- If demand for 2020 is instead 3,000 units should the company pay to increase their capacity? Why? Please explain your calculations and reference to the chart in Figure 1. Assume units are sold at the normal price.

Hint: If you expand capacity, you will have to pay additional fixed costs of $50,000. Remember that fixed costs are fixed within the relevant range. If you expand capacity then you are outside this range. If you expand capacity then you can make revenue on 1,000 additional units at the normal price and would pay variable costs on 1,000 additional units. Please consider the incremental profit or loss of expanding capacity. If the incremental profit of expanding capacity is positive then you should do so.

- Assume sales and demand are 1,000 units, how much will the company make on the sale of the next unit (1,001st)? Discuss which amounts on the income statement will change if the company makes and sells one more unit. Please discuss your calculations and reference to Figure 1.

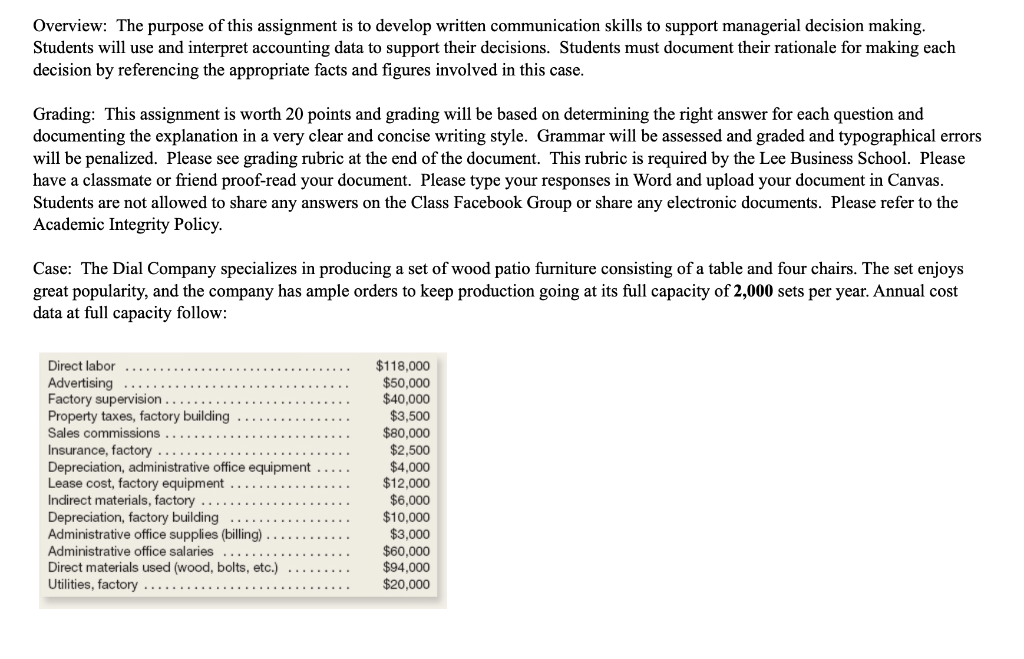

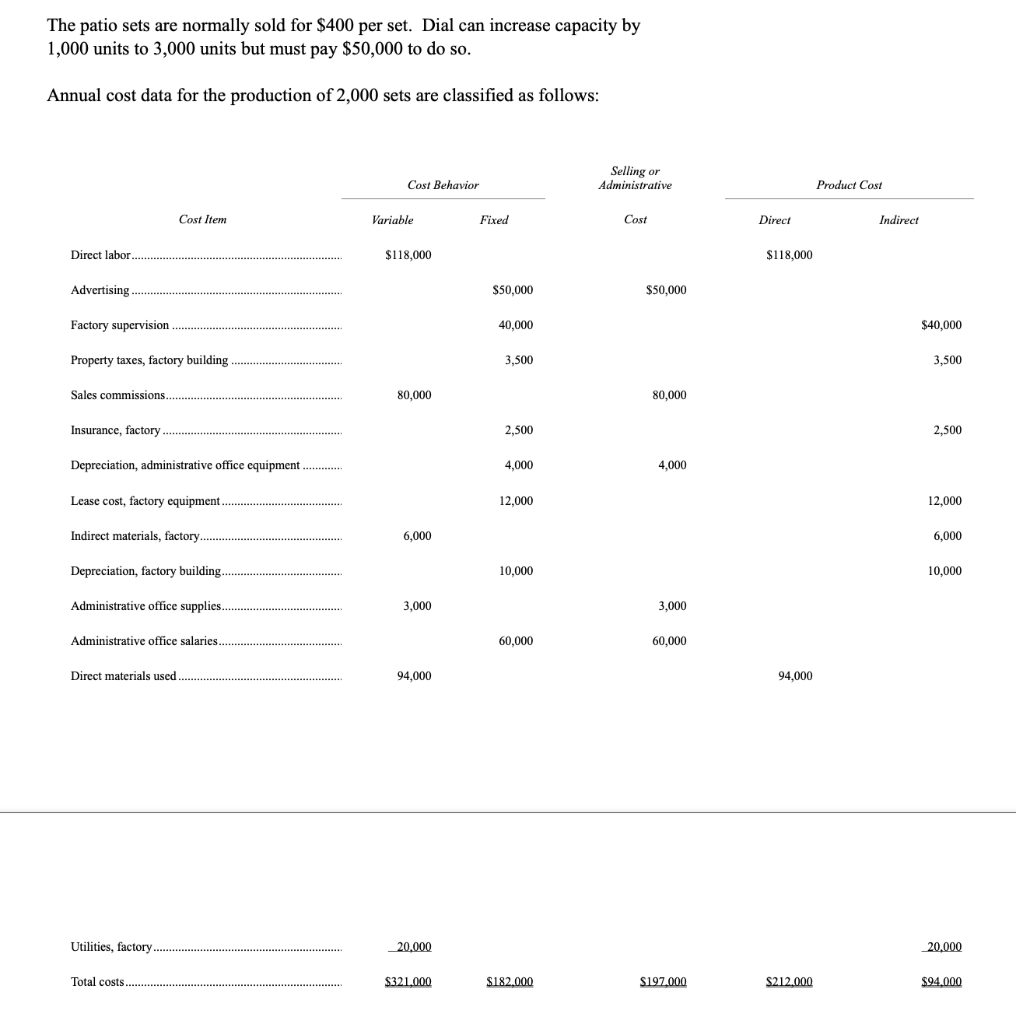

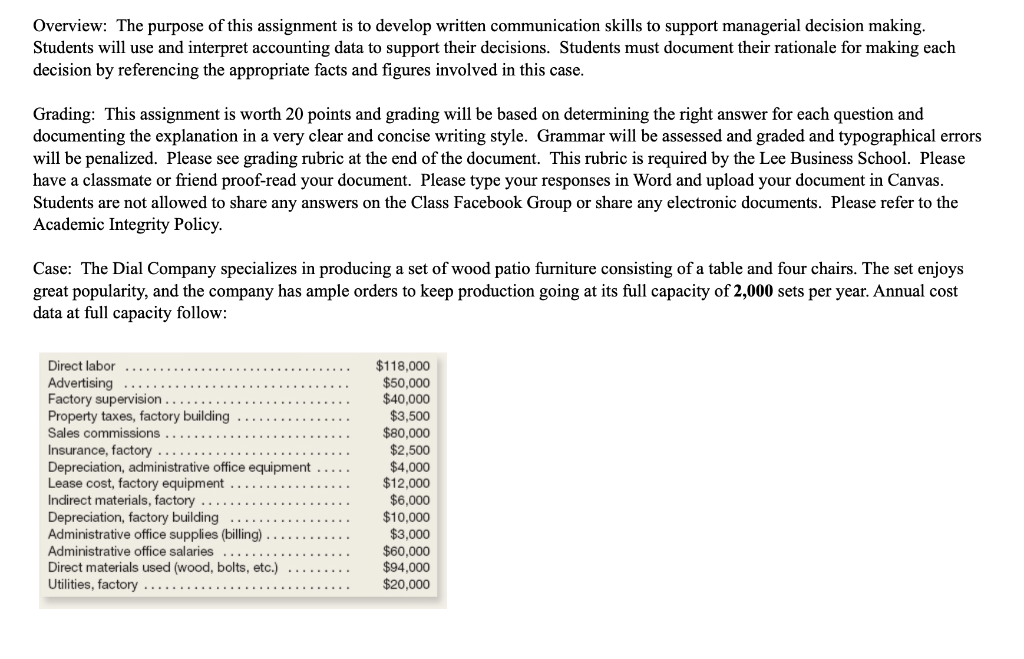

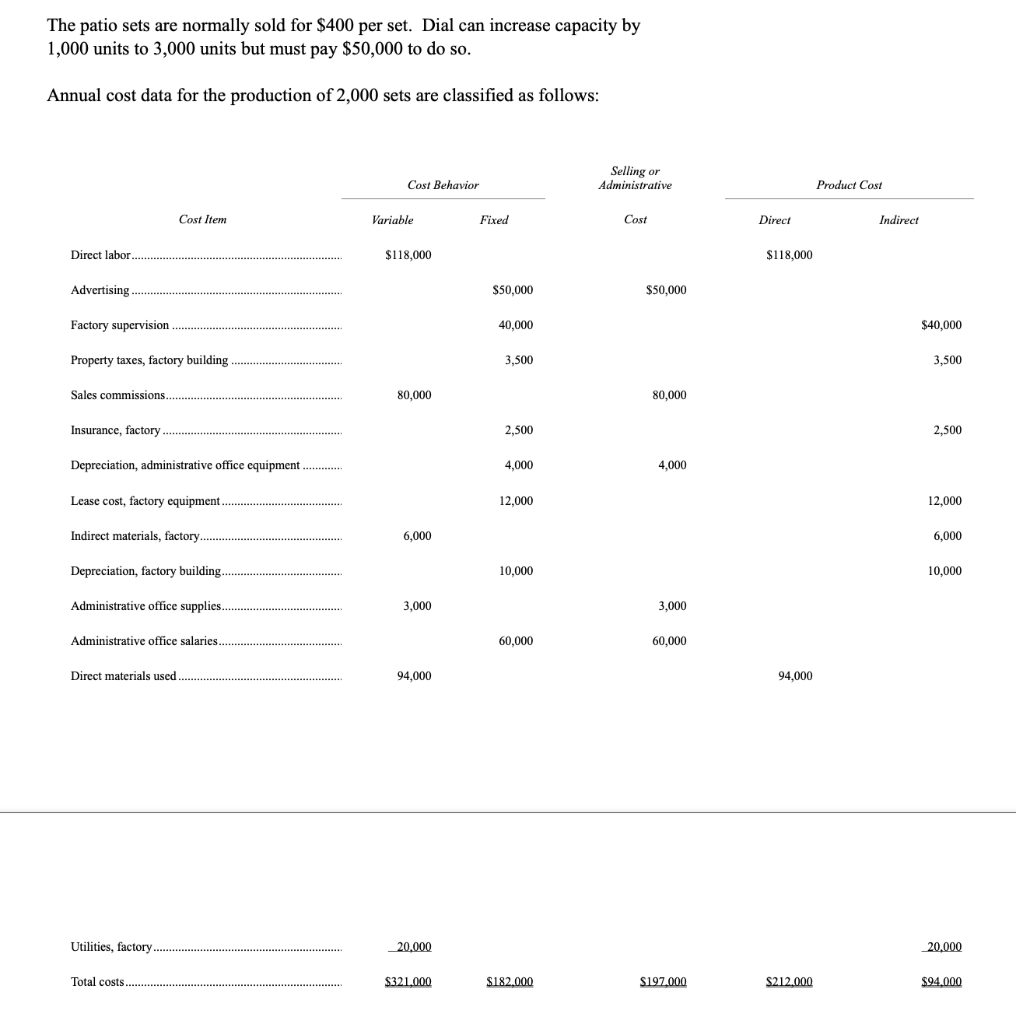

Overview: The purpose of this assignment is to develop written communication skills to support managerial decision making. Students will use and interpret accounting data to support their decisions. Students must document their rationale for making each decision by referencing the appropriate facts and figures involved in this case. Grading: This assignment is worth 20 points and grading will be based on determining the right answer for each question and documenting the explanation in a very clear and concise writing style. Grammar will be assessed and graded and typographical errors will be penalized. Please see grading rubric at the end of the document. This rubric is required by the Lee Business School. Please have a classmate or friend proof-read your document. Please type your responses in Word and upload your document in Canvas. Students are not allowed to share any answers on the Class Facebook Group or share any electronic documents. Please refer to the Academic Integrity Policy. Case: The Dial Company specializes in producing a set of wood patio furniture consisting of a table and four chairs. The set enjoys great popularity, and the company has ample orders to keep production going at its full capacity of 2,000 sets per year. Annual cost data at full capacity follow: Direct labor Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation, administrative office equipment Lease cost, factory equipment Indirect materials, factory Depreciation, factory building Administrative office supplies (billing) Administrative office salaries Direct materials used (wood, bolts, etc.) Utilities, factory ..... $118,000 $50.000 $40,000 $3,500 $80,000 $2,500 $4,000 $12,000 $6,000 $10,000 $3,000 $60,000 $94,000 $20,000 The patio sets are normally sold for $400 per set. Dial can increase capacity by 1,000 units to 3,000 units but must pay $50,000 to do so. Annual cost data for the production of 2,000 sets are classified as follows: Selling or Administrative Cost Behavior Product Cost Cost Item Variable Fixed Cost Direct Indirect Direct labor $118,000 $118,000 Advertising $50,000 $50,000 Factory supervision 40,000 $40,000 Property taxes, factory building 3,500 3,500 Sales commissions. 80,000 80,000 Insurance, factory 2,500 2,500 Depreciation, administrative office equipment 4,000 4,000 Lease cost, factory equipment 12.000 12,000 Indirect materials, factory. 6,000 6,000 Depreciation, factory building 10,000 10,000 Administrative office supplies...... 3,000 3,000 Administrative office salaries. 60,000 60,000 Direct materials used. 94.000 94,000 Utilities, factory 20,000 20.000 Total costs. $321,000 $182.000 $ 197.000 $197.000 S212.000 $94.000 Overview: The purpose of this assignment is to develop written communication skills to support managerial decision making. Students will use and interpret accounting data to support their decisions. Students must document their rationale for making each decision by referencing the appropriate facts and figures involved in this case. Grading: This assignment is worth 20 points and grading will be based on determining the right answer for each question and documenting the explanation in a very clear and concise writing style. Grammar will be assessed and graded and typographical errors will be penalized. Please see grading rubric at the end of the document. This rubric is required by the Lee Business School. Please have a classmate or friend proof-read your document. Please type your responses in Word and upload your document in Canvas. Students are not allowed to share any answers on the Class Facebook Group or share any electronic documents. Please refer to the Academic Integrity Policy. Case: The Dial Company specializes in producing a set of wood patio furniture consisting of a table and four chairs. The set enjoys great popularity, and the company has ample orders to keep production going at its full capacity of 2,000 sets per year. Annual cost data at full capacity follow: Direct labor Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation, administrative office equipment Lease cost, factory equipment Indirect materials, factory Depreciation, factory building Administrative office supplies (billing) Administrative office salaries Direct materials used (wood, bolts, etc.) Utilities, factory ..... $118,000 $50.000 $40,000 $3,500 $80,000 $2,500 $4,000 $12,000 $6,000 $10,000 $3,000 $60,000 $94,000 $20,000 The patio sets are normally sold for $400 per set. Dial can increase capacity by 1,000 units to 3,000 units but must pay $50,000 to do so. Annual cost data for the production of 2,000 sets are classified as follows: Selling or Administrative Cost Behavior Product Cost Cost Item Variable Fixed Cost Direct Indirect Direct labor $118,000 $118,000 Advertising $50,000 $50,000 Factory supervision 40,000 $40,000 Property taxes, factory building 3,500 3,500 Sales commissions. 80,000 80,000 Insurance, factory 2,500 2,500 Depreciation, administrative office equipment 4,000 4,000 Lease cost, factory equipment 12.000 12,000 Indirect materials, factory. 6,000 6,000 Depreciation, factory building 10,000 10,000 Administrative office supplies...... 3,000 3,000 Administrative office salaries. 60,000 60,000 Direct materials used. 94.000 94,000 Utilities, factory 20,000 20.000 Total costs. $321,000 $182.000 $ 197.000 $197.000 S212.000 $94.000