Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*if images are blurry, just zoom in* Assuming this company follows ASPE, can you help identify the issues with the warranty provision as well as

*if images are blurry, just zoom in*

Assuming this company follows ASPE, can you help identify the issues with the warranty provision as well as the lease agreements and how they would be solved.

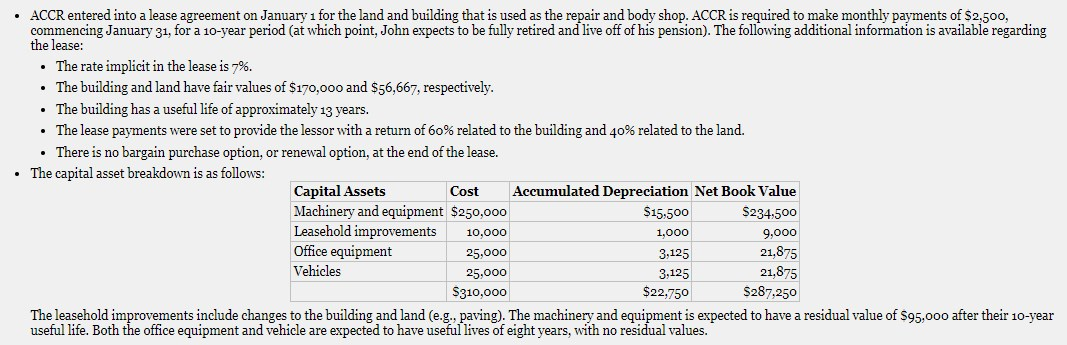

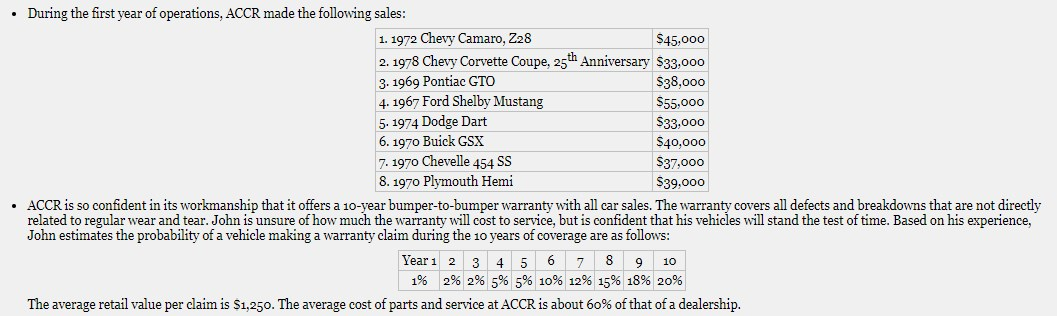

ACCR entered into a lease agreement on January 1 for the land and building that is used as the repair and body shop. ACCR is required to make monthly payments of $2,500, commencing January 31, for a 10-year period (at which point, John expects to be fully retired and live off of his pension). The following additional information is available regarding the lease: The rate implicit in the lease is 7%. The building and land have fair values of $170,000 and $56,667, respectively. The building has a useful life of approximately 13 years. The lease payments were set to provide the lessor with a return of 60% related to the building and 40% related to the land. There is no bargain purchase option, or renewal option, at the end of the lease. The capital asset breakdown is as follows: Capital Assets Cost Accumulated Depreciation Net Book Value Machinery and equipment $250,000 $15,500 $234,500 Leasehold improvements 10,000 1,000 9,000 Office equipment 25,000 3,125 21,875 Vehicles 25,000 3,125 21,875 $310,000 $22,750 S287,250 The leasehold improvements include changes to the building and land (e.g., paving). The machinery and equipment is expected to have a residual value of $95,000 after their 10-year useful life. Both the office equipment and vehicle are expected to have useful lives of eight years, with no residual values. During the first year of operations, ACCR made the following sales: 1. 1972 Chevy Camaro, 228 $45,000 2. 1978 Chevy Corvette Coupe, 25th Anniversary $33,000 3. 1969 Pontiac GTO $38,000 4. 1967 Ford Shelby Mustang $55,000 5. 1974 Dodge Dart $33,000 6. 1970 Buick GSX $40,000 7. 1970 Chevelle 454 SS $37,000 8. 1970 Plymouth Hemi $39.000 ACCR is so confident in its workmanship that it offers a 10-year bumper-to-bumper warranty with all car sales. The warranty covers all defects and breakdowns that are not directly related to regular wear and tear. John is unsure of how much the warranty will cost to service, but is confident that his vehicles will stand the test of time. Based on his experience, John estimates the probability of a vehicle making a warranty claim during the 10 years of coverage are as follows: Year 1 2 3 4 5 6 7 8 9 10 1% 2% 2% 5% 5% 10% 12% 15% 18% 20% The average retail value per claim is $1,250. The average cost of parts and service at ACCR is about 60% of that of a dealership. ACCR entered into a lease agreement on January 1 for the land and building that is used as the repair and body shop. ACCR is required to make monthly payments of $2,500, commencing January 31, for a 10-year period (at which point, John expects to be fully retired and live off of his pension). The following additional information is available regarding the lease: The rate implicit in the lease is 7%. The building and land have fair values of $170,000 and $56,667, respectively. The building has a useful life of approximately 13 years. The lease payments were set to provide the lessor with a return of 60% related to the building and 40% related to the land. There is no bargain purchase option, or renewal option, at the end of the lease. The capital asset breakdown is as follows: Capital Assets Cost Accumulated Depreciation Net Book Value Machinery and equipment $250,000 $15,500 $234,500 Leasehold improvements 10,000 1,000 9,000 Office equipment 25,000 3,125 21,875 Vehicles 25,000 3,125 21,875 $310,000 $22,750 S287,250 The leasehold improvements include changes to the building and land (e.g., paving). The machinery and equipment is expected to have a residual value of $95,000 after their 10-year useful life. Both the office equipment and vehicle are expected to have useful lives of eight years, with no residual values. During the first year of operations, ACCR made the following sales: 1. 1972 Chevy Camaro, 228 $45,000 2. 1978 Chevy Corvette Coupe, 25th Anniversary $33,000 3. 1969 Pontiac GTO $38,000 4. 1967 Ford Shelby Mustang $55,000 5. 1974 Dodge Dart $33,000 6. 1970 Buick GSX $40,000 7. 1970 Chevelle 454 SS $37,000 8. 1970 Plymouth Hemi $39.000 ACCR is so confident in its workmanship that it offers a 10-year bumper-to-bumper warranty with all car sales. The warranty covers all defects and breakdowns that are not directly related to regular wear and tear. John is unsure of how much the warranty will cost to service, but is confident that his vehicles will stand the test of time. Based on his experience, John estimates the probability of a vehicle making a warranty claim during the 10 years of coverage are as follows: Year 1 2 3 4 5 6 7 8 9 10 1% 2% 2% 5% 5% 10% 12% 15% 18% 20% The average retail value per claim is $1,250. The average cost of parts and service at ACCR is about 60% of that of a dealershipStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started