Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If I need additional information to answer this question can you please let me know what to look for 1. What amount of deferred tax

If I need additional information to answer this question can you please let me know what to look for

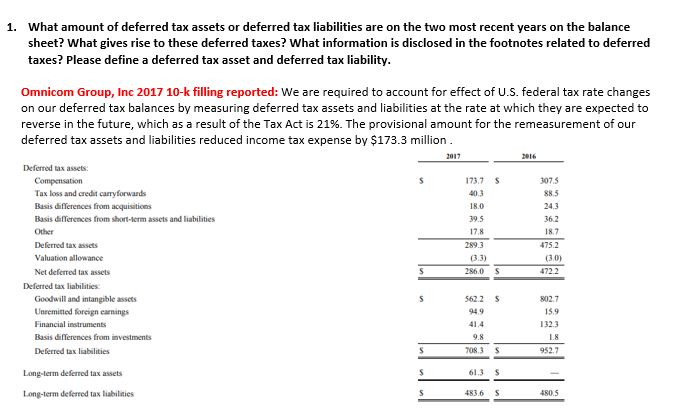

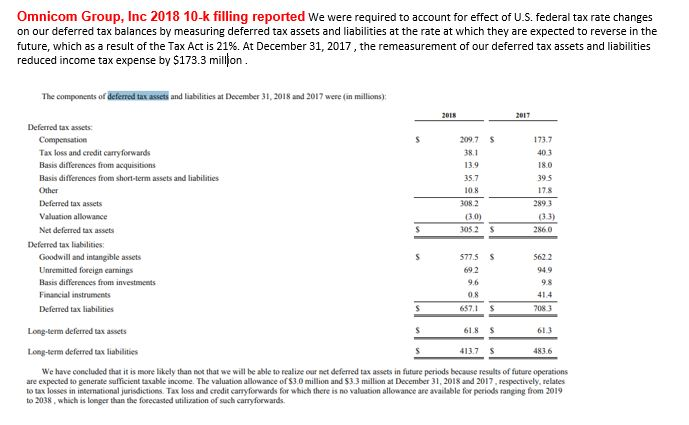

1. What amount of deferred tax assets or deferred tax liabilities are on the two most recent years on the balance sheet? What gives rise to these deferred taxes? What information is disclosed in the footnotes related to deferred taxes? Please define a deferred tax asset and deferred tax liability. Omnicom Group, Inc 2017 10-k filling reported: We are required to account for effect of U.S. federal tax rate changes on our deferred tax balances by measuring deferred tax assets and liabilities at the rate at which they are expected to reverse in the future, which as a result of the Tax Act is 21%. The provisional amount for the remeasurement of our deferred tax assets and liabilities reduced income tax expense by $173.3 million 2017 173. 75 3075 88.5 40.3 Deferred tax assets Compensation Tax loss and credit carryforwards Basis differences from acquisitions Basis differences from short-term assets and liabilities Other Deferred tax assets Valuation allowance Net deferred tax assets Deferred tax liabilities: Goodwill and intangible assets Unremitted foreign earnings Financial instruments Basis differences from investments Deferred tax liabilities 18.0 39.5 17.8 2893 (3.3) 2860 4722 302.7 562. 25 949 15.9 132.3 9.8 7083 S 952.7 Long-term deferred tax assets 61.3 S Long-term deferred tax liabilities 483. 65 Omnicom Group, Inc 2018 10-k filling reported We were required to account for effect of U.S. federal tax rate changes on our deferred tax balances by measuring deferred tax assets and liabilities at the rate at which they are expected to reverse in the future, which as a result of the Tax Act is 21%. At December 31, 2017, the remeasurement of our deferred tax assets and liabilities reduced income tax expense by $173.3 million. The components of deferred tax assets and liabilities at December 31, 2018 and 2017 were in millions) 209. 75 173.7 403 361 13.9 35.7 180 395 10.8 Deferred tax assets Compensation Tax loss and credit carry forwards Basis differences from acquisitions Basis differences from short-term assets and liabilities Other Deferred tax assets Valuation allowance Net deferred tax assets Deferred tax liabilities Goodwill and intangible assets Unremitted foreign carrings Basis differences from investments Financial instruments Deferred tax liabilities 308.2 (3.0) 3052 2893 (33) 2860 562.2 949 57755 692 9.6 OR 657.1 5 98 $ 414 7083 Long-term deferred tax assets 61.8 $ 613 Long-term deferred tax liabilities 413.7 5 483.6 We have concluded that it is more likely than that we will be able to realize our net deferred tax assets in future periods because results of future operations are expected to generate sufficient taxable income. The valuation allowance of $3.0 million and $3.3 million at December 31, 2018 and 2017, respectively, relates to tax losses in international jurisdictions Tax loss and credit carry forwards for which there is no valuation allowance are available for periods ranging from 2019 to 2038, which is longer than the forecasted utilization of such canyforwards. 1. What amount of deferred tax assets or deferred tax liabilities are on the two most recent years on the balance sheet? What gives rise to these deferred taxes? What information is disclosed in the footnotes related to deferred taxes? Please define a deferred tax asset and deferred tax liability. Omnicom Group, Inc 2017 10-k filling reported: We are required to account for effect of U.S. federal tax rate changes on our deferred tax balances by measuring deferred tax assets and liabilities at the rate at which they are expected to reverse in the future, which as a result of the Tax Act is 21%. The provisional amount for the remeasurement of our deferred tax assets and liabilities reduced income tax expense by $173.3 million 2017 173. 75 3075 88.5 40.3 Deferred tax assets Compensation Tax loss and credit carryforwards Basis differences from acquisitions Basis differences from short-term assets and liabilities Other Deferred tax assets Valuation allowance Net deferred tax assets Deferred tax liabilities: Goodwill and intangible assets Unremitted foreign earnings Financial instruments Basis differences from investments Deferred tax liabilities 18.0 39.5 17.8 2893 (3.3) 2860 4722 302.7 562. 25 949 15.9 132.3 9.8 7083 S 952.7 Long-term deferred tax assets 61.3 S Long-term deferred tax liabilities 483. 65 Omnicom Group, Inc 2018 10-k filling reported We were required to account for effect of U.S. federal tax rate changes on our deferred tax balances by measuring deferred tax assets and liabilities at the rate at which they are expected to reverse in the future, which as a result of the Tax Act is 21%. At December 31, 2017, the remeasurement of our deferred tax assets and liabilities reduced income tax expense by $173.3 million. The components of deferred tax assets and liabilities at December 31, 2018 and 2017 were in millions) 209. 75 173.7 403 361 13.9 35.7 180 395 10.8 Deferred tax assets Compensation Tax loss and credit carry forwards Basis differences from acquisitions Basis differences from short-term assets and liabilities Other Deferred tax assets Valuation allowance Net deferred tax assets Deferred tax liabilities Goodwill and intangible assets Unremitted foreign carrings Basis differences from investments Financial instruments Deferred tax liabilities 308.2 (3.0) 3052 2893 (33) 2860 562.2 949 57755 692 9.6 OR 657.1 5 98 $ 414 7083 Long-term deferred tax assets 61.8 $ 613 Long-term deferred tax liabilities 413.7 5 483.6 We have concluded that it is more likely than that we will be able to realize our net deferred tax assets in future periods because results of future operations are expected to generate sufficient taxable income. The valuation allowance of $3.0 million and $3.3 million at December 31, 2018 and 2017, respectively, relates to tax losses in international jurisdictions Tax loss and credit carry forwards for which there is no valuation allowance are available for periods ranging from 2019 to 2038, which is longer than the forecasted utilization of such canyforwardsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started