Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If bondholders were able to convert their bonds into 6,000 common shares, and company executives had exercisable stock options available for an additional 5,000

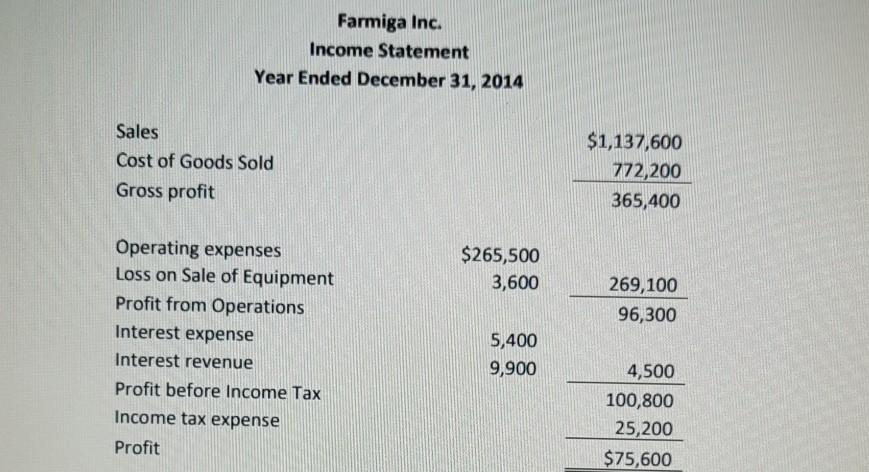

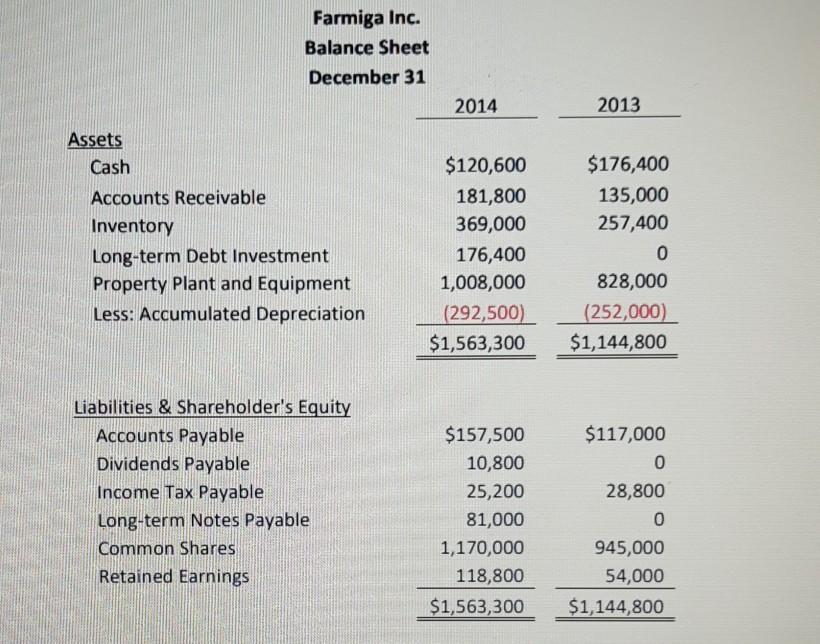

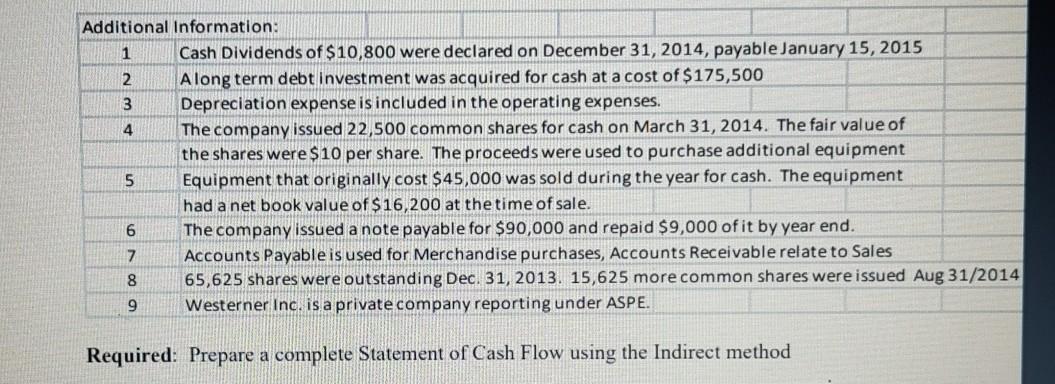

If bondholders were able to convert their bonds into 6,000 common shares, and company executives had exercisable stock options available for an additional 5,000 shares, what would Farmiga's fully diluted EPS be for 2014? (2 marks) Farmiga Inc. Income Statement Year Ended December 31, 2014 Sales Cost of Goods Sold Gross profit Operating expenses Loss on Sale of Equipment Profit from Operations Interest expense Interest revenue Profit before Income Tax Income tax expense Profit $265,500 3,600 5,400 9,900 $1,137,600 772,200 365,400 269,100 96,300 4,500 100,800 25,200 $75,600 Assets Cash Farmiga Inc. Balance Sheet December 31 Accounts Receivable Inventory Long-term Debt Investment Property Plant and Equipment Less: Accumulated Depreciation Liabilities & Shareholder's Equity Accounts Payable Dividends Payable Income Tax Payable Long-term Notes Payable Common Shares Retained Earnings 2014 $120,600 181,800 369,000 176,400 1,008,000 (292,500) $1,563,300 $157,500 10,800 25,200 81,000 1,170,000 118,800 $1,563,300 2013 $176,400 135,000 257,400 0 828,000 (252,000) $1,144,800 $117,000 0 28,800 0 945,000 54,000 $1,144,800 Referring back to Farmiga Inc. Question 4 data, calculate the earnings per share (EPS) for 2014. (2 marks) If bondholders were able to convert their bonds into 6,000 common shares, and company executives had exercisable stock options available for an additional 5,000 shares, what would Farmiga's fully diluted EPS be for 2014? (2 marks) Additional Information: 1 2 3 4 5 Cash Dividends of $10,800 were declared on December 31, 2014, payable January 15, 2015 Along term debt investment was acquired for cash at a cost of $175,500 Depreciation expense is included in the operating expenses. The company issued 22,500 common shares for cash on March 31, 2014. The fair value of the shares were $10 per share. The proceeds were used to purchase additional equipment Equipment that originally cost $45,000 was sold during the year for cash. The equipment had a net book value of $16,200 at the time of sale. 6 The company issued a note payable for $90,000 and repaid $9,000 of it by year end. 7 Accounts Payable is used for Merchandise purchases, Accounts Receivable relate to Sales 8 65,625 shares were outstanding Dec. 31, 2013. 15,625 more common shares were issued Aug 31/2014 9 Westerner Inc. is a private company reporting under ASPE. Required: Prepare a complete Statement of Cash Flow using the Indirect method

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the fully diluted earnings per share EPS for Farmiga Inc for 2014 we need to consider the impact of the conversion of bonds and the exerc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started