Answered step by step

Verified Expert Solution

Question

1 Approved Answer

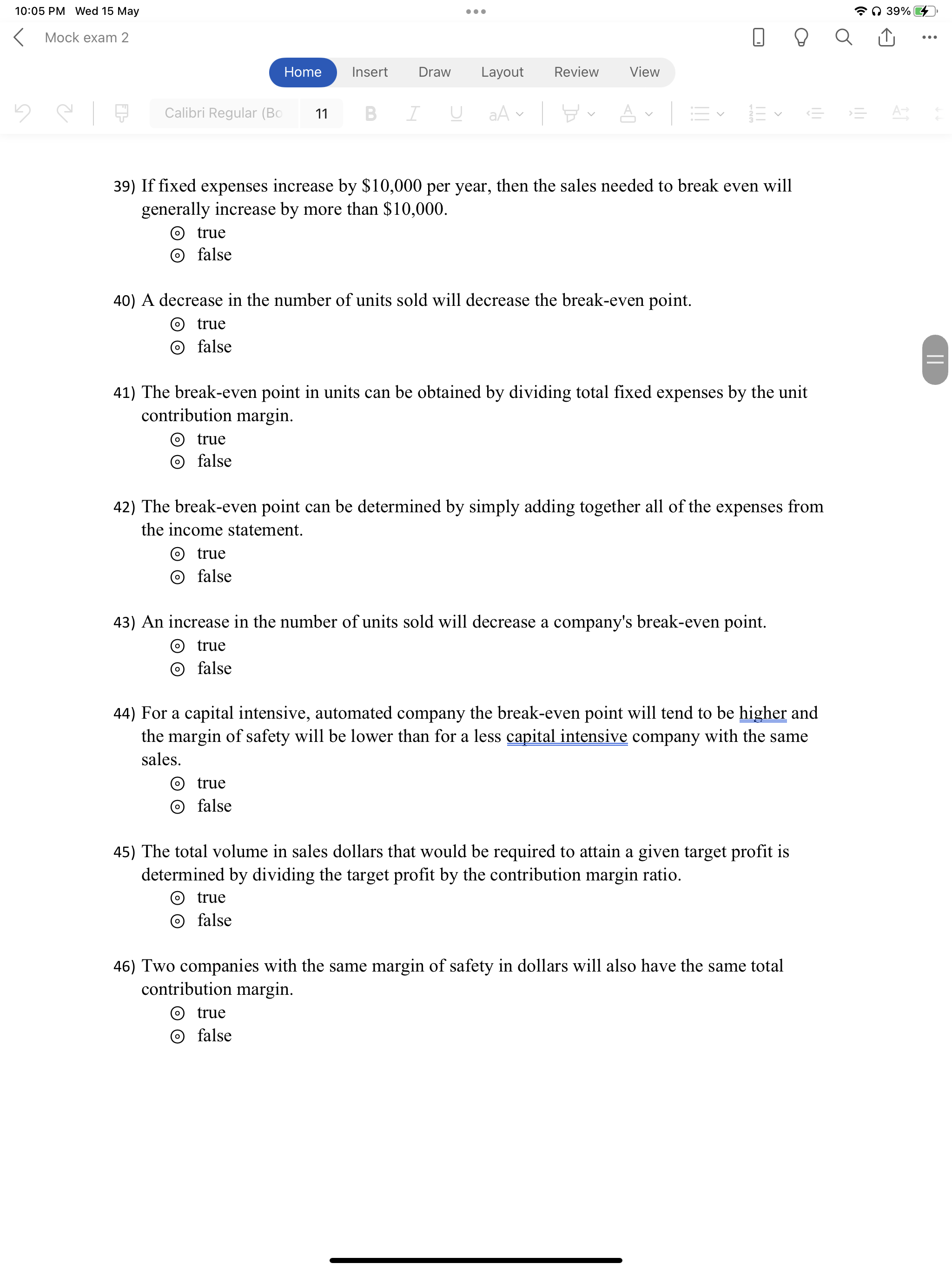

If fixed expenses increase by $ 1 0 , 0 0 0 per year, then the sales needed to break even will generally increase by

If fixed expenses increase by $ per year, then the sales needed to break even will

generally increase by more than $

true

false

A decrease in the number of units sold will decrease the breakeven point.

true

false

The breakeven point in units can be obtained by dividing total fixed expenses by the unit

contribution margin.

true

false

The breakeven point can be determined by simply adding together all of the expenses from

the income statement.

true

false

An increase in the number of units sold will decrease a company's breakeven point.

true

false

For a capital intensive, automated company the breakeven point will tend to be higher and

the margin of safety will be lower than for a less capital intensive company with the same

sales.

true

false

The total volume in sales dollars that would be required to attain a given target profit is

determined by dividing the target profit by the contribution margin ratio.

true

false

Two companies with the same margin of safety in dollars will also have the same total

contribution margin.

true

false

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started