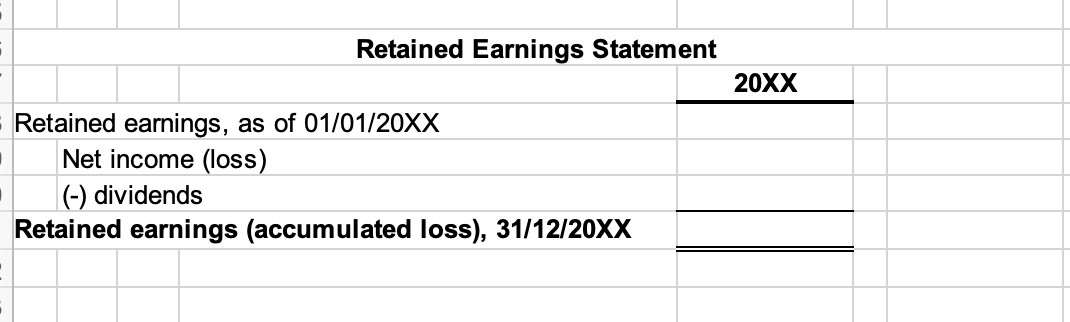

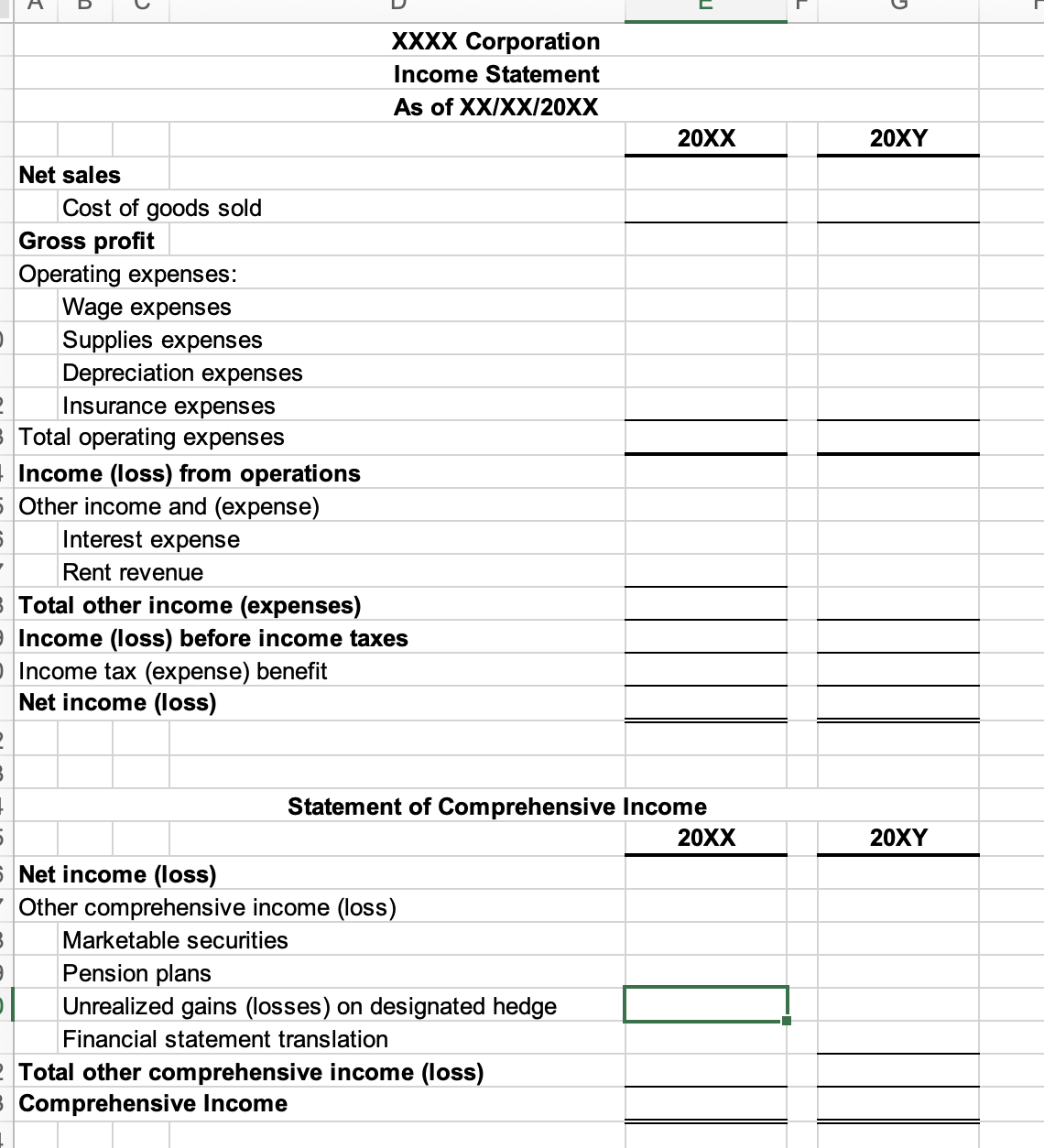

If anyone can take this information and fill it into the Income Statement, Statement of Comprehensive Income, and Retained Earnings Statement, I will greatly appreciate it! Thank you!

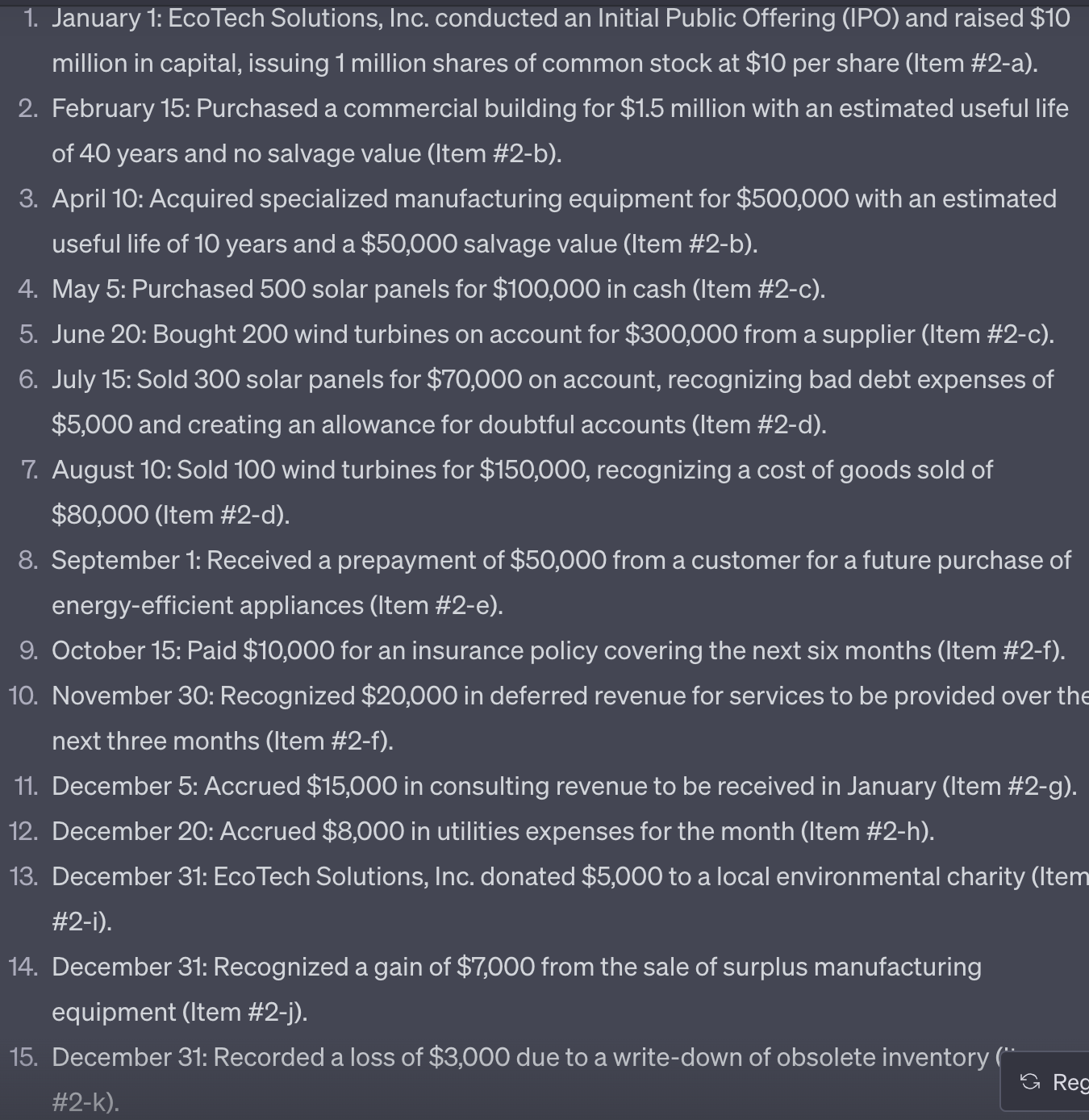

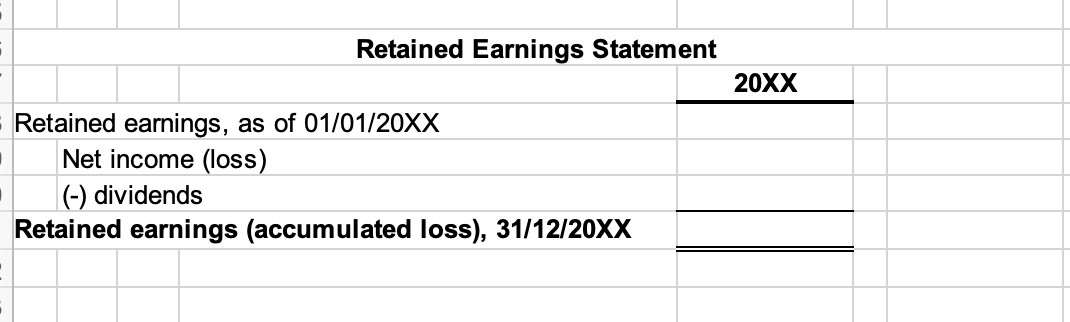

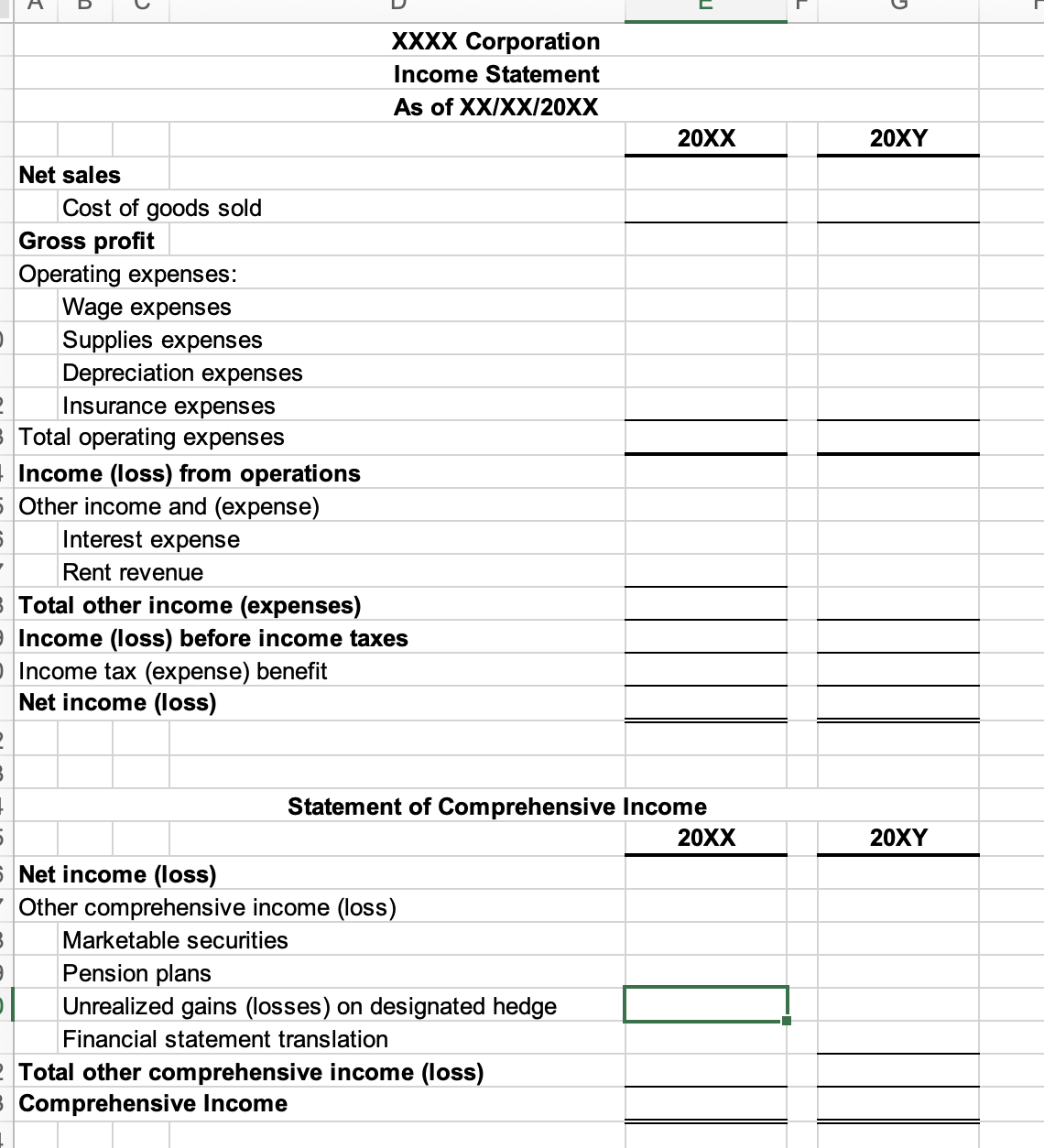

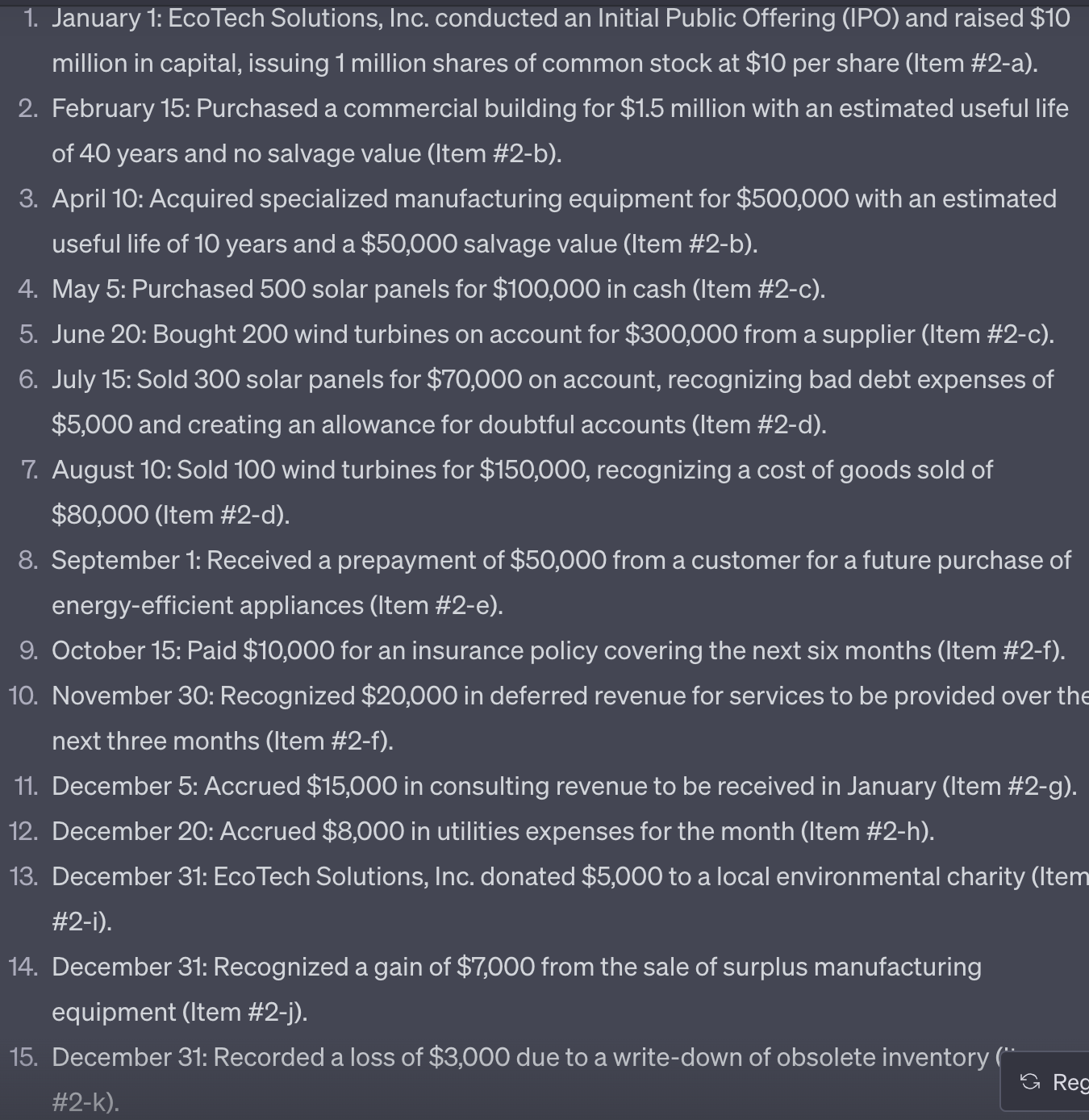

1. January 1: EcoTech Solutions, Inc. conducted an Initial Public Offering (IPO) and raised $10 million in capital, issuing 1 million shares of common stock at \$10 per share (Item \#2-a). 2. February 15: Purchased a commercial building for $1.5 million with an estimated useful life of 40 years and no salvage value (Item \#2-b). 3. April 10: Acquired specialized manufacturing equipment for $500,000 with an estimated useful life of 10 years and a $50,000 salvage value (Item \#2-b). 4. May 5: Purchased 500 solar panels for $100,000 in cash (Item \#2-c). 5. June 20: Bought 200 wind turbines on account for $300,000 from a supplier (Item \#2-c). 6. July 15 : Sold 300 solar panels for $70,000 on account, recognizing bad debt expenses of $5,000 and creating an allowance for doubtful accounts (Item \#2-d). 7. August 10: Sold 100 wind turbines for $150,000, recognizing a cost of goods sold of $80,000 (Item \#2-d). 8. September 1: Received a prepayment of $50,000 from a customer for a future purchase of energy-efficient appliances (Item \#2-e). 9. October 15: Paid $10,000 for an insurance policy covering the next six months (Item \#2-f). 10. November 30: Recognized $20,000 in deferred revenue for services to be provided over the next three months (Item \#2-f). 11. December 5: Accrued $15,000 in consulting revenue to be received in January (Item \#2-g). 12. December 20: Accrued $8,000 in utilities expenses for the month (Item \#2-h). 13. December 31: EcoTech Solutions, Inc. donated $5,000 to a local environmental charity (Item \#2-i). 14. December 31: Recognized a gain of $7,000 from the sale of surplus manufacturing equipment (Item \#2-j). 15. December 31: Recorded a loss of $3,000 due to a write-down of obsolete inventory \#2-k). XXXX Corporation Income Statement As of XX/XX/20XX Net sales Cost of goods sold Gross profit Operating expenses: Wage expenses Supplies expenses Depreciation expenses Insurance expenses Total operating expenses Income (loss) from operations Other income and (expense) Interest expense Rent revenue Total other income (expenses) Income (loss) before income taxes Income tax (expense) benefit Net income (loss) Statement of Comprehensive Income Net income (loss) Other comprehensive income (loss) Marketable securities Pension plans Unrealized gains (losses) on designated hedge Financial statement translation Total other comprehensive income (loss) Comprehensive Income 1. January 1: EcoTech Solutions, Inc. conducted an Initial Public Offering (IPO) and raised $10 million in capital, issuing 1 million shares of common stock at \$10 per share (Item \#2-a). 2. February 15: Purchased a commercial building for $1.5 million with an estimated useful life of 40 years and no salvage value (Item \#2-b). 3. April 10: Acquired specialized manufacturing equipment for $500,000 with an estimated useful life of 10 years and a $50,000 salvage value (Item \#2-b). 4. May 5: Purchased 500 solar panels for $100,000 in cash (Item \#2-c). 5. June 20: Bought 200 wind turbines on account for $300,000 from a supplier (Item \#2-c). 6. July 15 : Sold 300 solar panels for $70,000 on account, recognizing bad debt expenses of $5,000 and creating an allowance for doubtful accounts (Item \#2-d). 7. August 10: Sold 100 wind turbines for $150,000, recognizing a cost of goods sold of $80,000 (Item \#2-d). 8. September 1: Received a prepayment of $50,000 from a customer for a future purchase of energy-efficient appliances (Item \#2-e). 9. October 15: Paid $10,000 for an insurance policy covering the next six months (Item \#2-f). 10. November 30: Recognized $20,000 in deferred revenue for services to be provided over the next three months (Item \#2-f). 11. December 5: Accrued $15,000 in consulting revenue to be received in January (Item \#2-g). 12. December 20: Accrued $8,000 in utilities expenses for the month (Item \#2-h). 13. December 31: EcoTech Solutions, Inc. donated $5,000 to a local environmental charity (Item \#2-i). 14. December 31: Recognized a gain of $7,000 from the sale of surplus manufacturing equipment (Item \#2-j). 15. December 31: Recorded a loss of $3,000 due to a write-down of obsolete inventory \#2-k). XXXX Corporation Income Statement As of XX/XX/20XX Net sales Cost of goods sold Gross profit Operating expenses: Wage expenses Supplies expenses Depreciation expenses Insurance expenses Total operating expenses Income (loss) from operations Other income and (expense) Interest expense Rent revenue Total other income (expenses) Income (loss) before income taxes Income tax (expense) benefit Net income (loss) Statement of Comprehensive Income Net income (loss) Other comprehensive income (loss) Marketable securities Pension plans Unrealized gains (losses) on designated hedge Financial statement translation Total other comprehensive income (loss) Comprehensive Income