Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If in June the stock price is $53 your net profit on the bull money spread would be $300 $150 $50 $400 Ignoring commissions, the

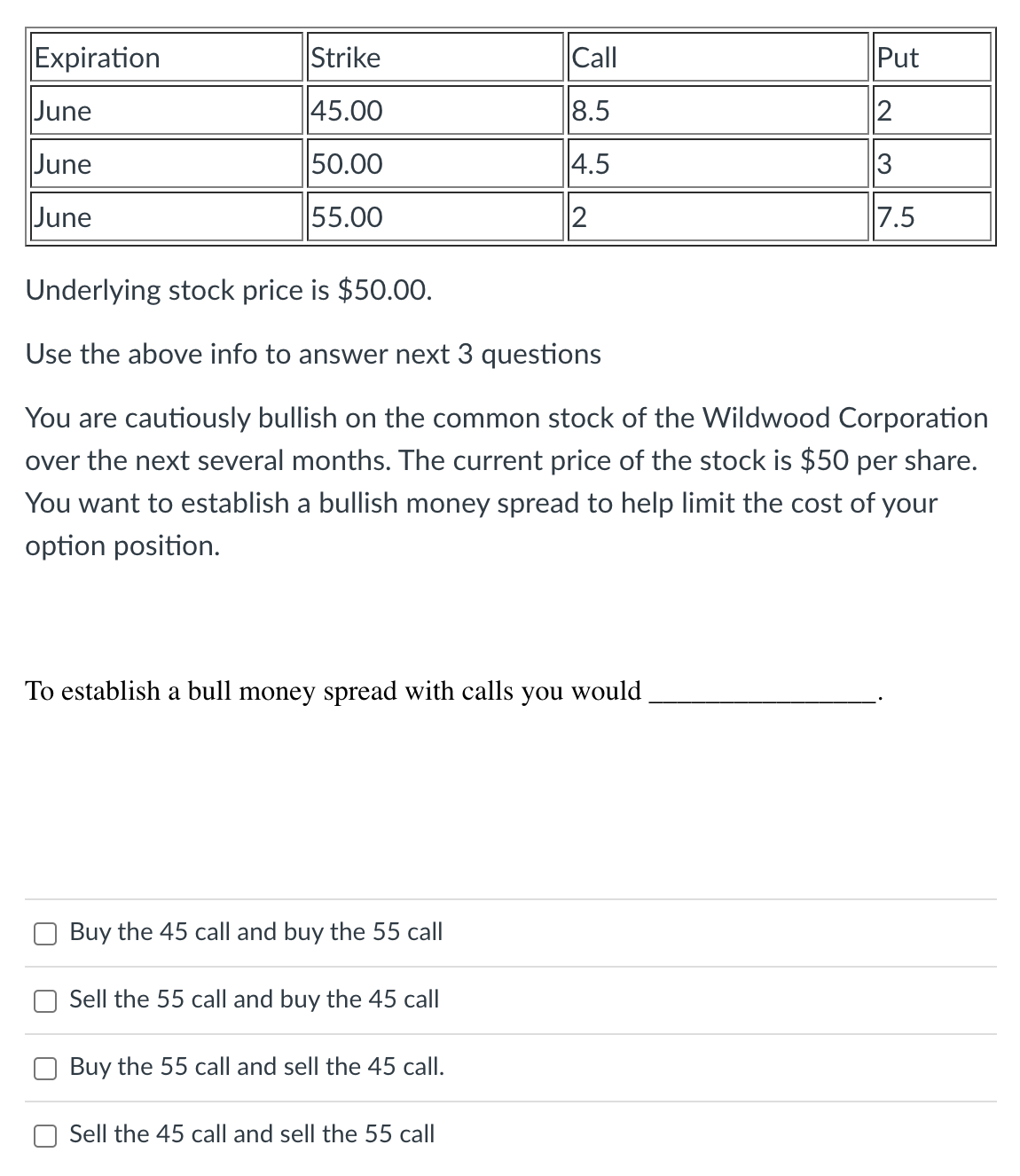

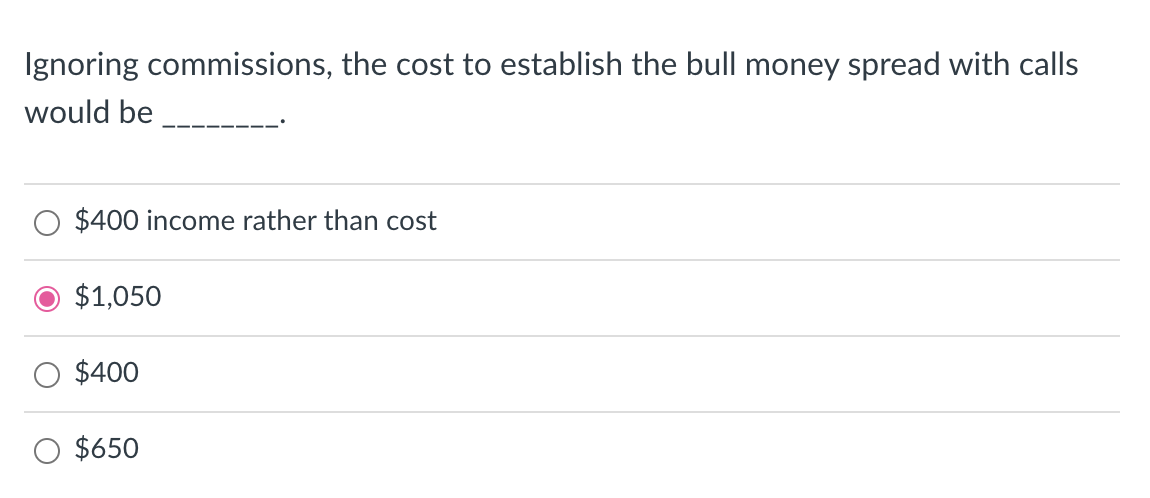

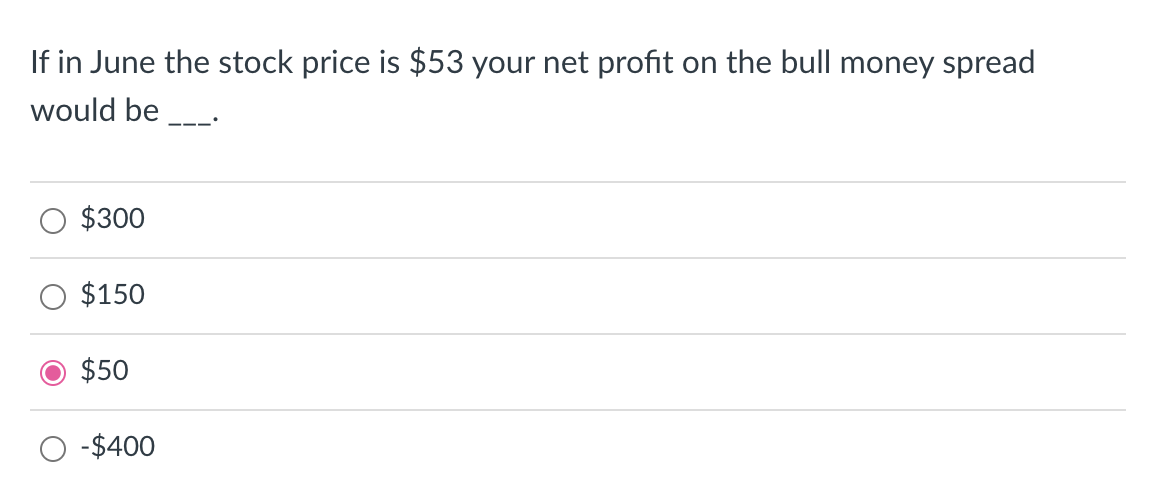

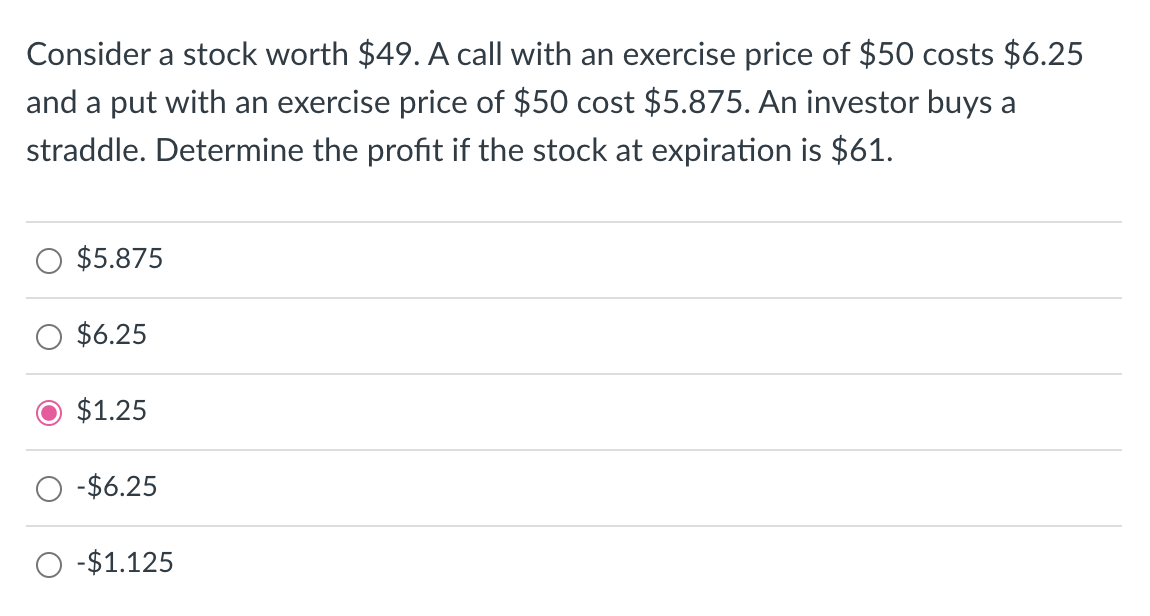

If in June the stock price is $53 your net profit on the bull money spread would be $300 $150 $50 $400 Ignoring commissions, the cost to establish the bull money spread with calls would be $400 income rather than cost $1,050 $400 $650 Consider a stock worth $49. A call with an exercise price of $50 costs $6.25 and a put with an exercise price of $50 cost $5.875. An investor buys a straddle. Determine the profit if the stock at expiration is $61. $5.875 $6.25 $1.25 $6.25 $1.125 Underlying stock price is $50.00. Use the above info to answer next 3 questions You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. To establish a bull money spread with calls you would Buy the 45 call and buy the 55 call Sell the 55 call and buy the 45 call Buy the 55 call and sell the 45 call. Sell the 45 call and sell the 55 call If in June the stock price is $53 your net profit on the bull money spread would be $300 $150 $50 $400 Ignoring commissions, the cost to establish the bull money spread with calls would be $400 income rather than cost $1,050 $400 $650 Consider a stock worth $49. A call with an exercise price of $50 costs $6.25 and a put with an exercise price of $50 cost $5.875. An investor buys a straddle. Determine the profit if the stock at expiration is $61. $5.875 $6.25 $1.25 $6.25 $1.125 Underlying stock price is $50.00. Use the above info to answer next 3 questions You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. To establish a bull money spread with calls you would Buy the 45 call and buy the 55 call Sell the 55 call and buy the 45 call Buy the 55 call and sell the 45 call. Sell the 45 call and sell the 55 call

If in June the stock price is $53 your net profit on the bull money spread would be $300 $150 $50 $400 Ignoring commissions, the cost to establish the bull money spread with calls would be $400 income rather than cost $1,050 $400 $650 Consider a stock worth $49. A call with an exercise price of $50 costs $6.25 and a put with an exercise price of $50 cost $5.875. An investor buys a straddle. Determine the profit if the stock at expiration is $61. $5.875 $6.25 $1.25 $6.25 $1.125 Underlying stock price is $50.00. Use the above info to answer next 3 questions You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. To establish a bull money spread with calls you would Buy the 45 call and buy the 55 call Sell the 55 call and buy the 45 call Buy the 55 call and sell the 45 call. Sell the 45 call and sell the 55 call If in June the stock price is $53 your net profit on the bull money spread would be $300 $150 $50 $400 Ignoring commissions, the cost to establish the bull money spread with calls would be $400 income rather than cost $1,050 $400 $650 Consider a stock worth $49. A call with an exercise price of $50 costs $6.25 and a put with an exercise price of $50 cost $5.875. An investor buys a straddle. Determine the profit if the stock at expiration is $61. $5.875 $6.25 $1.25 $6.25 $1.125 Underlying stock price is $50.00. Use the above info to answer next 3 questions You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. To establish a bull money spread with calls you would Buy the 45 call and buy the 55 call Sell the 55 call and buy the 45 call Buy the 55 call and sell the 45 call. Sell the 45 call and sell the 55 call Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started