Answered step by step

Verified Expert Solution

Question

1 Approved Answer

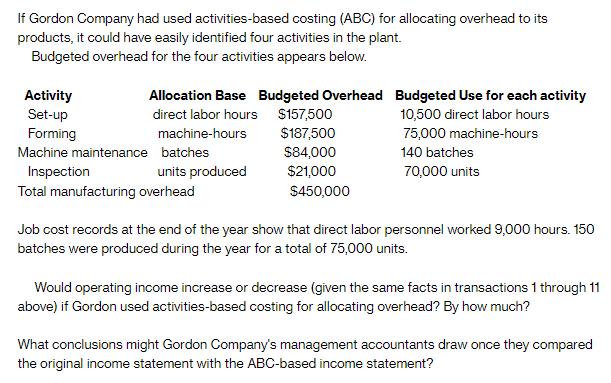

If Gordon Company had used activities-based costing (ABC) for allocating overhead to its products, it could have easily identified four activities in the plant.

If Gordon Company had used activities-based costing (ABC) for allocating overhead to its products, it could have easily identified four activities in the plant. Budgeted overhead for the four activities appears below. Activity Set-up Forming Machine maintenance Inspection Allocation Base Budgeted Overhead direct labor hours machine-hours batches units produced Total manufacturing overhead $157,500 $187,500 $84,000 $21,000 $450,000 Budgeted Use for each activity 10,500 direct labor hours 75,000 machine-hours 140 batches 70,000 units Job cost records at the end of the year show that direct labor personnel worked 9,000 hours. 150 batches were produced during the year for a total of 75,000 units. Would operating income increase or decrease (given the same facts in transactions 1 through 11 above) if Gordon used activities-based costing for allocating overhead? By how much? What conclusions might Gordon Company's management accountants draw once they compared the original income statement with the ABC-based income statement?

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To determine the impact of using activitybased costing ABC for allocating overhead on operating income well compare the results using the traditional costing method with the ABCbased costing method 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started