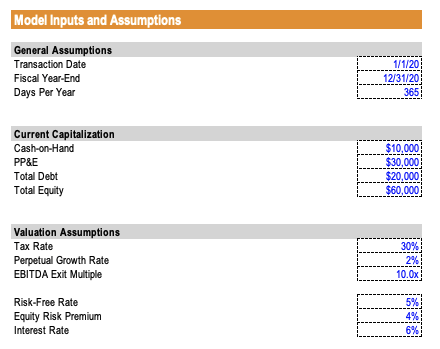

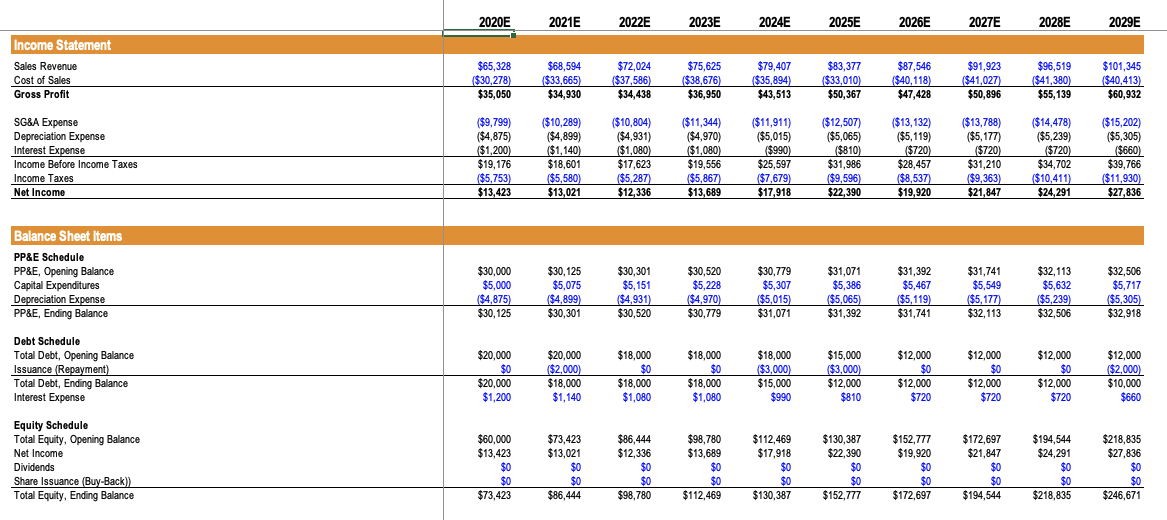

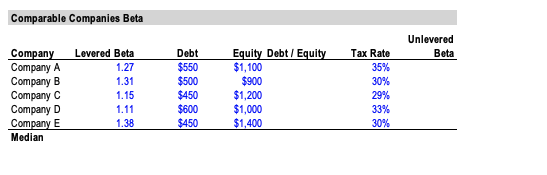

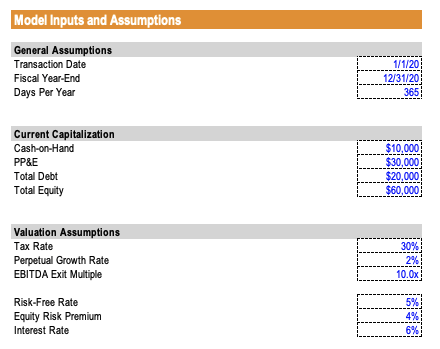

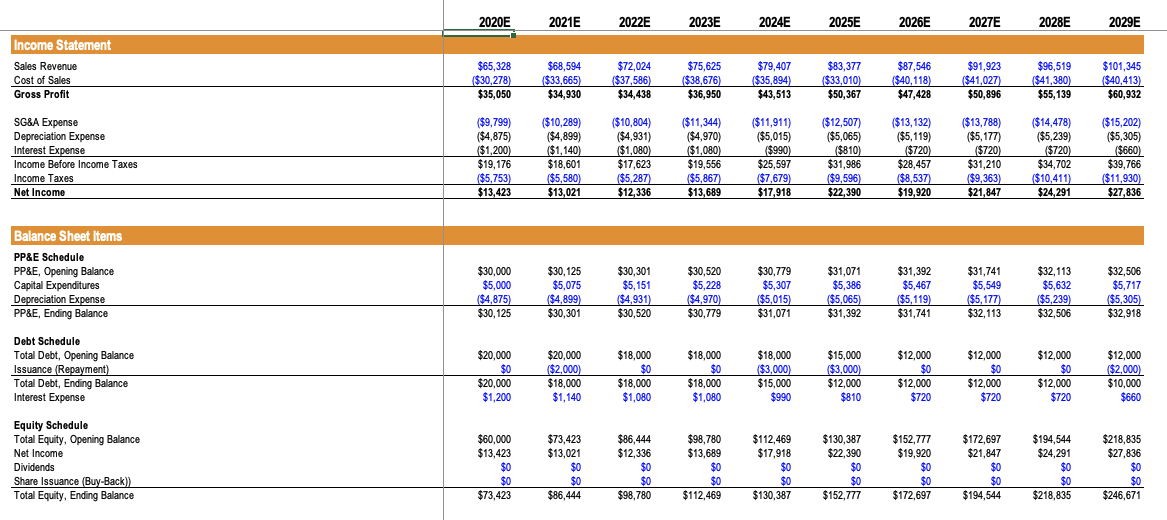

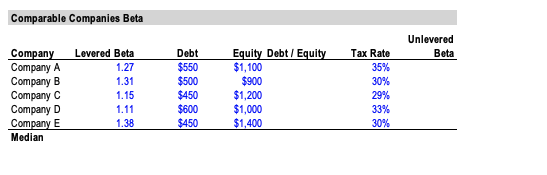

2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E 2029E Income Statement Sales Revenue Cost of Sales Gross Profit $65,328 ($30,278) $35,050 $ $68,594 ($33,665 $34,930 $72,024 ($37,586) $34,438 $75,625 ($38,676) $36,950 $79,407 ($35,894) $43,513 $83,377 ($33,010) $50,367 $87,546 ($40,118) $47,428 $91,923 ($41,027) $50,896 $96,519 $41,380) $55,139 $101,345 ($40,413) $60,932 SG&A Expense Depreciation Expense Interest Expense Income Before Income Taxes Income Taxes Net Income ($9,799) ($4,875) ($1,200) $19,176 ($5,753) ($10,289) ($4,899) ($1,140 $18,601 ($5,580) $13,021 ($10,804) ($4,931) ($1,080) $17,623 ($5,287) ($11,344) ($4,970) ($1,080) $19,556 ($5,867) $13,689 ($11,911) ($ ($5,015) ($990) $25,597 ($7,679) ($12,507) ($5,065) ($810) $31,986 ($9,596) $22,390 ($13,132) ($5,119) ($720) $28,457 ($8,537) $19,920 ($13,788) ($5,177) ($720) $31,210 ($9,363) $21,847 ($14,478) ($5,239) $720 $34,702 ($10,411) $24,291 ($15,202) ($5,305) ($660) $39,766 ($11,930) $27,836 $13,423 $12,336 $17,918 Balance Sheet Items PP&E Schedule PP&E, Opening Balance Capital Expenditures Depreciation Expense PP&E, Ending Balance $30,000 $5,000 ($4,875) $30,125 $30,125 $5,075 ($4,899) $30,301 $30,301 $5,151 ($4,931) $30,520 $30,520 $5,228 ($4,970) $30,779 $30,779 $5,307 ($5,015) $31,071 $31,071 $5,386 ($5,065) $31,392 $31,392 $5,467 $5,119) $31,741 $31,741 $5,549 ($5,177) $32,113 $32,113 $5,632 ($5,239) $32,506 $32,506 $5,717 ($5,305) $32,918 Debt Schedule Total Debt, Opening Balance Issuance (Repayment) Total Debt, Ending Balance Interest Expense $20,000 $0 $20,000 $1,200 $20,000 ($2,000) $18,000 $1,140 $18,000 $0 $18,000 $1,080 $18,000 $0 $18,000 $1,080 $18,000 $3,000) $15,000 $990 $15,000 $3,000) $12,000 $810 $12,000 $0 $12,000 $720 $12,000 $0 $12,000 $720 $12,000 $0 $12,000 $720 $12,000 ($2,000) $10,000 $660 Equity Schedule Total Equity, Opening Balance Net Income Dividends Share Issuance (Buy-Back)) Total Equity, Ending Balance $60,000 $13,423 $0 $0 $73,423 $73,423 $13,021 $0 $0 $86,444 $86,444 $12,336 $0 $0 $98,780 $98,780 $13,689 $0 $0 $112,469 $112,469 $17,918 $0 $0 $130,387 $130,387 $22,390 $0 $0 $152,777 $152,777 $19,920 $0 $0 $172,697 $172,697 $21,847 $0 $0 $194,544 $194,544 $24.291 $0 $0 $218,835 $218,835 $27,836 $0 $0 $246,671 Comparable Trading Metrics Company Name Earnings EV [$] PIE Valuation (2020E) EV/EBITDA EV/EBIT [x] [x] EV/Sales [x] Company A Company B Company C Company D Company E Average Median Price [$/sh.) $38 $81 $52 $70 $21 Market Data Market Cap [$] $168,041 $123,883 $10,326 $11,618 $964 $185,122 $143,824 $12,764 $11,004 $968 Sales [$] $46,854 $56,415 $3,997 $2,246 $345 Financial Data (202E) EBITDA EBIT [$] [$] $14, 104 $11,127 $12,344 $9,878 $1,319 $1,103 $706 $584 $88 $66 [$] $7,381 $5,618 $620 $357 $41 Comparable Companies Beta Unlevered Beta Tax Rate 35% 30% Company Company A Company B Company C Company D Company E Median Levered Beta 1.27 1.31 1.15 1.11 1.38 Debt $550 $500 $450 $600 $450 Equity Debt / Equity $1,100 $900 $1,200 $1,000 $1,400 29% 33% 30% 2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E 2029E Income Statement Sales Revenue Cost of Sales Gross Profit $65,328 ($30,278) $35,050 $ $68,594 ($33,665 $34,930 $72,024 ($37,586) $34,438 $75,625 ($38,676) $36,950 $79,407 ($35,894) $43,513 $83,377 ($33,010) $50,367 $87,546 ($40,118) $47,428 $91,923 ($41,027) $50,896 $96,519 $41,380) $55,139 $101,345 ($40,413) $60,932 SG&A Expense Depreciation Expense Interest Expense Income Before Income Taxes Income Taxes Net Income ($9,799) ($4,875) ($1,200) $19,176 ($5,753) ($10,289) ($4,899) ($1,140 $18,601 ($5,580) $13,021 ($10,804) ($4,931) ($1,080) $17,623 ($5,287) ($11,344) ($4,970) ($1,080) $19,556 ($5,867) $13,689 ($11,911) ($ ($5,015) ($990) $25,597 ($7,679) ($12,507) ($5,065) ($810) $31,986 ($9,596) $22,390 ($13,132) ($5,119) ($720) $28,457 ($8,537) $19,920 ($13,788) ($5,177) ($720) $31,210 ($9,363) $21,847 ($14,478) ($5,239) $720 $34,702 ($10,411) $24,291 ($15,202) ($5,305) ($660) $39,766 ($11,930) $27,836 $13,423 $12,336 $17,918 Balance Sheet Items PP&E Schedule PP&E, Opening Balance Capital Expenditures Depreciation Expense PP&E, Ending Balance $30,000 $5,000 ($4,875) $30,125 $30,125 $5,075 ($4,899) $30,301 $30,301 $5,151 ($4,931) $30,520 $30,520 $5,228 ($4,970) $30,779 $30,779 $5,307 ($5,015) $31,071 $31,071 $5,386 ($5,065) $31,392 $31,392 $5,467 $5,119) $31,741 $31,741 $5,549 ($5,177) $32,113 $32,113 $5,632 ($5,239) $32,506 $32,506 $5,717 ($5,305) $32,918 Debt Schedule Total Debt, Opening Balance Issuance (Repayment) Total Debt, Ending Balance Interest Expense $20,000 $0 $20,000 $1,200 $20,000 ($2,000) $18,000 $1,140 $18,000 $0 $18,000 $1,080 $18,000 $0 $18,000 $1,080 $18,000 $3,000) $15,000 $990 $15,000 $3,000) $12,000 $810 $12,000 $0 $12,000 $720 $12,000 $0 $12,000 $720 $12,000 $0 $12,000 $720 $12,000 ($2,000) $10,000 $660 Equity Schedule Total Equity, Opening Balance Net Income Dividends Share Issuance (Buy-Back)) Total Equity, Ending Balance $60,000 $13,423 $0 $0 $73,423 $73,423 $13,021 $0 $0 $86,444 $86,444 $12,336 $0 $0 $98,780 $98,780 $13,689 $0 $0 $112,469 $112,469 $17,918 $0 $0 $130,387 $130,387 $22,390 $0 $0 $152,777 $152,777 $19,920 $0 $0 $172,697 $172,697 $21,847 $0 $0 $194,544 $194,544 $24.291 $0 $0 $218,835 $218,835 $27,836 $0 $0 $246,671 Comparable Trading Metrics Company Name Earnings EV [$] PIE Valuation (2020E) EV/EBITDA EV/EBIT [x] [x] EV/Sales [x] Company A Company B Company C Company D Company E Average Median Price [$/sh.) $38 $81 $52 $70 $21 Market Data Market Cap [$] $168,041 $123,883 $10,326 $11,618 $964 $185,122 $143,824 $12,764 $11,004 $968 Sales [$] $46,854 $56,415 $3,997 $2,246 $345 Financial Data (202E) EBITDA EBIT [$] [$] $14, 104 $11,127 $12,344 $9,878 $1,319 $1,103 $706 $584 $88 $66 [$] $7,381 $5,618 $620 $357 $41 Comparable Companies Beta Unlevered Beta Tax Rate 35% 30% Company Company A Company B Company C Company D Company E Median Levered Beta 1.27 1.31 1.15 1.11 1.38 Debt $550 $500 $450 $600 $450 Equity Debt / Equity $1,100 $900 $1,200 $1,000 $1,400 29% 33% 30%