Question

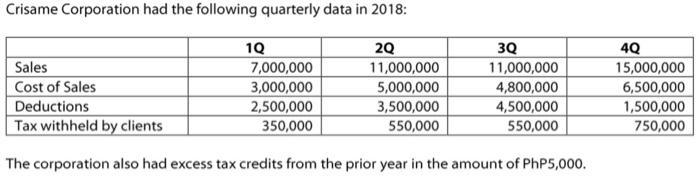

If Crisame Corporation itemizes deductions in 2018, what is its income tax payable in the 3rd quarter of 2018? Crisame Corporation had the following quarterly

If Crisame Corporation itemizes deductions in 2018, what is its income tax payable in the 3rd quarter of 2018?

Crisame Corporation had the following quarterly data in 2018: 1Q 2Q 3Q Sales 7,000,000 11,000,000 11,000,000 Cost of Sales 3,000,000 5,000,000 4,800,000 Deductions 2,500,000 3,500,000 4,500,000 Tax withheld by clients 350,000 550,000 550,000 The corporation also had excess tax credits from the prior year in the amount of PhP5,000. 4Q 15,000,000 6,500,000 1,500,000 750,000

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Sales 3rd quarter 11000000 Cost of sales 48000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

7th Canadian edition

1119368456, 978-1119211587, 1119211581, 978-1119320623, 978-1119368458

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App