Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if anyone could help me absert aby oc these questions i would be forever grateful 1. XYZ Motel, Miami Florida Rooms Available 1240 1,120 1240

if anyone could help me absert aby oc these questions i would be forever grateful

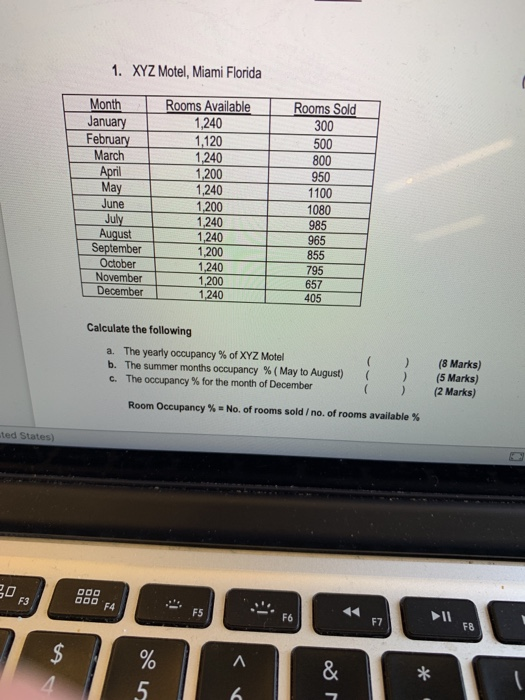

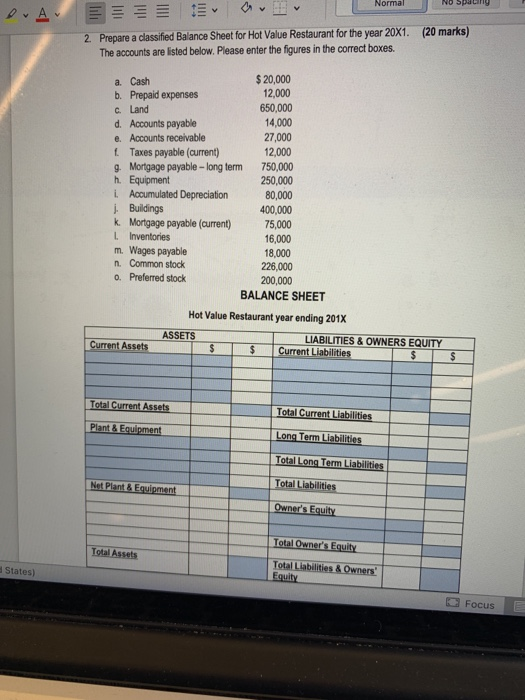

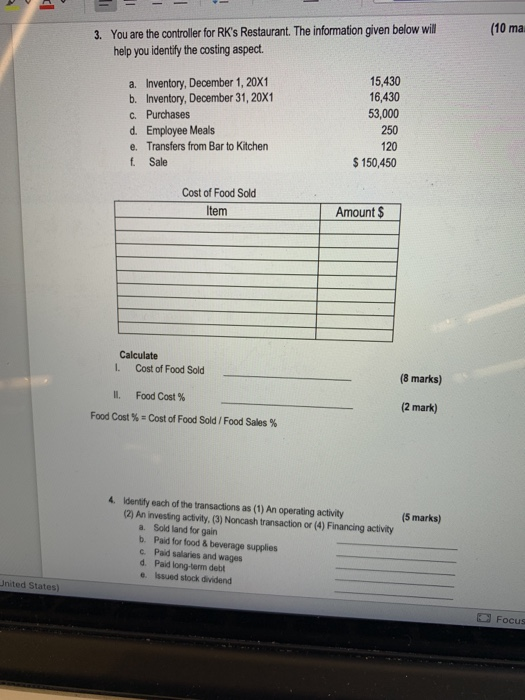

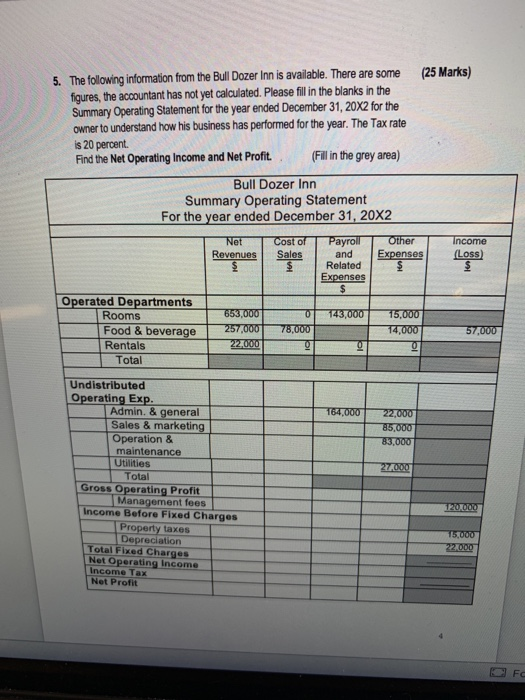

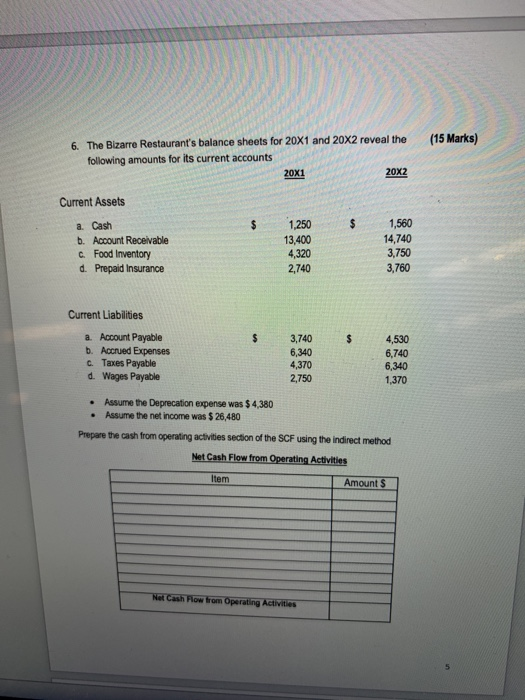

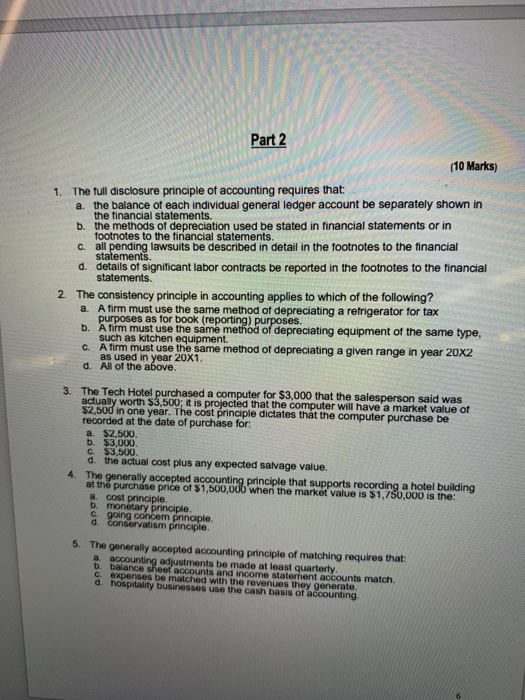

1. XYZ Motel, Miami Florida Rooms Available 1240 1,120 1240 Rooms Sold 300 January February March April Ma June 800 950 1100 1080 985 965 855 795 657 405 1.200 1,240 1,200 1240 August September 1,240 1,200 1.240 December 1,240 Calculate the following The yearly occupancy % of XYZ Motel a. b.The summer months occupancy %(May to August) ( ( (8 Marks) (5 Marks) ) The occupancy % for the month of December () (2 Marks) Room Occupancy % No. of rooms sold , no. of rooms available % ted States) F4 F5 F6 F8 Normal 2 Prepare a classfied Balance Sheet for Hot Value Restaurant for the year 20x1. (20 marks) The accounts are listed below. Please enter the figures in the correct boxes. a. Cash b. Prepaid expenses c. Land d. Accounts payable e. Accounts receivable t Taxes payable (aurrent) g. Mortgage payable-long term 750,000 h. Equipment i. Accumulated Depreciation 80,000 j. Buildings 20,000 2,000 650,000 14,000 27,000 2,000 250,000 ppele caren10.00 k. Mortgage payable (aurrent) 75,000 L Inventories m. Wages payable n. Common stock o. Preferred stock 16,000 18,000 226,000 200,000 BALANCE SHEET Hot Value Restaurant year ending 201X ASSETS LIABILITIES &OWNERS EQUITY Current Assets Current Liabilities Total Current Liab Long Term Liabilities 1 Total LongTerm, Liabilities Total Assets Total Liabilities&Owners States) Focus (25 Marks) 5. The following information from the Bull Dozer Inn is available. There are some figures, the accountant has not yet calculated. Pleas fill in the blanks in the Summary Operating Statement for the year ended December 31, 20X2 for the owner to understand how his business has performed for the year. The Tax rate is 20 percent Find the Net Operating Income and Net Profit(Fill in the grey area) Bull Dozer Inn Summary Operating Statement For the vear ended December 31, 20X2 Net Cost of Payroll Other RevenuesSalesand ExpensesLoss Related Operated Departments Rooms 653,000143,000 15,000 Food&beverage257,000 Rentals Total Undistributed Operating Exp Admin. & general Sales & marketing Operation & maintenance Utilities Total Management fees Property taxes Gross Operating Profit Income Before Fixed Charges Depreciation Total Fixed Charges Net Operating Income Income Tax Net Profit The Bizarre Restaurant's balance sheets for 20X1 and 20x2 reveal the following amounts for its current accounts (15 6. 20x1 20X2 Current Assets a. Cash b. Account Receivable c. Food Inventory d. Prepaid Insurance 1,250 3,400 4,320 2,740 1,560 4,740 3,750 3,760 Current Liabilities a. Account Payable b. Accrued Expenses c. Taxes Payable d. Wages Payable 3,740 4,530 6,740 6,340 1,370 6,340 4,370 2,750 . Assume the Deprecation expense was $4,380 . Assume the net income was $ 26,480 Prepare the cash from operating activities section of the SCF using the indirect method Net Cash Flow from Operating Activities Item Amount S Part 2 10 Marks) 1. The full disclosure principle of accounting requires that: a. b. c. d. the balance of each individual general ledger account be separately shown in the tinancial statements. the methods of depreciation used be stated in financial statements or in footnotes to the tinancial statements all lawsuits be described in detail in the footnotes to the financial ements details of significant labor contracts be reported in the footnotes to the financial statements. 2. The consistency principle in accounting applies to which of the following? a. A firm must use the same method ot depreciating a retrigerator tor tax urposes as for book (reporting) purposes. b. A firm must use the same method of depreciating equipment of the same type, such as kitchen equipment mustuse the same method of depreciating a given range in year 20x2 as used in year 20X1 d. All of the above 3. The Tech Hotel sed a computer for $3,000 that the salesperson said was actually worth $3,500; it is projected that the computer will have a market value of recorded at the date of purchase for: 52,500 in one year. The cost principle dictates that the computer purchase be a. $2,500. b. $3,000 c. $3,500 d. the actual cost plus any expected salvage value. 4. The generally accepted accounting principle that supports recording a hotel building at the purchase price of $1,500,000 when the market value is $1,750,000 is the a. dost principle b. montary principle c. going concem principle d. conservatism principle 5. The generally accepted accounting principle of matching requires that: adjustments be made at least quarterly b. balance C. expenses be matched with the revenues they generate. d. hospitality businesses use the cash basis of accounting accounts and income statement accounts match Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started