Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If Elixir Company was able to sell all the lots except for 15 lots of Class C, how much is the cost of sales to

If Elixir Company was able to sell all the lots except for 15 lots of Class C, how much is the cost of sales to be recognized for the year?

b. What amount should be allocated as total cost of Class B lots under the Relative Sales Price method?

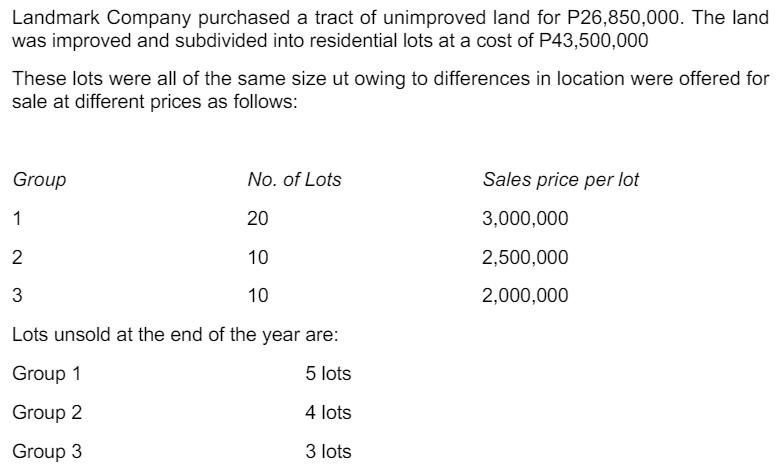

How much is the cost of inventory at the end of the year?

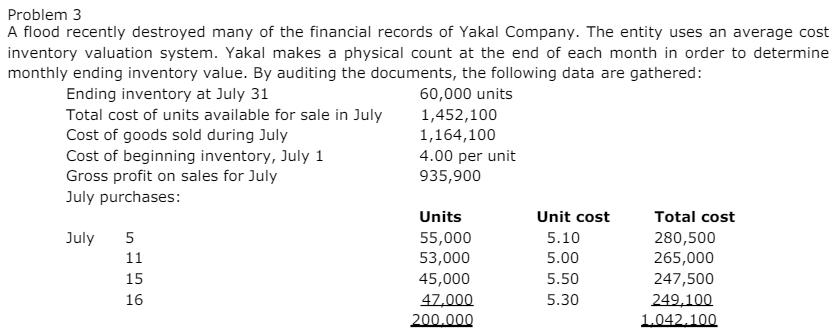

a. What is the cost of inventory on July 31?

b. How many units were sold during July?

c. What is the number of units on July 1?

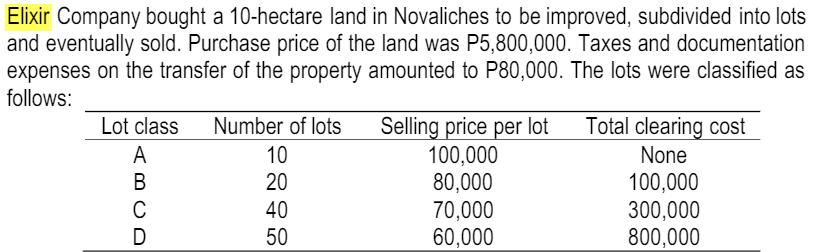

Elixir Company bought a 10-hectare land in Novaliches to be improved, subdivided into lots and eventually sold. Purchase price of the land was P5,800,000. Taxes and documentation expenses on the transfer of the property amounted to P80,000. The lots were classified as follows: Lot class Number of lots A 10 B 20 C 40 D 50 Selling price per lot 100,000 80,000 70,000 60,000 Total clearing cost None 100,000 300,000 800,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the question about the Elixir Company we need to calculate the cost of sales for the year and the allocation of costs to the different classes of lots Heres how to go about it Cost of Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started