Question

If Grenfell recommends that Providence hedge(using forwards or puts) the initial investment and the expected returns (C$3bn x (1 + 25%)5 = C$9.2bn) at the

If Grenfell recommends that Providence hedge(using forwards or puts) the initial investment and the expected returns (C$3bn x (1 + 25%)5 = C$9.2bn) at the end of the investment, determine how the realized US dollar IRR changes with different exchange rates. (Recall that with forwards, there will be no uncertainty about the return while options returns will vary with the future exchange rate.)

Perform this analysis assuming Grenfell recommends an all option and all forward strategy. Perform the analysis for 2 scenarios: one where Providence achieves the expected 25% IRR, and another where it achieves a 0% IRR.

Could Providence make better outcome by using a combination of forwards and options in the face of uncertainty around the Canadian dollar IRR (in both the 0% or 25% scenarios)?

Case: https://services.hbsp.harvard.edu/api/courses/862016/items/908N23-PDF-ENG/sclinks/c495e9500a0e74b9dc639661a79ccb9d

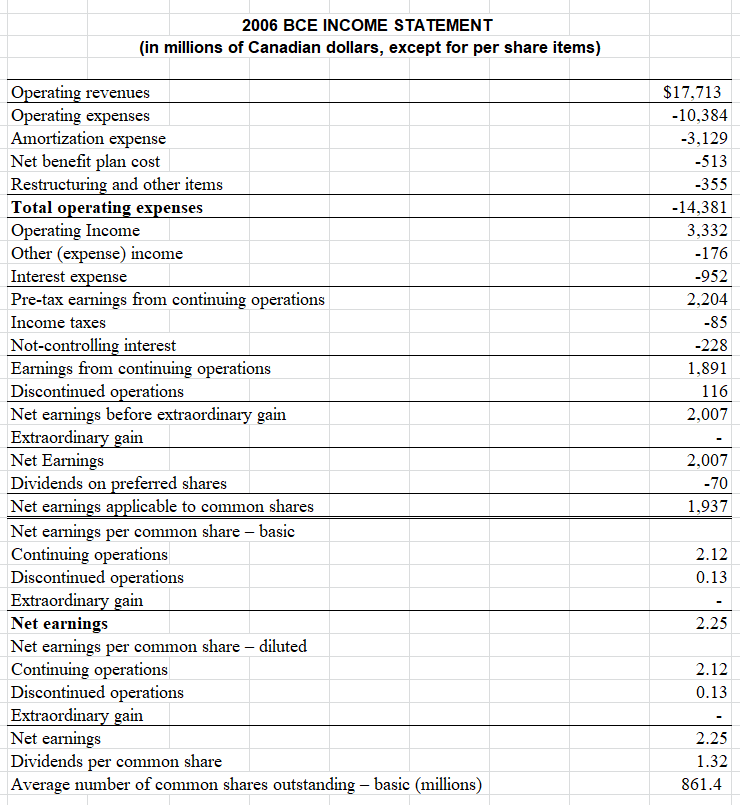

2006 BCE INCOME STATEMENT (in millions of Canadian dollars, except for per share items) Operating revenues $17,713 Operating expenses -10,384 Amortization expense -3,129 Net benefit plan cost -513 Restructuring and other items -355 Total operating expenses -14,381 Operating Income 3,332 Other (expense) income -176 Interest expense -952 Pre-tax earnings from continuing operations 2,204 Income taxes -85 Not-controlling interest -228 Earnings from continuing operations 1,891 Discontinued operations 116 Net earnings before extraordinary gain 2,007 Extraordinary gain Net Earnings 2,007 Dividends on preferred shares -70 Net earnings applicable to common shares 1,937 Net earnings per common share - basic Continuing operations Discontinued operations 2.12 0.13 Extraordinary gain Net earnings Net earnings per common share - diluted Continuing operations Discontinued operations Extraordinary gain 2.25 2.12 0.13 Net earnings 2.25 Dividends per common share 1.32 Average number of common shares outstanding - basic (millions) 861.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started