Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IF DONE IN EXCEL PLEASE SHOW CALCULATIONS FOR THE CELLS You are a financial analyst at Spartan Spirit Corporation. Your boss asks you to evaluate

IF DONE IN EXCEL PLEASE SHOW CALCULATIONS FOR THE CELLS

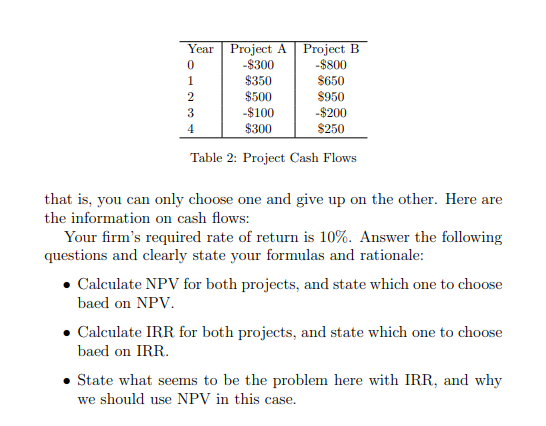

You are a financial analyst at Spartan Spirit Corporation. Your boss asks you to evaluate two potential projects to make a decision as which one to choose. These two projects are mutually exclusive, 1 Year Project A 0 -$300 $350 2 $500 3 -$100 4 $300 Project B -$800 $650 $950 -$200 $250 Table 2: Project Cash Flows that is, you can only choose one and give up on the other. Here are the information on cash flows: Your firm's required rate of return is 10%. Answer the following questions and clearly state your formulas and rationale: Calculate NPV for both projects, and state which one to choose baed on NPV. Calculate IRR for both projects, and state which one to choose baed on IRR. State what seems to be the problem here with IRR, and why we should use NPV in this caseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started