Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If everything is correct I will give a thumbs up. Suppose that Wilson Bank sceks to understand its exposure to interest rate risk. To do

If everything is correct I will give a thumbs up.

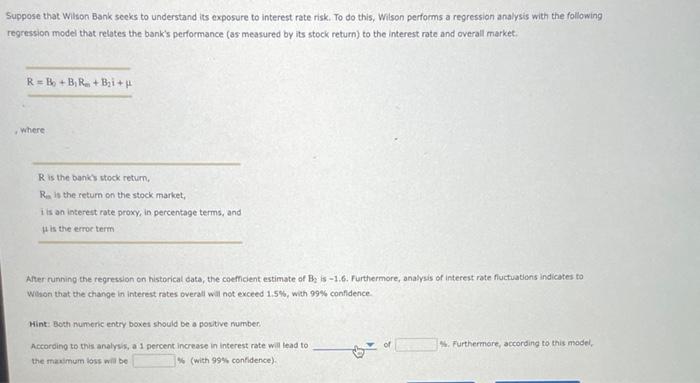

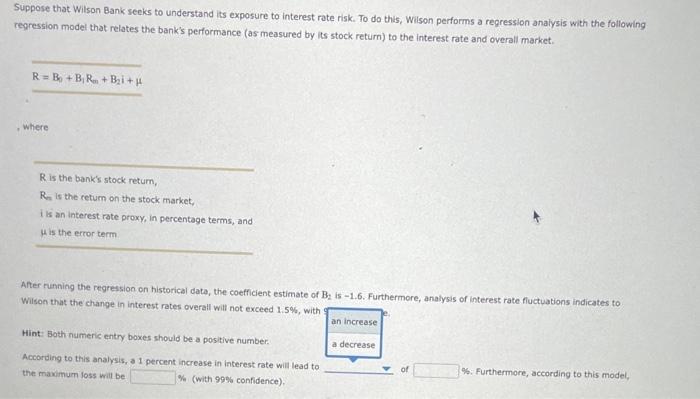

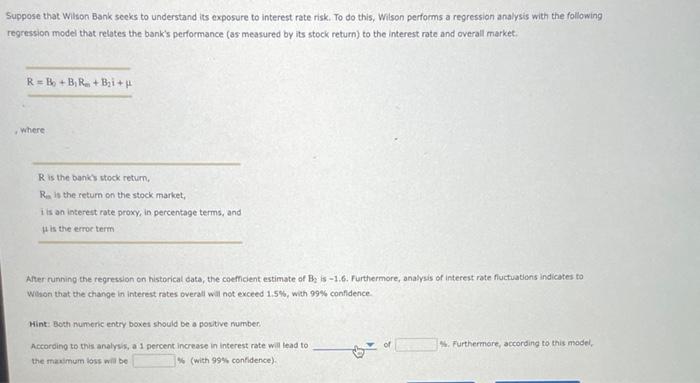

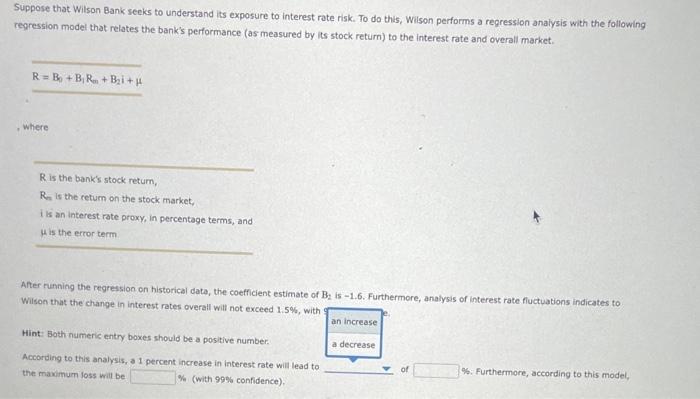

Suppose that Wilson Bank sceks to understand its exposure to interest rate risk. To do this. Wilson performs a regression analysis with the following regression model that relates the bank's performance (as measured by its stock return) to the interest rate and overall market. R=Bi+B1Rn+B2i+ , where R is the baniks stock return, Rn is the return on the stock market, its an iatereit rate proxy, in percentage terms, and 4 is the erroc term Ather running the regression on historical cata, the coeffient estimate of B2 is -1.6 . Furthermore, analysis of interent rate fluctiations indicates to Wion that the change in interest rates overall will not exceed 1.5%, with 99% confidence Hint: Both numenc entry boxes should be a postive mumber: According to this analysis, a 1 percent increase in interest rate will lead to W. Furthermore, according to this madel. the maitmum loss wil be W (with 99% confidence) Suppose that Wilson Bank seeks to understand its exposure to interest rate risk. To do this, Wilson performs a regression anaiysis with the following regression model that relates the bank's performance (as measured by its stock retum) to the interest rate and overall market. R=B0+B1Rm+B2i+ , Where R is the bank's stock return, Rn is the return on the stock market, i is an interest rate proxy, in percentage terms, and His the error term After running the regression on historical data, the coefficient estimate of B2 is -1.6 . Furthermore, analysis of interest rate fluctuations indicates to Wilson that the change in interest rates overall will not exceed 1.5%, with Hint: Both numeric entry boxes should be a positive number. According to this analysis, a 1 percent increase in interest rate will lead to the maximum loss will be of % (with 99% confidence). \%. Furthermore, according to this model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started