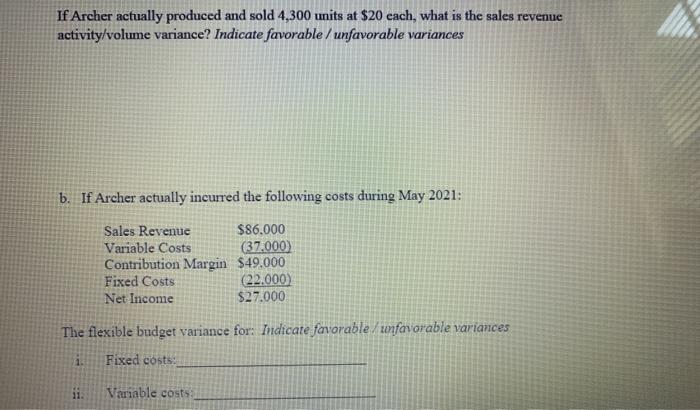

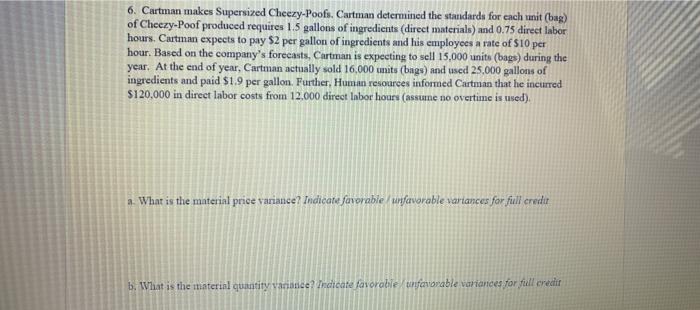

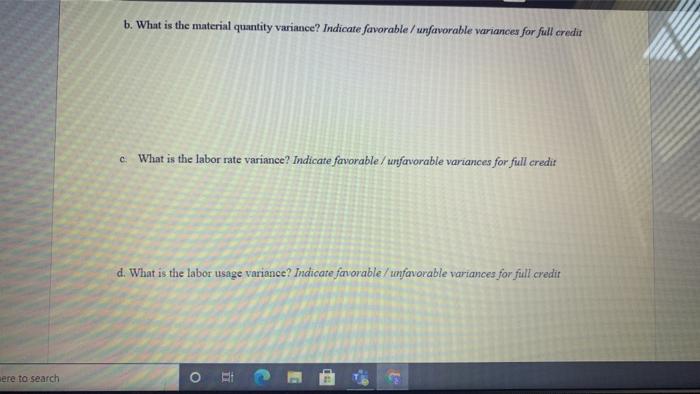

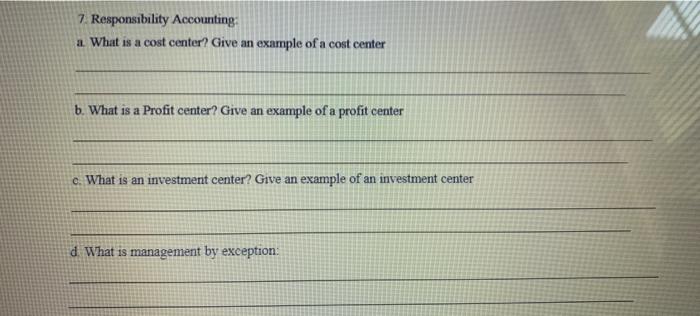

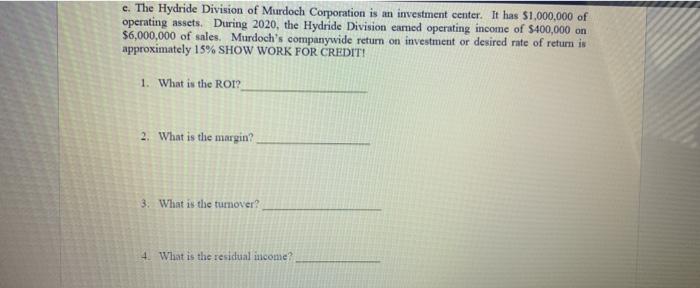

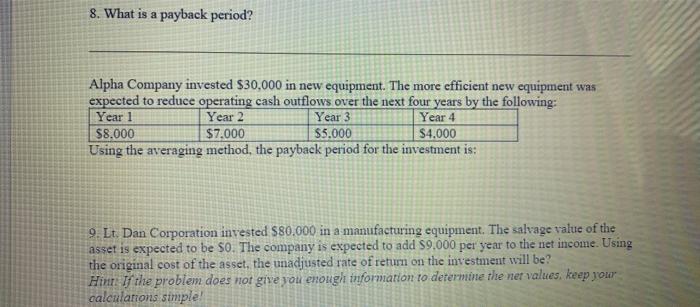

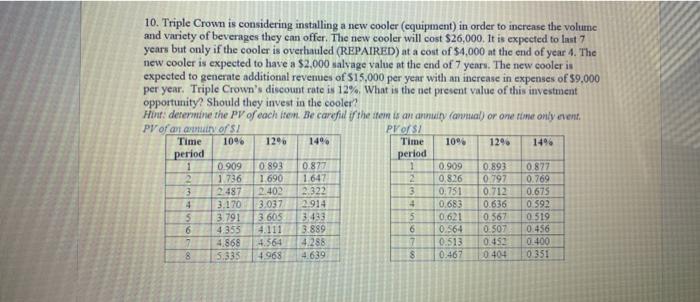

If Archer actually produced and sold 4,300 units at $20 each, what is the sales revenue activity/volume variance? Indicate favorable / unfavorable variances b. If Archer actually incurred the following costs during May 2021: Sales Revenue $86.000 Variable Costs (37.000) Contribution Margin $49.000 Fixed Costs (22.000) Net Income $27.000 The flexible budget variance for: Indicate favorable/unfavorable variances 1. Fixed costs 11 Variable costs 6. Cartman makes Supersized Cheezy-Poofs. Cartman determined the standards for each unit (bag) of Cheezy-Poof produced requires 1.5 gallons of ingredients direct materials) and 0.75 direct labor hours. Cartman expects to pay $2 per gallon of ingredients and his employees a rate of $10 per hour. Based on the company's forecasts, Cartman is expecting to sell 15,000 units (bags) during the year. At the end of year, Cartman actually sold 16,000 units (bags) and used 25.000 gallons of ingredients and paid $1.9 per gallon. Further, Human resources informed Cartman that he incurred $120.000 in direct labor costs from 12.000 direct labor hours (assume no overtime is used). a What is the material price variance? Indicate favorable / unfavorable variances for full credit b. What is the material quantity variance Indicate favorable tnfanorable variances for fill credit b. What is the material quantity variance? Indicate favorable / unfavorable variances for full credit C What is the labor rate variance? Indicate favorable / unfavorable variances for full credit d. What is the labor usage variance? Indicate favorable / unfavorable variances for full credit ere to search o 7. Responsibility Accounting: a. What is a cost center? Give an example of a cost center b. What is a Profit center? Give an example of a profit center e. What is an investment center? Give an example of an investment center d. What is management by exception: e. The Hydride Division of Murdoch Corporation is an investment center. It has $1,000,000 of operating assets. During 2020, the Hydride Division earned operating income of $400,000 on $6,000,000 of sales. Murdoch's companywide return on investment or desired rate of return is approximately 15% SHOW WORK FOR CREDIT! 1. What is the ROI 2. What is the margin? 3. What is the tumover? 4. What is the residual income? 8. What is a payback period? Alpha Company invested $30,000 in new equipment. The more efficient new equipment was expected to reduce operating cash outflows over the next four years by the following: Year 1 Year 2 Year 3 Year 4 $8.000 $7.000 $5.000 $4.000 Using the averaging method, the payback period for the investment is: 9. Lt. Dan Corporation invested $80.000 in a manufacturing equipment. The salvage value of the asset is expected to be 50. The company is expected to add $9.000 per year to the net income. Using the original cost of the asset, the unadjusted rate of return on the investment will be? Hint. If the problem does not give you enough information to determine the ner values, keep your calculations simple! 10. Triple Crown is considering installing a new cooler (equipment) in order to increase the volume and variety of beverages they can offer. The new cooler will cost $26,000. It is expected to Inst years but only if the cooler is overhauled (REPAIRED) at a cost of $4,000 at the end of year 4. The new cooler is expected to have a $2,000 salvage value at the end of 7 years. The new cooler is expected to generate additional revenues of $15,000 per year with an increase in expenses of $9.000 per year. Triple Crown's discount rate is 12% What is the net present value of this investment opportunity? Should they invest in the cooler Hint: determine the PV of each item. Be careful if the item is an annuity (animal) or one time only event. PV of art of PTOS Time 10% 1296 1496 Time 10% 1296 1496 period period 1 0.909 0.893 0.877 1 0.909 0.893 0877 1.736 1.690 1.647 2 0.8.26 0.797 0.769 3 2.487 2.402 2.322 3 0.751 0.712 0.675 4 3.170 3.037 2.914 + 0.683 0.636 0.592 $ 3.791 3.605 3.433 5 0.621 0.567 0519 6 4.355 4.111 3.889 0.564 0507 0.456 2 4,868 4.564 4.288 7 0.513 0.453 0.400 8 5.335 4.968 4.639 $ 0.467 0404 0 351 6