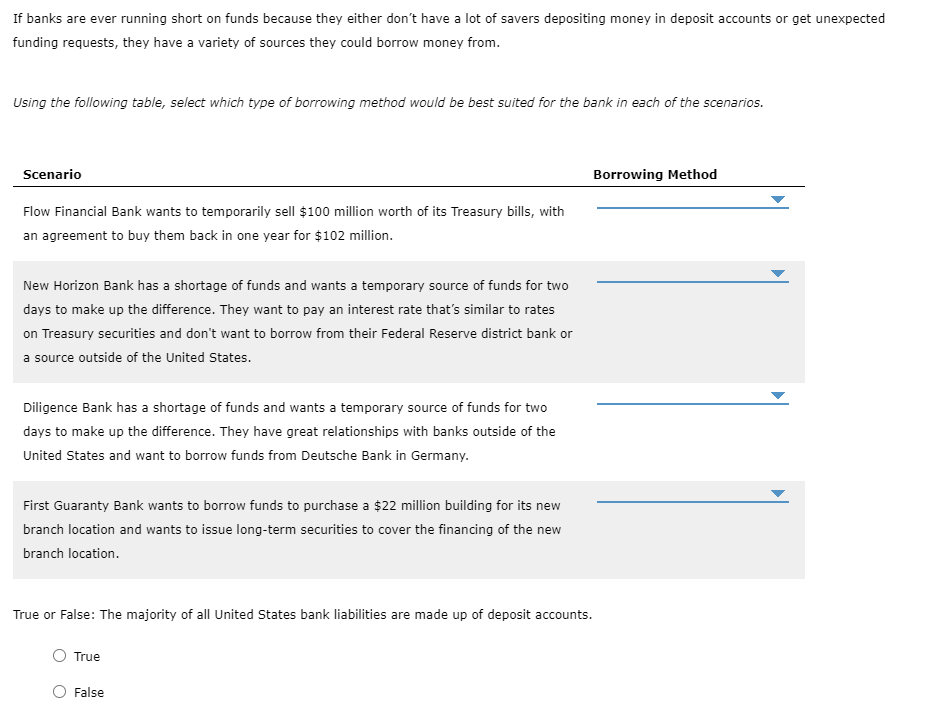

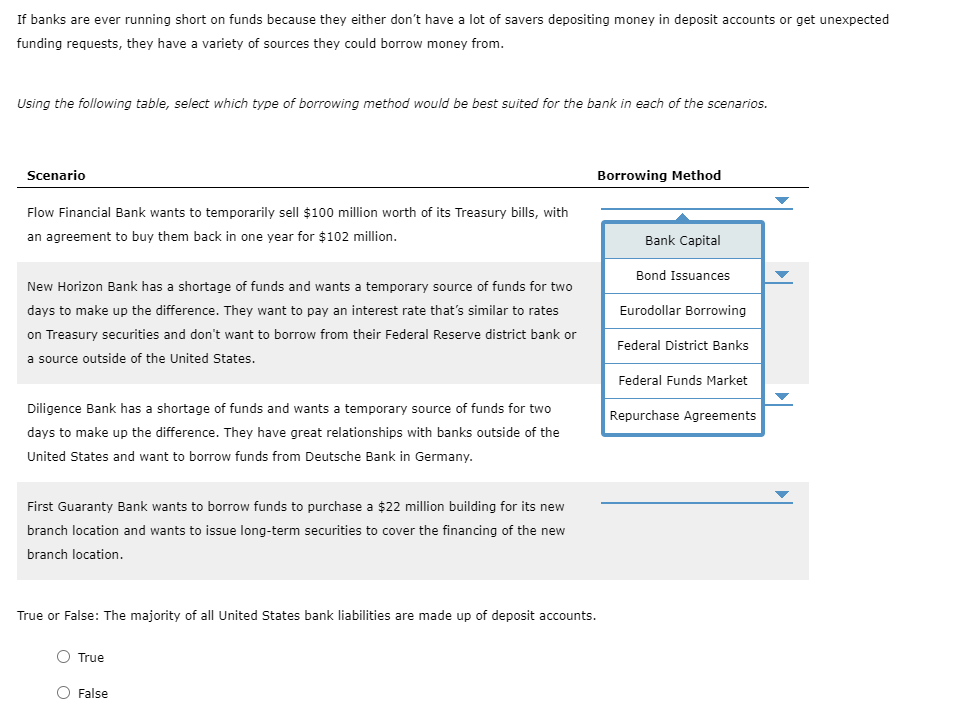

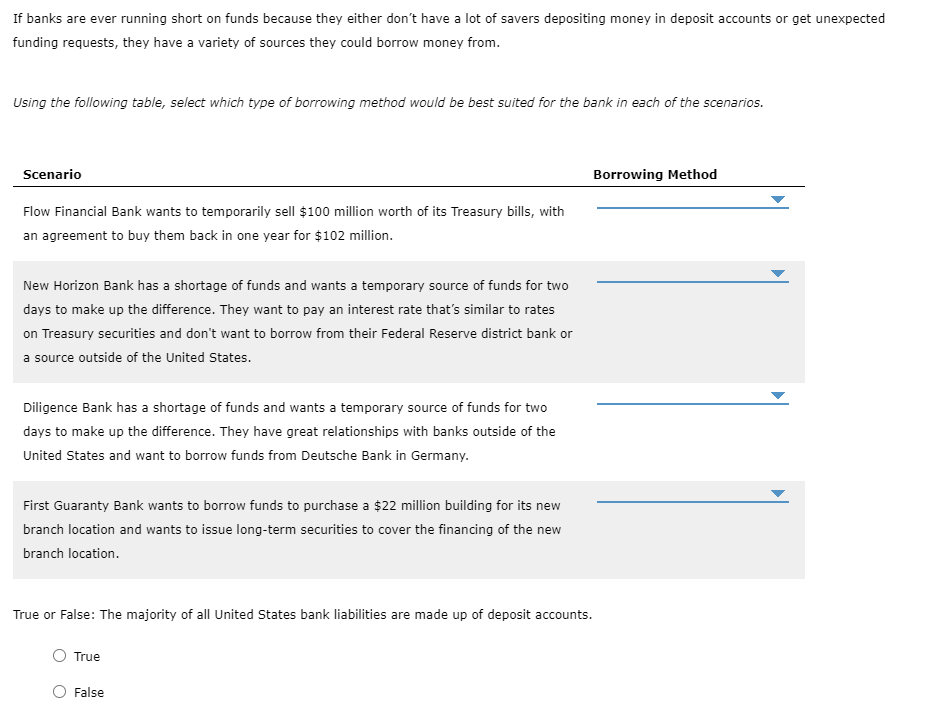

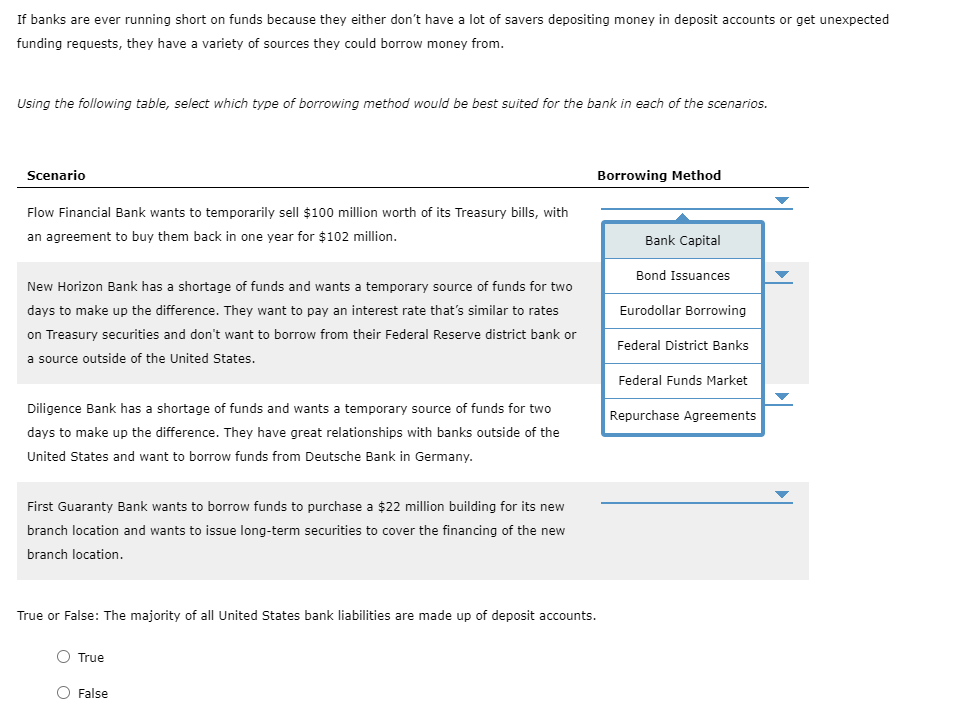

If banks are ever running short on funds because they either don't have a lot of savers depositing money in deposit accounts or get unexpected funding requests, they have a variety of sources they could borrow money from. Using the following table, select which type of borrowing method would be best suited for the bank in each of the scenarios. Scenario Borrowing Method Flow Financial Bank wants to temporarily sell $100 million worth of its Treasury bills, with an agreement to buy them back in one year for $102 million. New Horizon Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They want to pay an interest rate that's similar to rates on Treasury securities and don't want to borrow from their Federal Reserve district bank or a source outside of the United States. Diligence Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They have great relationships with banks outside of the United States and want to borrow funds from Deutsche Bank in Germany. First Guaranty Bank wants to borrow funds to purchase a $22 million building for its new branch location and wants to issue long-term securities to cover the financing of the new branch location. True or False: The majority of all United States bank liabilities are made up of deposit accounts. True False If banks are ever running short on funds because they either don't have a lot of savers depositing money in deposit accounts or get unexpected funding requests, they have a variety of sources they could borrow money from. Using the following table, select which type of borrowing method would be best suited for the bank in each of the scenarios. Scenario Borrowing Method Flow Financial Bank wants to temporarily sell $100 million worth of its Treasury bills, with an agreement to buy them back in one year for $102 million. Bank Capital Bond Issuances Eurodollar Borrowing New Horizon Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They want to pay an interest rate that's similar to rates on Treasury securities and don't want to borrow from their Federal Reserve district bank or a source outside of the United States. Federal District Banks Federal Funds Market Repurchase Agreements Diligence Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They have great relationships with banks outside of the United States and want to borrow funds from Deutsche Bank in Germany. First Guaranty Bank wants to borrow funds to purchase a $22 million building for its new branch location and wants to issue long-term securities to cover the financing of the new branch location. True or False: The majority of all United States bank liabilities are made up of deposit accounts. O True O False