Question

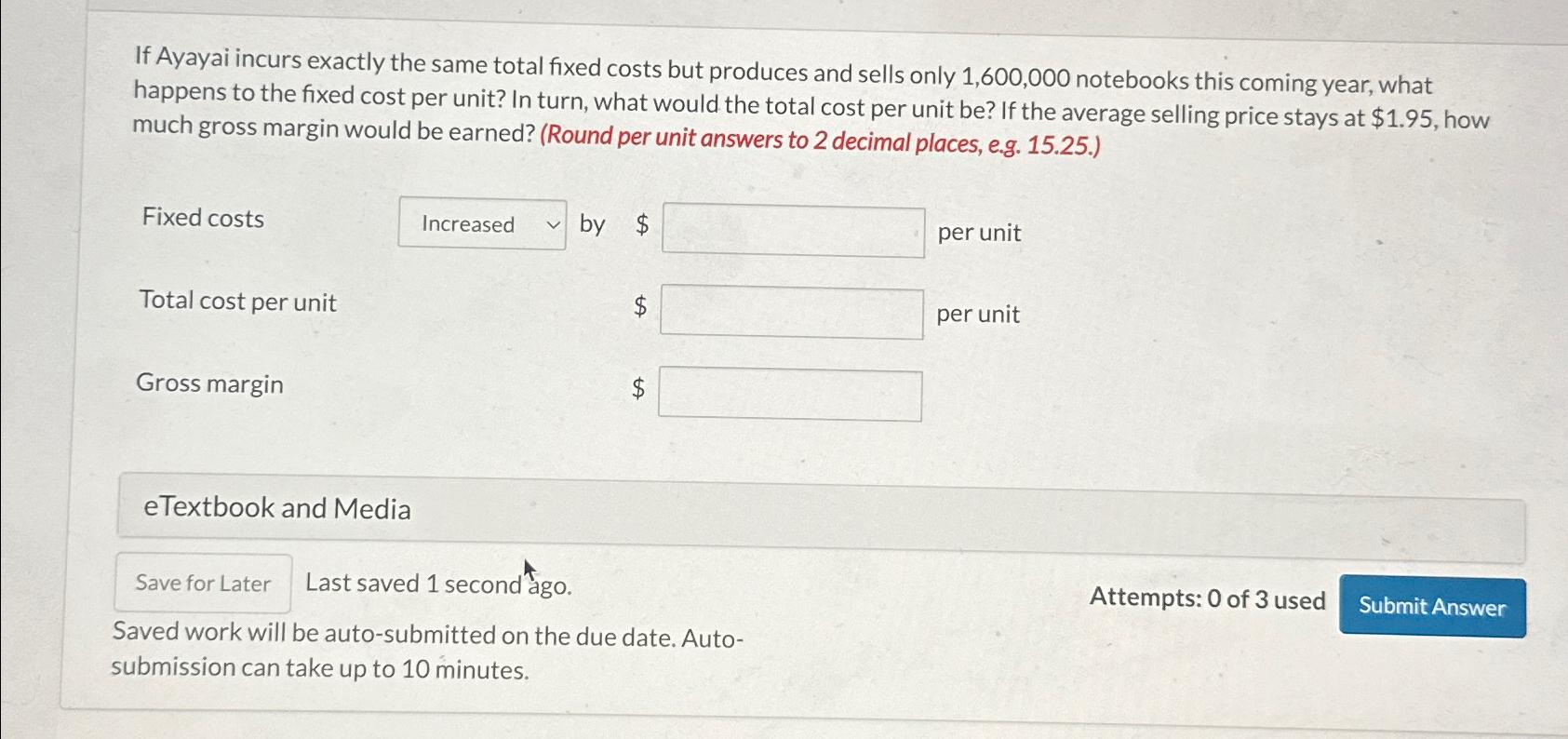

If Ayayai incurs exactly the same total fixed costs but produces and sells only 1,600,000 notebooks this coming year, what happens to the fixed cost

If Ayayai incurs exactly the same total fixed costs but produces and sells only

1,600,000notebooks this coming year, what happens to the fixed cost per unit? In turn, what would the total cost per unit be? If the average selling price stays at

$1.95, how much gross margin would be earned? (Round per unit answers to 2 decimal places, e.g. 15.25.)\ Fixed costs by

$per unit\ Total cost per unit\

$per unit\ Gross margin\

$\ eTextbook and Media\ Last saved 1 second ago.\ Attempts: 0 of 3 used\ Saved work will be auto-submitted on the due date. Autosubmission can take up to 10 minutes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started